Golden Pact Value Calculator

How Golden Pact Works

Golden Pact (GOT) uses a dual-value anchoring system combining physical gold and Bitcoin. Its reference value is calculated as:

Reference Value = (Gold Price per Gram × Gold Reserve Weight) + (Bitcoin Price × BTC Reserve Weight)

When the market price deviates from this reference value, the protocol automatically adjusts supply to stabilize the price.

Calculate Reference Value

Reference Value Result

GOTCurrent market price of GOT: $22.60

Source: Phemex (as of October 22, 2025)

Looking for a crypto that’s not just another meme coin or a fiat‑pegged stablecoin? Golden Pact tries to bridge that gap by tying its value to both physical gold and Bitcoin, the so‑called “digital gold.” If you’ve ever wondered how a token can claim gold‑backing while still living on a blockchain, this guide breaks it down in plain English.

What is Golden Pact (GOT)?

Golden Pact (GOT) is an algorithmic, non‑stablecoin cryptocurrency that combines dual‑value anchoring through physical gold and Bitcoin. Launched as a DeFi 3.0 protocol, it aims to give users a hedge against inflation and market volatility while keeping transactions fast and transparent on a public ledger.

Unlike traditional stablecoins that lock to a 1:1 fiat peg, GOT doesn’t promise a fixed price. Instead, it seeks “value stability” by keeping a reserve that includes both actual gold (via PAXG tokens) and Bitcoin holdings.

How does the dual‑value anchoring work?

The system rests on two pillars:

- Physical gold backing: Golden Pact holds PAXG tokens, which themselves represent one gram of real gold stored in vaults. This gives the token a tangible asset base that can be audited.

- Digital gold (Bitcoin): Bitcoin provides liquidity and global reach. Because Bitcoin is widely traded, the reserve can quickly adjust to market demand without moving physical metal.

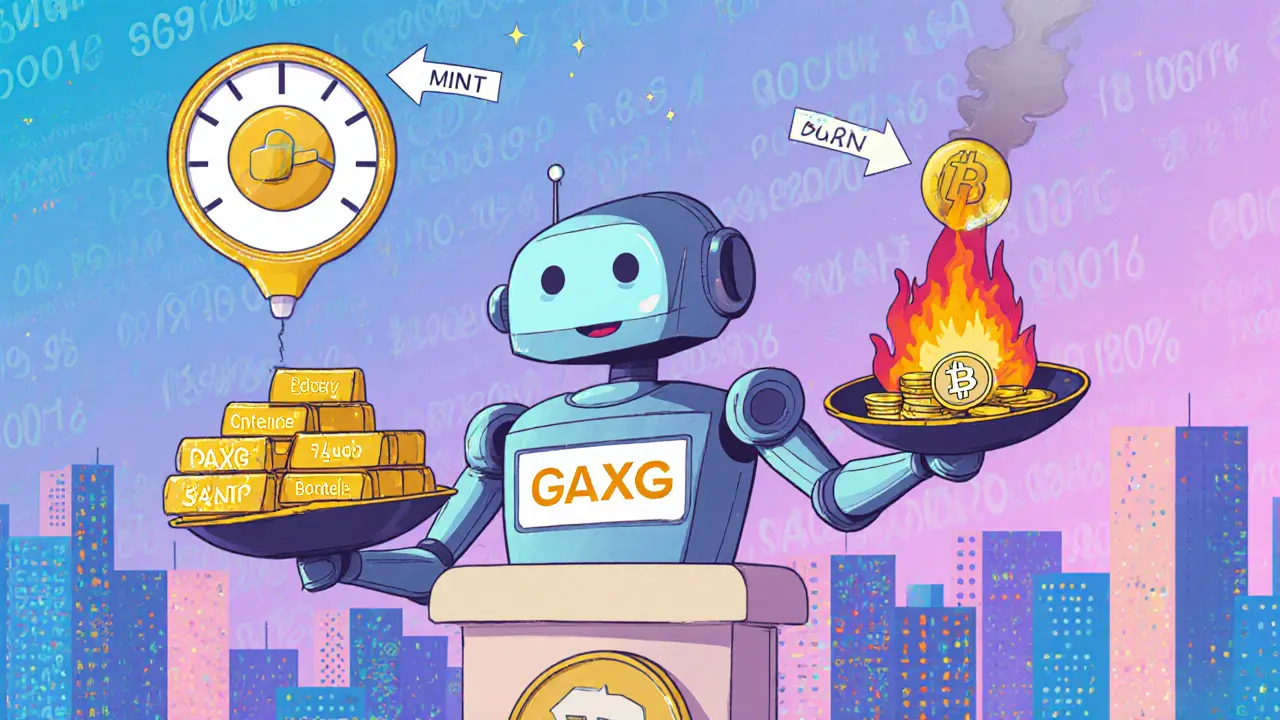

The protocol’s smart contracts continuously monitor the market price of GOT, the spot price of gold, and Bitcoin’s price. When GOT drifts too far from the combined reference value, the algorithm either mints new tokens (to increase supply) or burns existing ones (to reduce supply), automatically re‑balancing the peg.

Tokenomics and supply figures

Supply reporting for GOT is a bit messy. CoinStats lists a total supply of 4,416,959 tokens, while Phemex shows 1.62 million. The discrepancy likely stems from differing definitions of “total” vs “circulating” supply and the fact that some tokens may be locked in the reserve treasury.

As of October 22 2025, the market cap hovers around $92 million, with daily trading volume between $2 million and $2.5 million across major exchanges. Price snapshots vary:

- CoinStats: $20.85 (+1.03% 24 h)

- Phemex: $22.60 (‑0.65% 24 h)

- Binance: $23.78 (+2.61% 24 h)

Algorithmic mechanisms that keep value stable

The core of GOT’s stability lies in its smart‑contract‑driven supply algorithm. Here’s a simplified flow:

- The protocol calculates a reference value = (gold price per gram × gold reserve weight) + (Bitcoin price × BTC reserve weight).

- It compares the current market price of GOT to this reference.

- If GOT trades above the reference, the contract mints additional GOT and sells the proceeds into the gold‑or‑BTC reserve, increasing supply and pulling the price down.

- If GOT trades below the reference, the contract buys back GOT from the market and burns it, shrinking supply and pushing the price up.

This feedback loop runs automatically 24/7, removing human bias and enabling rapid reactions to market swings.

Use cases and advantages

Because GOT is anchored to gold, it appeals to people who want a crypto that can act as a store of wealth, especially in high‑inflation economies. Its Bitcoin component adds the speed and borderless nature that pure precious‑metal tokens lack.

- Cross‑border payments: Send value without relying on banks, and the receiver can convert GOT into either gold‑backed assets or Bitcoin instantly.

- Inflation hedge: Physical gold historically retains purchasing power; GOT lets you hold that exposure on a blockchain.

- DeFi integration: GOT can be used as collateral in lending platforms that accept gold‑backed tokens.

For investors, the dual backing offers a diversification benefit: you’re not putting all your eggs in either a fiat‑stablecoin or a pure crypto basket.

Risks and criticisms

Every innovative token comes with trade‑offs. The main concerns around Golden Pact are:

- Price volatility: Since GOT isn’t a strict 1:1 peg, its price can swing more than USDT or USDC, as the 24‑hour numbers show.

- Transparency gaps: Conflicting supply data and limited public audit reports make it harder for users to verify the exact gold and Bitcoin holdings.

- Regulatory uncertainty: Hybrid tokens that involve precious metals may fall under both crypto regulations and commodities law, varying by jurisdiction.

- Complexity: Average retail investors might find the dual‑anchor mechanism confusing, which could limit mainstream adoption.

Compared to failed algorithmic stablecoins like TerraUSD, GOT’s asset backing reduces systemic risk, but the market still questions whether a “non‑stablecoin” can achieve the same trust levels as fiat‑pegged stablecoins.

Golden Pact vs. other popular tokens

| Token | Backing | Stability Mechanism | Market Cap (≈ 2025) | Typical 24 h Volatility |

|---|---|---|---|---|

| Golden Pact (GOT) | Physical gold (PAXG) + Bitcoin | Algorithmic supply adjustment | $92 M | ±2‑3 % |

| USDT | US dollar reserves (fiat) | 1:1 fiat peg | $85 B | ≈0.1 % |

| PAXG | Physical gold (1 g per token) | 1:1 gold peg | $500 M | ≈0.5 % |

| TerraUSD (UST) - legacy | Algorithmic (no collateral) | Algorithmic price target | Defunct (2022) | >100 % |

The table shows that GOT sits between fiat‑backed stablecoins and pure gold tokens, offering a middle ground of real‑asset exposure and algorithmic flexibility.

Investor quick‑check checklist

- Verify the latest audit reports for gold and Bitcoin reserves.

- Confirm the token’s current supply figures on multiple data aggregators.

- Assess your risk tolerance: GOT’s price moves more than USDT but less than unbacked altcoins.

- Consider use‑case: if you need a cross‑border payment tool with some gold exposure, GOT may fit.

- Watch regulatory news in your jurisdiction regarding hybrid metal‑crypto assets.

Frequently Asked Questions

What does “non‑stablecoin” mean for Golden Pact?

Unlike stablecoins that promise a fixed 1:1 price (e.g., USDT = $1), Golden Pact aims for “value stability.” Its price may fluctuate, but the dual‑gold reserve is designed to keep the token’s purchasing power relatively steady over the long term.

How is the physical gold stored?

GOT uses PAXG tokens, each representing one gram of gold held in professionally audited vaults. The vaults are overseen by independent custodians, and the holdings are regularly audited, with reports posted on the Golden Pact website.

Can I use GOT for everyday purchases?

Because GOT’s price can move a few percent a day, it’s not ideal for merchants who need a stable transaction value. However, you can convert GOT to a stablecoin or fiat at the point of sale if the merchant accepts crypto conversions.

Is Golden Pact safe from hacks?

The protocol runs on audited smart contracts and stores assets in reputable custodial services. Like any DeFi project, it’s still exposed to smart‑contract bugs and market risks, so using a hardware wallet and only allocating what you can afford to lose is prudent.

Where can I buy Golden Pact?

GOT trades on several exchanges, including Binance, Phemex, and a handful of smaller DEXs. Always check the ticker (GOT) and verify the contract address if you’re using a decentralized platform.

By understanding how Golden Pact blends physical gold with Bitcoin, you can decide whether its hybrid model fits your portfolio or payment needs. Keep an eye on audit updates and market movements, and treat it as a high‑risk, high‑potential asset.

Golden Pact is basically the crypto world’s Swiss Army knife – it’s got gold, it’s got Bitcoin, and the protocol does the heavy lifting with algorithmic mint‑and‑burn cycles 🚀💎. If you love DeFi jargon like “liquidity reserve” and “oracle feed”, this token is a playground.

This hybrid idea feels like a bridge between the ancient and the futuristic – gold for stability, Bitcoin for freedom. It’s encouraging to see projects try to solve real‑world inflation worries. I hope the audits become more transparent so we can all feel safer.

What a joke, trying to call this a "stable" thing when the price still bounces like a bad meme coin. If you trust the smart contract, you better trust the devs – and that’s a gamble.

Fair point about the volatility, but the dual‑backing does give it a safety net that pure altcoins lack. It’s not perfect, but it’s a step toward real asset exposure on‑chain.

They’re probably hiding the real amount of gold in some secret vault. The whole thing smells like a massive market manipulation scheme.

From a technical standpoint, the algorithmic mint‑burn loop is solid, assuming the oracle feeds stay honest. The gold‑backed PAXG component adds a layer of tangible collateral that few tokens have.

Dual backing is clever but adds complexity. You have to track both gold price and BTC volatility. If one side drifts, the algorithm corrects supply. That could mean sudden minting events. Users should understand the mechanics before diving in.

Oh great, another “golden” token that promises stability. Yeah, right – until the algorithm decides to burn your holdings.

Let’s unpack the philosophy behind Golden Pact. The idea is to fuse two historically respected stores of value – physical gold and Bitcoin – into a single on‑chain asset. Gold has been a hedge against inflation for centuries, while Bitcoin offers borderless liquidity and digital scarcity. By holding both, GOT attempts to smooth out the price swings that pure crypto assets experience. The protocol’s smart contracts continuously compare the market price of GOT to a weighted reference value derived from the gold and Bitcoin reserves. When the market price exceeds the reference, the system mints new tokens, selling the proceeds into the reserve, thereby expanding supply and nudging the price down. Conversely, when the price falls below the reference, the contracts buy back and burn tokens, shrinking supply to push the price up. This feedback loop operates 24/7, removing human bias from the equation. In theory, the dual‑anchor should reduce volatility compared to uncollateralized tokens, while still retaining the speed and accessibility of blockchain transactions. However, the real‑world execution hinges on transparent audits of the gold holdings and the reliability of price oracles. If either side of the reserve is under‑collateralized, the algorithm could misfire, leading to sudden supply shocks. Additionally, the token’s classification as a “non‑stablecoin” means it’s not pegged 1:1 to any asset, so merchants may still shy away from using it for everyday purchases. For investors seeking exposure to both gold and Bitcoin without moving physical assets, GOT provides a convenient wrapper, but the price can still swing a few percent daily. Ultimately, the value proposition rests on trust in the custodians, the robustness of the code, and the market’s willingness to accept a hybrid asset as a legitimate store of wealth.

In accordance with the provided documentation, the aforementioned asset class exhibits a composite valuation methodology.

Wow! This could actually be a game‑changer!!! The dual‑backing concept is so promising!!!

i think they need more transparency also i dont get why they call it non stablecoin

I see the appeal of mixing gold and bitcoin, but honestly it feels like a marketing gimmick. The algorithm sounds nice but if the reserves aren’t truly there, it’s just a fancy promise. I’d keep a small amount only if I could verify the audits myself. Otherwise, I’d stay with traditional stablecoins or pure BTC.

Sure, let’s trust a black‑box algorithm while the creators keep their vault keys hidden. It’s not a conspiracy, it’s just common sense.

Honestly, the concept is pretty neat – it’s like putting your money in a digital piggy bank that’s stuffed with gold bars and a slice of Bitcoin. If the system works, you get the best of both worlds. Still, we should watch how the supply adjustments play out in real market conditions.

Ah, another “innovative” token hoping to outsmart regulators. Good luck navigating the legal minefield.

Looks solid, but keep an eye on the volume – low liquidity can amplify price swings!!!

They’re just trying to westernize our assets, but the gold is still ours. I won’t trust a foreign blockchain with national wealth.

Drama alert: this token is the love child of gold fever and Bitcoin mania. Will it survive the hype cycle? Only time will tell.

They’re hiding the real numbers in plain sight, as usual. Don’t be fooled.

It’s an interesting experiment, but the lack of a clear audit trail makes me skeptical. I’d wait for third‑party verification.