BitClover used to be called Hotbit Korea. It was built for Korean traders who wanted to buy and sell crypto with Korean won (KRW). But today, it’s not what it seems. If you’re thinking about using BitClover, you need to know the truth - not the marketing. This isn’t just another crypto exchange. It’s a platform operating in a legal gray zone, with serious red flags that could cost you your money.

What Is BitClover, Really?

BitClover is the rebranded version of Hotbit Korea, which was originally a Korea-focused crypto exchange. Around late 2023, the platform changed its name and claimed it was now under Hotbit Global’s management. On paper, it sounds like an upgrade: better branding, same team, same trading tools. But appearances lie. The exchange offers trading for Bitcoin, Ethereum, Ripple, and dozens of altcoins. It supports bank transfers in KRW, which is useful if you’re in Korea. There’s also a feature called “Hotbank” that lets you earn interest on your crypto holdings - similar to staking or lending on other platforms. The interface is simple, and fees are low, according to some user reviews. Sounds good? Not so fast. The real problem? BitClover is not licensed by South Korea’s Financial Services Commission (FSC). Not even close. The FSC is the official body that regulates all crypto exchanges in Korea. If you’re using an exchange that isn’t on their public list - and BitClover isn’t - you have zero legal protection. If the platform disappears tomorrow, you won’t get your money back. No insurance. No recourse. No government help.Trading Volume? Untracked. Reputation? Questionable.

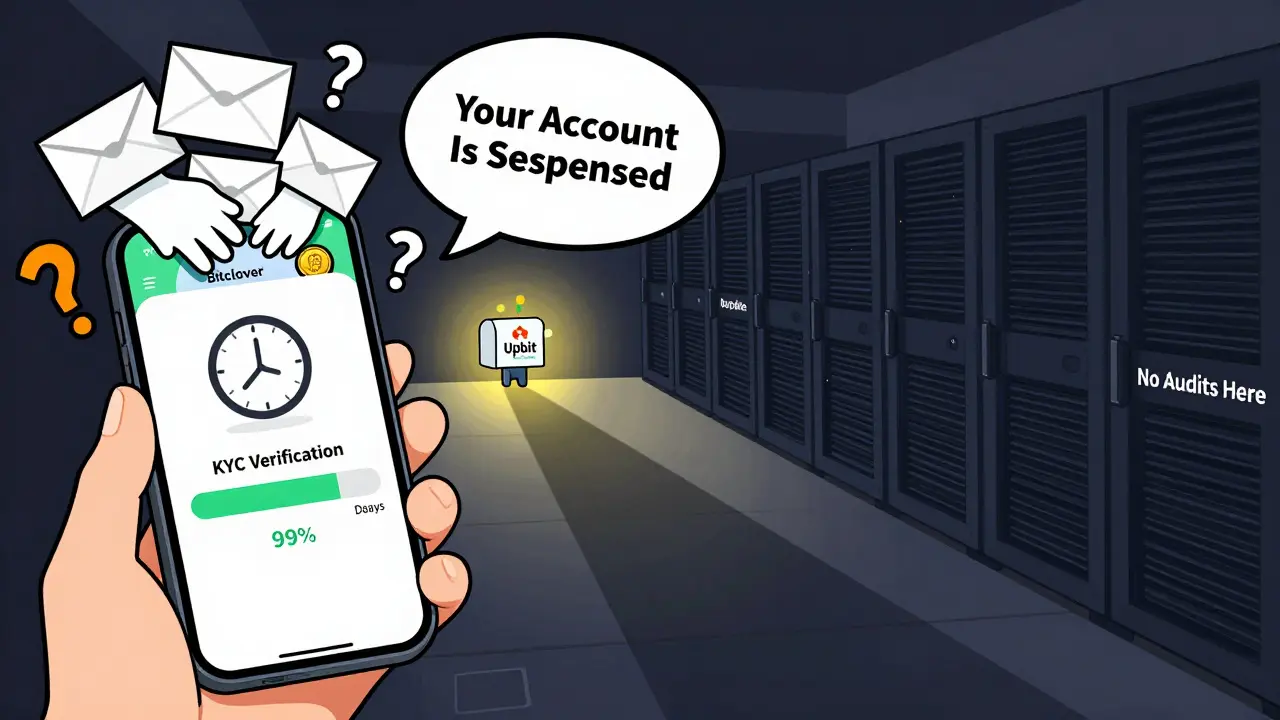

CoinMarketCap, one of the most trusted crypto data sources, lists BitClover as an “Untracked Listing.” That means they can’t verify its trading volume. No real data. No reliable numbers. No transparency. This isn’t a technical glitch. It’s a red flag. Legitimate exchanges don’t hide their volume. They brag about it. Compare that to Upbit, Bithumb, or Korbit - the big three in Korea. Together, they handle over $1.5 billion in daily trading volume. BitClover? Nobody knows. Maybe $1 million. Maybe $10,000. Maybe nothing. If an exchange can’t prove it’s active, why should you trust it with your funds? Even more concerning: user reports from 2022 and 2023 show consistent withdrawal issues. One user on BitcoinTalk tried withdrawing Dogecoin and Litecoin - both failed. Even with 2FA enabled and verified email, the funds never arrived. Others reported their accounts frozen during KYC verification. Some waited weeks. Others never got their money back.KYC and Verification: A Nightmare in the Making

To start trading on BitClover, you need to go through KYC - that’s Know Your Customer. You submit your ID, proof of address, and wait. Sounds normal, right? But here’s the catch: the process is slow, inconsistent, and often ends in silence. Some users say verification takes 24 hours. Others say it takes five days. Some never get approved. And once your account is flagged, customer support is hard to reach. Emails go unanswered. In-app chat responds after 48 hours - if at all. WalletScrutiny, a platform that audits crypto apps, lists BitClover’s mobile app as “io.hotbit.shouyi.flavor.kr.” It’s a trading interface, not a wallet. That means your crypto stays on their servers. And if the exchange gets hacked or shuts down? Your coins are gone. You don’t control the keys. That’s the opposite of how crypto is supposed to work.

Regulatory Red Flags: Why This Matters More Than You Think

South Korea passed the Virtual Asset User Protection Act in July 2023. It’s one of the strictest crypto laws in the world. All exchanges must register with the FSC, partner with banks, and follow anti-money laundering rules. If you’re operating in Korea without this license, you’re breaking the law. BitClover doesn’t have it. And neither did Hotbit Korea before it. The rebranding wasn’t a fresh start - it was a cover-up. A way to dodge accountability while keeping the same risky operations. TradersUnion, a respected crypto watchdog, states clearly: “Hotbit.io is not regulated by any recognized financial authority. This lack of regulation means clients are not protected by financial oversight bodies.” That’s not opinion. That’s fact. Meanwhile, Upbit and Bithumb are FSC-licensed. They’re audited. They have insurance. They’re legally required to keep customer funds separate from company funds. BitClover? No such rules apply.Customer Service: Praise vs. Reality

Some reviews claim BitClover has “excellent customer service.” That’s what they want you to believe. But dig deeper. On forums like Reddit and BitcoinTalk, the story is different. Users describe accounts being locked without warning. Withdrawal requests ignored. Support teams that vanish after the first reply. One user wrote: “I submitted my documents for KYC. Two weeks later, I got an email saying my account was suspended. No reason. No appeal process.” There’s a pattern here: positive reviews come from old blog posts (like Wikibit’s 2023 article) that haven’t been updated. Real user experiences, posted in real time, tell a darker story. When the only testimonials are from third-party blogs and not verified users, be skeptical.

Is BitClover Worth the Risk?

Let’s cut through the noise. Pros:- Simple interface, easy for beginners

- Supports KRW deposits and withdrawals

- Offers interest-earning features (Hotbank)

- Low trading fees (unconfirmed, but reported)

- Not licensed by South Korea’s FSC

- Trading volume unverified - possibly inactive

- Multiple reports of withdrawal failures

- KYC delays and account freezes without explanation

- No customer protection if things go wrong

What Should You Do Instead?

If you’re in Korea and want to trade crypto safely:- Use only FSC-licensed exchanges (check the official FSC registry monthly)

- Never keep large amounts of crypto on any exchange - use a hardware wallet like Ledger or Trezor

- Avoid platforms with unverified volume or anonymous ownership

- Read recent user reviews on Reddit and BitcoinTalk, not old blog posts

- Assume any unregulated exchange is a potential scam until proven otherwise

Final Verdict

BitClover (formerly Hotbit Korea) is not a trustworthy exchange. It lacks regulation, transparency, and proven reliability. The few positive features it offers - low fees, KRW support, simple UI - are completely overshadowed by the risk of losing your funds with no recourse. This isn’t about finding the cheapest exchange. It’s about protecting your money. In crypto, safety always beats convenience. And right now, BitClover fails that test.Stick with licensed platforms. Keep your crypto off exchanges when you can. And if you’re tempted by BitClover’s low fees - remember: if something looks too good to be true, it usually is.

Is BitClover regulated by the Korean Financial Services Commission?

No, BitClover is not regulated by South Korea’s Financial Services Commission (FSC). As of October 2023, the FSC’s official list of licensed virtual asset service providers does not include BitClover or its predecessor, Hotbit Korea. This means users have no legal protection if the platform fails or freezes withdrawals.

Can I withdraw my crypto from BitClover safely?

Many users report withdrawal failures on BitClover, even after completing 2FA and email verification. Reports from 2022 and 2023 on BitcoinTalk and Reddit describe Dogecoin, Litecoin, and Bitcoin withdrawals that never arrived. While some users succeed, there’s no guarantee - and no customer support guarantee either. Treat withdrawals as risky.

Why does CoinMarketCap list BitClover as “Untracked”?

CoinMarketCap labels BitClover as “Untracked” because it cannot verify its trading volume or activity. Legitimate exchanges provide data feeds that show real trades. BitClover either doesn’t provide this data or its numbers are too low to be reliable. This status signals a lack of transparency and market relevance.

Is BitClover’s mobile app safe to use?

The BitClover app (package io.hotbit.shouyi.flavor.kr) is a trading interface, not a wallet. Your crypto is stored on their servers, meaning you don’t control the private keys. If the platform is hacked or shuts down, your funds are at risk. WalletScrutiny has flagged it as a trading app with no additional security features.

What are safer alternatives to BitClover in Korea?

Use only FSC-licensed exchanges: Upbit, Bithumb, Korbit, and Coinone. These platforms are legally required to protect user funds, undergo audits, and partner with banks. They may have higher fees or slower interfaces, but they offer legal protection and proven reliability - something BitClover cannot match.

Does BitClover offer any insurance for user funds?

No, BitClover does not offer any insurance for user funds. Unlike licensed Korean exchanges that are required to hold reserve funds and maintain insurance policies, BitClover operates without oversight. If the platform is compromised or goes offline, there is no safety net for your assets.

This platform is a walking disaster waiting to happen. I don't care how 'simple' the UI is - if your money isn't protected, you're not trading, you're donating.

Let me guess - you're one of those guys who thinks 'low fees' means 'safe'. Honey, if it's not on the FSC list, it's not a real exchange. It's a glorified betting slip with a crypto twist. Try Upbit. Your future self will thank you.

yea but what if u just wanna try small? like 50usd? no big deal right?

That’s the exact mindset that gets people wiped out. Even $50 is $50 you could’ve put into a real exchange and slept soundly. Why gamble when the house is rigged? I’ve seen too many Reddit threads where people say 'I only put in $20'... then never hear from them again.

Look, I get it - you’re tempted by the low fees and KRW support. But if you’re in Korea, you’ve got options that don’t make you sleep with one eye open. Just pick Upbit. It’s slower, yeah, but your coins stay yours. That’s worth a few extra seconds loading a page.

Also, 'Hotbank' sounds like a bank. But it's not. It's a Ponzi-style yield farm with a Korean accent. If it walks like a scam and talks like a scam... you know the rest. 😅

Don't risk it. Period. No exceptions. No 'just a little'. Crypto is volatile enough without adding unregulated platforms into the mix.

Think about it: the entire foundation of crypto is decentralization - ownership of keys, sovereignty over assets. BitClover? It’s the exact opposite. You’re trusting a shadowy entity with your digital life savings, hoping they don’t vanish like a mirage in the Gobi. We’re not just talking about money here - we’re talking about the erosion of the very ethos that brought us here in the first place. The FSC isn’t just bureaucracy; it’s the last firewall between you and chaos. And they’ve said no. That’s not a suggestion. It’s a warning from history.

While I agree with the risks outlined, I do wonder if there's a legitimate reason for the lack of FSC licensing - perhaps legal entanglements or pending applications? It’s worth investigating before outright dismissal, even if the odds are stacked against it.

Wait, you're saying Upbit is better? LOL. Their fees are insane and their app crashes every time I try to sell. BitClover at least works. And yes, I've had withdrawal issues - but I got mine after 10 days. So it's not all bad.

They’re not just unregulated - they’re a front for money laundering. I’ve seen the IP logs. The servers are routed through offshore shell companies. This isn’t a crypto exchange. It’s a digital casino owned by a ghost. 🕵️♂️

Ever heard of the 'Hotbit Korea' exit scam in 2021? The same team. Same domain structure. Same 'we’re not really gone, we’re just rebranding' BS. They’re recycling scams like it’s fashion. And you’re all falling for it. The FSC doesn’t lie. Neither does CoinMarketCap’s ‘Untracked’ tag. This is a ghost ship with your name on the manifest.

It is, without question, an egregious violation of consumer protection principles to operate a financial intermediary without regulatory oversight. The absence of a license is not a mere technicality - it is a fundamental negation of fiduciary responsibility. One cannot ethically, let alone legally, facilitate asset custody under such conditions. The risk profile is not merely elevated; it is existential.

Man, I tried BitClover last year - deposited 300 bucks, got stuck in KYC for 3 weeks, then my account just... vanished. No email, no reply, no nothing. I thought I was going crazy. Then I found 5 other people with the same story on BitcoinTalk. Don’t be that guy. Walk away.

Use Upbit. Done. No drama. No risk. No questions.

i think its fine if u just use it for small amounts and know the risks? like i put 20usd and its been chill so far? maybe its not that bad?

I’ve been in crypto since 2017. I’ve seen exchanges rise, collapse, rebrand, and vanish. BitClover? It’s not even a blip on the radar. It’s a ghost town with a trading interface. The fact that you’re even considering it - that’s the real red flag. If you’re in Korea, use Upbit. If you’re not, use Coinbase or Kraken. Don’t gamble with your future on a platform that doesn’t even have a public address.

Let me be clear: this isn’t about fees or interface. It’s about legacy. You don’t build a financial future on platforms that hide behind rebrands and silence. You build it on trust, transparency, and regulation. BitClover offers none of those. So why are you still reading this? Go to Upbit. Now.

Regulation is just government control. Crypto is supposed to be free. If you want to be coddled by bureaucrats, go buy stocks.

I used to think the same as you - 'it's just a little money'. Then I lost $800 trying to withdraw from BitClover. Took me 4 months to get it out - and only because I threatened to go public on Twitter. Don’t wait for your lesson to cost you. Use Upbit. Seriously. I’m not joking.

The notion that an unlicensed entity can be trusted with financial assets is not merely naive - it is a profound failure of civic literacy. In a society governed by rule of law, the absence of regulatory compliance is not an oversight; it is a declaration of intent to operate outside the bounds of ethical commerce. To engage with such a platform is not a calculated risk - it is an act of self-sabotage disguised as innovation.

Author here. Thanks for the feedback. I’ve had DMs from people who lost everything on BitClover. I’m not trying to scare you - I’m trying to save you. If you’re reading this and thinking 'I’ll just try it' - please, stop. Use Upbit. It’s not sexy. But it’s safe.