When you want to trade crypto, you’re not just picking a platform-you’re choosing a philosophy. On one side, there’s the familiar, fast, and easy centralized exchange. On the other, the open, permissionless, and self-custodied decentralized exchange. Both handle crypto trades, but they do it in ways that couldn’t be more different. One puts your money in someone else’s vault. The other lets you keep it in your own wallet. Which one should you use? It depends on what you value more: convenience or control.

How Centralized Exchanges Work (And Why They’re Still Dominant)

Centralized exchanges, or CEXs, operate like banks for crypto. Think Binance, Coinbase, or Kraken. You sign up, verify your identity, and deposit your Bitcoin or Ethereum. The exchange holds your coins in its own wallets-called custodial wallets-and you trade against other users on their platform. When you sell, the exchange matches your order with a buyer and credits your account. It’s simple. It’s fast. And it’s how 87.4% of all crypto trading volume happens as of 2025.Why? Because CEXs solve real problems most people have. They let you buy crypto with a credit card or bank transfer. You don’t need a wallet. You don’t need to understand gas fees. You don’t need to worry about private keys. Coinbase, for example, lets you deposit USD directly, trade instantly, and withdraw back to your bank-all in one place. That’s why 68% of positive reviews on Trustpilot mention “easy bank integration.”

Behind the scenes, CEXs are engineering powerhouses. They use off-chain order books that can handle tens of thousands of trades per second. Binance processed $79.28 billion in spot volume in Q1 2025 alone. Their systems run with 80ms average latency and 99.99% uptime. They store 95-98% of user funds in cold wallets-offline, air-gapped, and physically secured. They use AES-256 encryption and mandatory two-factor authentication. And they’re regulated. Kraken holds over 40 licenses worldwide. That’s why institutions trust them.

But there’s a catch. You’re trusting them with your money. And history shows that trust can be broken. The 2022 collapse of FTX wiped out $8 billion in user funds because the exchange misused customer deposits. That’s not a bug-it’s a feature of centralized systems. When one entity controls the keys, it controls the money. And if that entity fails, lies, or gets hacked, you lose everything. Since 2011, CEXs have lost over $4.7 billion to hacks. That’s real money. Real people. Real losses.

How Decentralized Exchanges Work (And Why They’re Growing)

Decentralized exchanges, or DEXs, are built on blockchain smart contracts. No middleman. No account. No KYC. You connect your wallet-like MetaMask or Phantom-and trade directly with other users. Your coins never leave your control. When you swap ETH for USDC on Uniswap, you’re not sending it to an exchange. You’re triggering a code that swaps tokens between wallets using an algorithm called an Automated Market Maker (AMM).The first big DEX, EtherDelta, launched in 2017. Today, there are over 1,097 DEXs. The biggest, Uniswap, hit $3.72 billion in 24-hour volume in Q1 2025. That’s tiny compared to Binance, but it’s growing fast. DEXs now make up 12.6% of the $71.35 billion crypto exchange market-up from just 4.2% in 2020.

Why do people use them? Freedom. No one can freeze your account. No government can shut you down. Ukrainian traders used Kyber Network to keep trading during 2024 banking restrictions. No ID? No problem. You just need a wallet and some crypto to start.

Modern DEXs aren’t slow anymore. Thanks to Layer-2 networks like Arbitrum and zkSync, trades settle in under a second. Gas fees dropped by up to 90% compared to Ethereum mainnet. In Q2 2025, an average Uniswap trade on Arbitrum cost $1.27. That’s cheaper than most CEX trading fees.

But DEXs aren’t perfect. You’re responsible for everything. If you set your slippage tolerance too high on SushiSwap in 2023, you could lose thousands. A WalletConnect survey found 63% of new users abandoned their first trade because of gas errors or confusing interfaces. You need to understand terms like “liquidity pools,” “impermanent loss,” and “approve transactions.” MintLayer estimates it takes 15-20 hours to become competent with DEXs-versus 2-3 hours for CEXs.

Liquidity: Why CEXs Still Win the Volume Game

Liquidity is the lifeblood of trading. It’s how easily you can buy or sell without moving the price. CEXs have it in spades. Binance, OKX, and Coinbase have order books with millions of buy and sell orders stacked at every price point. That means tight spreads-sometimes just 0.01% on BTC/USD. You get filled fast. You don’t pay a premium.DEXs struggle here. Even Uniswap, the largest, has less than 5% of Binance’s volume. Why? Because liquidity on DEXs comes from users who deposit tokens into pools. It’s decentralized, but it’s fragmented. You might find ETH/USDC liquidity on Uniswap, but what about SOL/USDT? Or a new memecoin? Good luck. Many small-cap tokens only exist on one DEX-and even then, the pool might be tiny. Slippage can hit 5% or more on illiquid pairs.

That’s why most DEX volume is still crypto-to-crypto. Only 2 of the top 10 DEXs offer fiat on-ramps. If you want to trade USD for Bitcoin, you’re still going to a CEX. And until that changes, DEXs will remain a niche for crypto-native users.

Security: Who Really Holds the Keys?

This is the biggest philosophical divide. CEXs promise security through institutional-grade systems. Cold storage. Insurance. Audits. But they’re still a single point of failure. Hackers don’t need to break into your wallet-they just need to break into the exchange. The 2014 Mt. Gox hack, the 2022 Ronin Bridge breach, the 2023 KuCoin hack-all happened because centralized systems are attractive targets.DEXs avoid that risk. No custodian means no central target. But they have their own dangers: smart contract bugs. In 2022, the Wormhole bridge exploit drained $320 million because of a flaw in the code. In 2023, misconfigured slippage settings on SushiSwap cost users $2.8 million. These aren’t hacks of wallets-they’re exploits of logic. And they’re harder to detect.

Here’s the trade-off: CEXs are more likely to lose money in a big, single event. DEXs are more likely to lose small amounts to user error or code flaws. According to the Blockchain Transparency Institute, 78% of top DEXs have had third-party audits. 100% of top 10 CEXs have public proof-of-reserves. Neither is perfect. But the risks are different.

Costs and Fees: What You’re Really Paying

CEX fees are simple: you pay a percentage per trade. Coinbase charges 0.00% to 0.60% depending on volume, plus a 1% fee for fiat deposits. Kraken’s fees range from 0.16% to 0.40%. Add in withdrawal fees, and it adds up.DEXs don’t charge trading fees per se. Instead, they take a small cut from liquidity pools-usually 0.01% to 1%. But you pay gas fees to the blockchain. On Ethereum mainnet, that used to be $20-$50 per trade. Now, on Arbitrum or Base, it’s under $1.50. That’s a win. But here’s the catch: every time you interact with a DEX-approve a token, swap, add liquidity-you pay gas. One trade might cost $1.27. Ten trades? $12.70. And if you’re trading frequently, those fees stack up.

CEXs are predictable. DEXs are variable. And if you’re not careful, you can end up paying more in gas than you make on the trade.

User Experience: Easy vs Empowering

CEXs win on UX. You sign up. You deposit. You trade. You withdraw. It’s like using PayPal. That’s why Coinbase has a 4.3/5 rating on Trustpilot with nearly 50,000 reviews. People love how simple it is.DEXs are the opposite. They’re empowering-but only if you know how to use them. You need a wallet. You need to understand seed phrases. You need to know how to check token approvals. You need to set slippage correctly. A 2025 MetaMask survey found 62% of new users needed 3+ tries to complete their first swap. The biggest failure point? Seed phrase mismanagement. 78% of support tickets came from people who lost access because they wrote down their phrase wrong or lost their phone.

Community support is also different. CEXs have help desks. Kraken answers tickets in 18 minutes on average. DEXs have Discord servers. Uniswap’s has 142,000 members. But answers come in hours, not minutes. You’re on your own.

Regulation and the Future

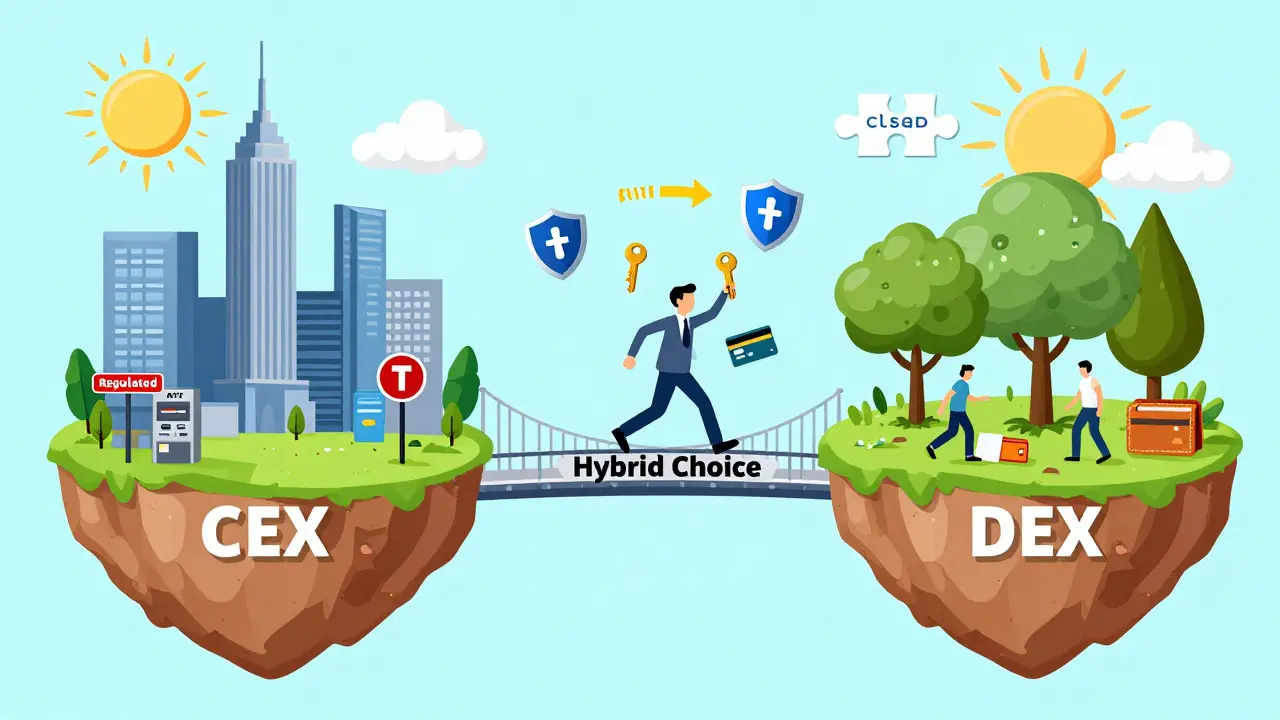

Governments are watching. In 2024, the SEC sued Uniswap Labs for operating an unregistered securities exchange. Europe’s MiCA rules forced 37% of unregulated CEXs to shut down. In 18 countries, interacting with DEXs is now illegal.But the market is adapting. Hybrid exchanges are rising. Coinbase’s Base network now processes $427 million in DEX volume. Some platforms combine CEX liquidity with DEX custody. You get the speed of a centralized system with the control of a decentralized one.

Experts are divided. Andreas Antonopoulos says DEXs are the true vision of Bitcoin-but too hard for mainstream use. Changpeng Zhao says CEXs are the only way to onboard the 95% of people who don’t know what a wallet is.

Here’s what the data says: CEXs serve 80% of retail volume. DEXs handle 65% of institutional DeFi interactions. They’re not rivals. They’re partners in a two-track system.

Which One Should You Use?

Ask yourself these questions:- Do you want to buy crypto with your bank account? → Go CEX.

- Do you want to trade new tokens without KYC? → Go DEX.

- Are you trading daily? → CEX has lower friction.

- Are you holding long-term and want full control? → DEX is safer.

- Do you hate managing seed phrases? → Stick with CEX.

- Do you care about censorship resistance? → DEX is your only option.

Most smart traders use both. They keep their long-term holdings in a wallet and trade on a DEX. They use a CEX to cash out or buy with fiat. It’s not an either/or. It’s a both/and.

The future isn’t about one winning. It’s about choice. And the more you understand both, the better your trades will be.

Can I use a DEX without a crypto wallet?

No. DEXs require you to connect a non-custodial wallet like MetaMask, Phantom, or Trust Wallet. You need to control your own private keys. If you don’t have a wallet yet, you’ll need to create one before using a DEX. Most CEXs let you trade without one, but DEXs don’t hold your funds for you.

Are DEXs safer than CEXs?

It depends. DEXs eliminate the risk of exchange hacks because you keep your own keys. But they introduce new risks: smart contract bugs, user errors (like wrong slippage settings), and phishing scams. CEXs have stronger security infrastructure but are vulnerable to insider fraud and large-scale breaches. Neither is perfectly safe. DEXs protect you from third parties. CEXs protect you from yourself-if you’re not careful.

Why do DEXs have higher slippage than CEXs?

Slippage happens when the price changes between when you click trade and when it executes. DEXs use liquidity pools, not order books. If a pool has low liquidity for a token pair, even a small trade can move the price. CEXs have deep order books with thousands of buy and sell orders, so your trade gets filled at the price you see. On DEXs, you need to set a slippage tolerance-usually 0.5% to 5%-to account for this.

Can I trade derivatives on a DEX?

Yes, but it’s limited. Most DEXs focus on spot trading. Some, like dYdX and GMX, offer perpetual futures and leveraged trading. But these are still niche. Over 90% of derivatives volume happens on CEXs like Binance and Bybit because they offer better liquidity, tighter spreads, and more reliable execution. DEX derivatives are growing, but they’re not ready for most retail traders yet.

What’s the best way to start as a beginner?

Start with a CEX like Coinbase or Kraken. Use it to buy your first Bitcoin or Ethereum with a credit card. Once you’re comfortable with crypto, set up a wallet like MetaMask and move a small amount of crypto to it. Then try a simple swap on Uniswap or PancakeSwap with a small amount you can afford to lose. Learn gas fees, slippage, and approvals before trading larger sums. Don’t skip the learning curve-mistakes on DEXs cost money fast.

Let’s be real-CEXs are just crypto banks with better UX. You think you’re in control? You’re just a customer. FTX didn’t fail because of a hack-it failed because people trusted a CEO with a yacht. DEXs aren’t perfect, but at least your money isn’t sitting in some CEO’s offshore account waiting for a wire transfer.

I started with Coinbase because I didn’t know what a private key was. Now I use MetaMask for everything longer than a week. The first time I lost $40 because I set slippage to 10%? Yeah. I cried. But I learned. And now I don’t need a help desk-I need a Google search. That’s power. And honestly? It feels better than being coddled.

The 87.4% CEX volume stat is misleading. It includes institutional wash trading, market-making bots, and fiat on-ramps. Real trading activity? DEXs are closing the gap. And when Layer 3s go live next year, liquidity fragmentation will collapse. This isn’t a trend. It’s an inevitability.

In India, we use DEXs because banks block crypto. No KYC? Perfect. Gas fees? Less than a chai. I swapped my first 0.1 ETH on PancakeSwap with my cousin’s phone. We didn’t even know what AMM meant. We just clicked. And it worked. Sometimes simplicity beats sophistication.

People don’t get it-CEXs are the reason crypto is a joke. They’re the Wall Street of Web3. They want regulation so they can keep their profits and blame you when they collapse. DEXs are the real revolution. And if you’re still using Coinbase, you’re part of the problem.

I’ve been doing this since 2017. I’ve lost money on CEXs. I’ve lost money on DEXs. But the biggest thing I’ve learned? It’s not about which one is better. It’s about knowing when to use each one. I keep my life savings in a cold wallet. I trade my fun money on Uniswap. I use Kraken to buy with my debit card. It’s not hard. It’s just different. And you don’t have to pick one. You can do both. It’s okay to be flexible.

I remember when I first tried to connect my wallet… I spent 45 minutes trying to figure out why my transaction failed. Turns out, I didn’t approve the token. I felt so dumb. But then I realized-this isn’t about being smart. It’s about being careful. And honestly? That’s kind of beautiful. You’re not being babysat. You’re being trusted. And that’s rare in this world.

The liquidity disparity is real, but it’s not a flaw-it’s a feature. CEXs aggregate liquidity through centralized incentives: fee rebates, staking rewards, and marketing budgets. DEXs rely on altruism, yield farming, and community spirit. One is a corporation. The other is a collective. Neither is inherently superior. But the fact that DEXs exist at all-without venture capital backing, without ads, without influencers-is a quiet revolution. And it’s growing. Slowly. But surely.

Gas fees on Ethereum are not the issue anymore. Arbitrum, Base, zkSync-they’ve solved that. The real bottleneck is UX. DEXs still assume you know what a nonce is. They still don’t explain why you need to approve a token before swapping. They treat users like engineers. But most people aren’t engineers. They’re just trying to buy Dogecoin. Until DEXs stop acting like a CLI and start feeling like an app, they’ll remain a niche.

You think DEXs are safe? Tell that to the 320 million stolen from Wormhole. Who audits those contracts? Some guy in a Discord server who got paid in ETH. Meanwhile, CEXs are audited by Big Four firms, insured by Lloyd’s, and regulated by the SEC. You want freedom? Fine. But don’t pretend you’re not gambling with code written by teenagers.

I don’t care what you say. CEXs are the only way to go. I live in America. I pay taxes. I follow rules. I don’t want to be some crypto anarchist with a seed phrase on a sticky note. If the government shuts down a CEX, they’ll shut it down with paperwork. If they shut down a DEX? You’re on your own. I’ll take the paperwork.

I use both. CEX to buy. DEX to trade. Wallet to hold. Simple. No drama. No yelling. No drama. No need to convince anyone. Just do what works. And if you’re still arguing about this? You’re spending too much time on Reddit and not enough time actually trading.

Oh wow. You’re telling me DEXs are for the ‘crypto-native’? Like I’m supposed to be impressed? I’m 32, I have a mortgage, and I don’t have time to learn how to ‘approve’ a token. I’m not a developer. I’m not a degens. I just want to buy Bitcoin without getting scammed. So no. I’m not joining your cult. I’ll stick with the bank that has a 24/7 hotline.

In India, we don’t have the luxury of choosing. CEXs are blocked. Banks freeze accounts. So we use DEXs. We use Telegram bots. We use peer-to-peer. We use whatever works. It’s not about ideology. It’s about survival. And if you think DEXs are ‘too complicated’-try doing it without a bank account. Then come back and tell me what’s hard.

I used to hate DEXs. Then I started using Uniswap with a $50 test amount. I lost $12 because I didn’t understand slippage. But I learned. And now I feel like I’m part of something bigger. It’s not just trading. It’s owning. It’s not about the money. It’s about not being controlled. And honestly? That’s worth a few mistakes.

I’m not a techie. I spell ‘gas fee’ wrong. I think ‘liquidity pool’ is a place you swim. But I still use DEXs. Because I don’t want someone else deciding what I can do with my money. Even if I mess up. Even if I lose. Even if I cry. I’d rather be wrong and free than right and trapped.

You call DEXs ‘decentralized’? LOL. Uniswap is run by a VC-backed company. Their devs are in San Francisco. Their DAO votes are bought by whales. The ‘community’ is just a marketing slogan. The only thing decentralized is the chaos. Meanwhile, Coinbase has 40 licenses and a CEO who talks to the Fed. At least they’re honest about it.

I don’t understand why anyone still uses DEXs. It’s like using a typewriter because you ‘believe in analog.’ You’re not being revolutionary. You’re being stubborn. And if you’re losing money because you don’t know what ‘impermanent loss’ means? That’s not freedom. That’s just bad luck.

The author’s conclusion is correct. The future is hybrid. The infrastructure is converging. Base by Coinbase is a DEX with CEX liquidity. Kraken’s upcoming wallet will allow direct DEX swaps. The lines are blurring. This isn’t a war. It’s an evolution. And the winners will be those who adapt-not those who cling to ideology.