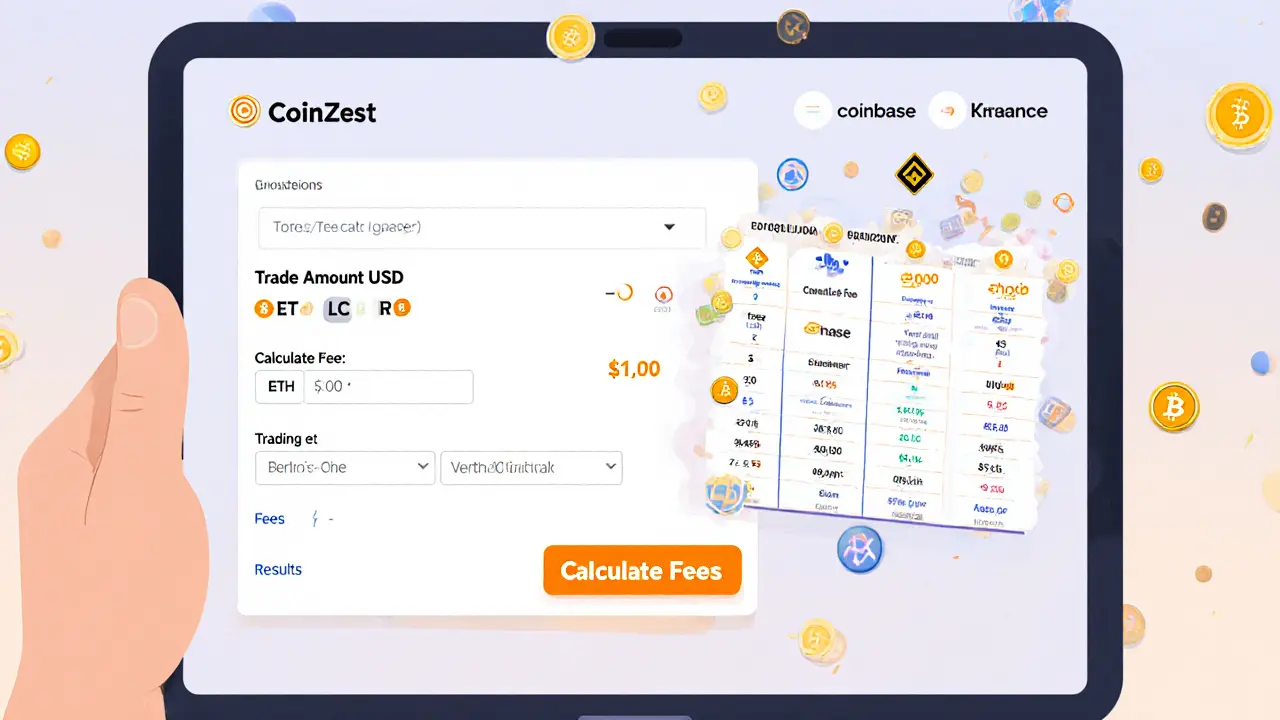

CoinZest Fee Calculator

Your Estimated Costs on CoinZest

Enter your trade amount and select a cryptocurrency to see estimated fees.

CoinZest vs Major Exchanges Comparison

| Feature | CoinZest | Coinbase | Kraken | Binance |

|---|---|---|---|---|

| Trading fee (flat) | 0.10% | 0% - 3.99% | 0% - 0.40% | 0% - 0.60% |

| BTC withdrawal fee | 0.0005 BTC | 0.0005 - 0.001 BTC | 0.0005 BTC | 0.0004 BTC |

| Fiat deposit methods | Wire transfer only | Bank, credit card, PayPal | Bank, credit card | Bank, credit card, crypto |

| Number of listed crypto assets | ~4-5 | 235 | 350+ | 158 (US) / 500+ (global) |

| Security disclosures | Basic 2FA, SSL | Cold storage, insurance, SOC 2 | Cold storage, audits, insurance | Cold storage, SAFU fund |

When you search for a place to turn cash into Bitcoin or explore altcoins, the first thing you look for is a trustworthy exchange that won’t charge you an arm‑and‑a‑leg. CoinZest is a newer platform that markets itself as an entry‑level crypto exchange for beginners. It promises solid security, simple flat fees, and the ability to fund your account with fiat via wire transfer. This CoinZest crypto exchange review breaks down what the service actually offers, where it shines, where it falls short, and how it compares to the industry giants.

What CoinZest Claims to Be

CoinZest positions itself as a starter‑friendly gateway to the crypto world. The homepage highlights three pillars:

- Security‑first mindset

- Uniform 0.10% trading fee

- Fiat deposits via wire transfer

Unlike many niche platforms that cater only to seasoned traders, CoinZest wants to attract users who are moving money from a traditional bank account into digital assets for the first time.

Fee Structure - Simple or Too Simple?

Most exchanges use a maker‑taker model: makers get a lower fee because they add liquidity, takers pay a bit more. CoinZest ditches that complexity and applies a flat 0.10% fee on every trade, regardless of order type. For a $1,000 Bitcoin purchase, you’ll pay $1 in fees. That sits comfortably below the historic industry average of 0.25% and matches the low‑end of the 2025 fee spectrum (0.10%‑0.15%).

Withdrawal fees are also modest. A Bitcoin withdrawal costs 0.0005BTC, which translates to roughly $15‑$20 depending on market price-well under the typical 0.0008BTC charge found on larger platforms.

Fiat On‑ramping - Wire Transfer Only

CoinZest accepts fiat deposits, but only through traditional bank wire transfers. No credit‑card or PayPal options are available. The lack of instant payment methods can be a friction point for newcomers used to a few‑second credit‑card top‑ups on exchanges like Coinbase or Binance. Wire transfers typically settle within 1‑3 business days, which slows down the onboarding experience.

Security Claims - What’s Really Behind the Buzz?

Security is the headline on CoinZest’s site, but the specifics are scarce. There is no public breakdown of cold‑storage percentages, insurance coverage, or third‑party audit reports. By comparison, Kraken advertises 95% of assets held in cold storage, multi‑signature wallets, and regular penetration testing.

What we do know:

- Two‑factor authentication (2FA) is mandatory for withdrawals.

- Standard SSL/TLS encryption secures web traffic.

- There is a statement about “world‑class security” but no verifiable certifications (e.g., ISO 27001).

For a beginner, the basic safeguards might feel adequate, yet the absence of detailed proof can raise eyebrows for more security‑conscious users.

Asset Coverage - How Many Coins Can You Trade?

The public documentation lists only a handful of major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). In 2025, leading exchanges boast hundreds of assets-Coinbase offers 235, Kraken supports over 350, and Crypto.com lists 313. CoinZest’s limited lineup makes it a niche choice for those who only need the top tier of coins.

User Experience & Community Sentiment

Reviews are thin. On Cryptogeek.info, CoinZest holds a 1‑out‑of‑5 rating based on a single user review. The lack of a larger review pool suggests either low adoption or dissatisfaction that hasn’t been publicly voiced. In contrast, ionomy Exchange has a 3‑star rating from two reviewers, illustrating that even small competitors often collect a handful of feedback points.

From a UI perspective, the platform provides a clean, minimalist dashboard. However, there is no public mobile app link, no advanced charting tools, and no educational portal-features that larger exchanges use to keep users engaged.

How CoinZest Stacks Up Against the Big Guys

| Feature | CoinZest | Coinbase | Kraken | Binance |

|---|---|---|---|---|

| Trading fee (flat) | 0.10% | 0%‑3.99% | 0%‑0.40% | 0%‑0.60% |

| BTC withdrawal fee | 0.0005BTC | 0.0005‑0.001BTC | 0.0005BTC | 0.0004BTC |

| Fiat deposit methods | Wire transfer only | Bank, credit card, PayPal | Bank, credit card | Bank, credit card, crypto |

| Number of listed crypto assets | ~4-5 | 235 | 350+ | 158 (US) / 500+ (global) |

| Security disclosures | Basic 2FA, SSL | Cold storage, insurance, SOC 2 | Cold storage, audits, insurance | Cold storage, SAFU fund |

| User rating (public) | 1/5 (single review) | 4.4/5 (thousands) | 4.2/5 (thousands) | 4.1/5 (thousands) |

The table shows that CoinZest wins on fee simplicity but loses heavily on asset variety, fiat convenience, and proven security depth. For a brand‑new trader who only wants to buy BTC or ETH and is comfortable with a wire transfer, the low fee could be attractive. For anyone looking for a broader market, fast fiat on‑ramps, or a robust security track record, the majors still dominate.

Pros, Cons, and Who Should Consider CoinZest

- Pros:

- Flat 0.10% fee eliminates maker‑taker confusion.

- Below‑average Bitcoin withdrawal cost.

- Simple, uncluttered interface-good for beginners.

- Cons:

- Only supports wire transfers for fiat - slow and less convenient.

- Very limited cryptocurrency selection.

- Sparse public security details; low user review volume.

- No mobile app or advanced trading tools.

- Best for:

- First‑time crypto buyers who value a straightforward fee schedule.

- Users who already have a bank that can handle wire transfers.

- Not ideal for:

- Active traders needing margi n, futures, or deep liquidity.

- Anyone who wants instant fiat funding via card or digital wallets.

- Security‑focused investors looking for detailed audit reports.

Bottom Line - Is CoinZest Worth Your Money?

If you’re standing at the edge of the crypto market, want to dip a small amount into Bitcoin or Ethereum, and don’t mind a few days for your fiat to clear, CoinZest offers one of the lowest flat fees you’ll find. However, the platform’s narrow asset list, limited fiat options, and thin security transparency make it a niche choice rather than a go‑to exchange for most users.

For the majority of traders-whether rookie or seasoned-the bigger, regulated exchanges still provide better overall value, faster funding, and a proven security pedigree. CoinZest could serve as a stepping stone for absolute beginners, but most will likely migrate to a more feature‑rich platform once they’ve gotten comfortable with the basics.

Frequently Asked Questions

What fiat currencies can I deposit on CoinZest?

CoinZest currently accepts only USD wire transfers. No credit‑card, PayPal, or other fiat options are available.

How does the 0.10% trading fee compare to other exchanges?

It is lower than the historic average of 0.25% and matches the low‑end of 2025 fee structures. Major platforms like Binance and Kraken charge between 0%‑0.60% depending on volume, but they use maker‑taker tiers, which can be confusing for beginners.

Is CoinZest secure enough for my funds?

CoinZest offers basic security: mandatory 2FA and SSL encryption. However, it does not publish cold‑storage ratios, insurance coverage, or third‑party audit results, which larger exchanges provide. If security transparency is a priority, consider a more established exchange.

Can I trade altcoins beyond Bitcoin and Ethereum on CoinZest?

The platform currently lists only a few major coins (BTC, ETH, LTC, XRP). If you need a broader selection, you’ll need to use a larger exchange.

What are the withdrawal fees for other cryptocurrencies?

CoinZest publishes a 0.0005BTC fee for Bitcoin withdrawals. For other assets, the fees are not clearly listed, which suggests they may be higher or variable. Users should contact support for exact numbers before trading.

When evaluating a niche exchange, it's useful to consider the underlying philosophy of its fee structure. A flat 0.10% rate suggests a desire for simplicity over volume discounts. However, the limited asset list may reflect a cautious approach to regulatory risk. The trade‑off between breadth and security is a classic dilemma.

I think CoinZest could be a decent option for folks who just want straightforward fees without fuss. The 0.10% flat fee is easy to grasp, and the basic 2FA adds a layer of safety. If you don't need a huge number of coins, it might just work.

It appears that the platform's security disclosures are markedly sparse when juxtaposed with industry standards. One observes the absence of cold storage assurances, which raises legitimate concerns regarding custodial vulnerability. Moreover, the exclusive reliance on wire transfers for fiat deposits could be construed as an operational bottleneck. Such omissions may signify a deliberate obfuscation of risk factors. Consequently, prospective users ought to exercise heightened vigilance.

Oh great, another exchange with a ‘flat fee’ that sounds fancy until you realize they only list a handful of coins. Maybe they think less is more, but most of us want choices, not a museum exhibit. And that withdrawal fee isn’t exactly groundbreaking. Guess they’re aiming for a niche market of the indifferent.

From a security standpoint, the basic two‑factor authentication combined with SSL encryption meets minimum industry expectations, but it falls short of the multi‑layered defenses offered by larger platforms. Users should consider storing the majority of holdings in personal wallets. Also, keep an eye on any future announcements regarding cold storage implementation.

Honestly, you can’t trust an exchange that limits fiat deposits to wire transfers only – that's a red flag for money‑laundering schemes. They probably want to keep everything under the radar. It's suspicious how they dodge the usual compliance checks.

Now, let’s consider the ramifications-, the fee structure-, the withdrawal limits-, all of which are, undeniably, quite… perplexing!!! If the platform truly aspires to compete, it must, without a doubt, expand its asset repertoire-, and perhaps, introduce more robust security protocols; otherwise, it remains marginal.

From a technical perspective, the API latency metrics appear sub‑optimal, which could impact high‑frequency trading strategies. Additionally, the lack of WS streaming is a notable omission for algorithmic deployments. These factors collectively diminish its attractiveness to institutional participants.

Listen, if you’re new to crypto, start small on CoinZest and test the withdrawal process-don’t dump a large sum without confirming the fee structure works for you. Protect your private keys, and always enable the strongest authentication settings available. Security is a habit, not a one‑time setup.

CoinZest presents itself as a lean alternative to the heavyweight exchanges, yet the limited number of listed assets fundamentally undermines its utility for diversified investors. While a 0.10% flat fee appears attractive on the surface, the true cost of transacting must be assessed in conjunction with network fees that are often omitted from the headline rate. Moreover, the platform’s exclusive reliance on wire transfers for fiat deposit introduces both latency and potential regulatory scrutiny, as wire transfers are subject to stringent AML procedures. The security architecture, limited to basic two‑factor authentication and SSL encryption, does not match the multi‑factor, cold‑storage, and insurance frameworks employed by industry leaders. Users are left to wonder whether their assets are held in hot wallets susceptible to breaches, especially given the absence of publicly disclosed audits. Additionally, the withdrawal fee of 0.0005 BTC, while modest, does not account for fluctuating network congestion, which can inflate real‑world costs dramatically. The user interface appears functional but lacks advanced trading tools such as limit orders, stop‑loss mechanisms, and real‑time market depth visualization, which are essential for active traders. Liquidity concerns arise when the order book depth is shallow, potentially leading to slippage on larger trades. The platform’s transparency is further called into question by the minimal disclosure of corporate governance and regulatory licensing. For institutional participants, the absence of a custodial service or insurance coverage is a deal‑breaker. From a compliance perspective, the lack of KYC flexibility-only wire transfers-may deter users in jurisdictions with stricter financial regulations. While the exchange markets itself as a ‘simplified’ solution, simplification should not come at the expense of essential safeguards. The comparative table with major exchanges highlights a stark contrast in asset breadth, security features, and deposit options. Prospective users must weigh the convenience of a flat fee against the broader ecosystem disadvantages. In summary, CoinZest may serve niche use‑cases, but for comprehensive trading needs, more established platforms provide superior value and protection.

This fee structure is laughable, and the security is barely adequate. Avoid it if you value your assets.

You'll figure it out eventually.

Honestly, the platform's a bit thin on features and the tech stack feels outdated. Not much to recommend.

Meh, sounds average.

The omission of comprehensive KYC procedures could be a deliberate attempt to stay under the radar of regulatory bodies. Such gaps often hint at deeper, concealed operational risks. Keep an eye out for any sudden policy changes.

Given the paucity of disclosed security protocols, one must entertain the possibility of covert vulnerabilities. It would be prudent to demand greater transparency before entrusting funds. Until then, skepticism remains justified.

Sure, because lacking features is exactly what users love.