Blockchain KYC Comparison Tool

Traditional KYC

Centralized databases, redundant document submission, manual checks, high security risks, limited auditability.

Blockchain KYC

Decentralized identity, immutable verification, smart contract automation, enhanced privacy, improved audit trail.

| Aspect | Traditional KYC | Blockchain KYC |

|---|---|---|

| Data Storage | Centralized databases owned by each institution | Encrypted off-chain files (IPFS) + immutable on-chain hashes |

| Customer Effort | Multiple document submissions per service | One-time upload, reusable across all participants |

| Security | Target for large-scale breaches | Tamper-proof ledger, cryptographic verification |

| Compliance Auditing | Manual logs, prone to gaps | Automated, timestamped ledger entries |

| Cost | High per-onboarding cost due to duplication | Lower long-term cost after network setup |

Benefits

- Eliminates redundancy

- Cost savings

- Enhanced security

- Transparency & auditing

- Customer empowerment

Challenges

- Scalability

- Regulatory divergence

- Technical complexity

- User adoption

- Interoperability

Key Technologies

- Blockchain

- Smart Contracts

- Hyperledger Fabric

- IPFS

- Cryptography

How It Works

With blockchain KYC, a user verifies their identity once. The verification is stored as an immutable hash on the blockchain, while sensitive documents are encrypted and stored off-chain (e.g., IPFS). When another institution needs to verify the user, they simply check the blockchain for the verification status and, with consent, retrieve the encrypted documents.

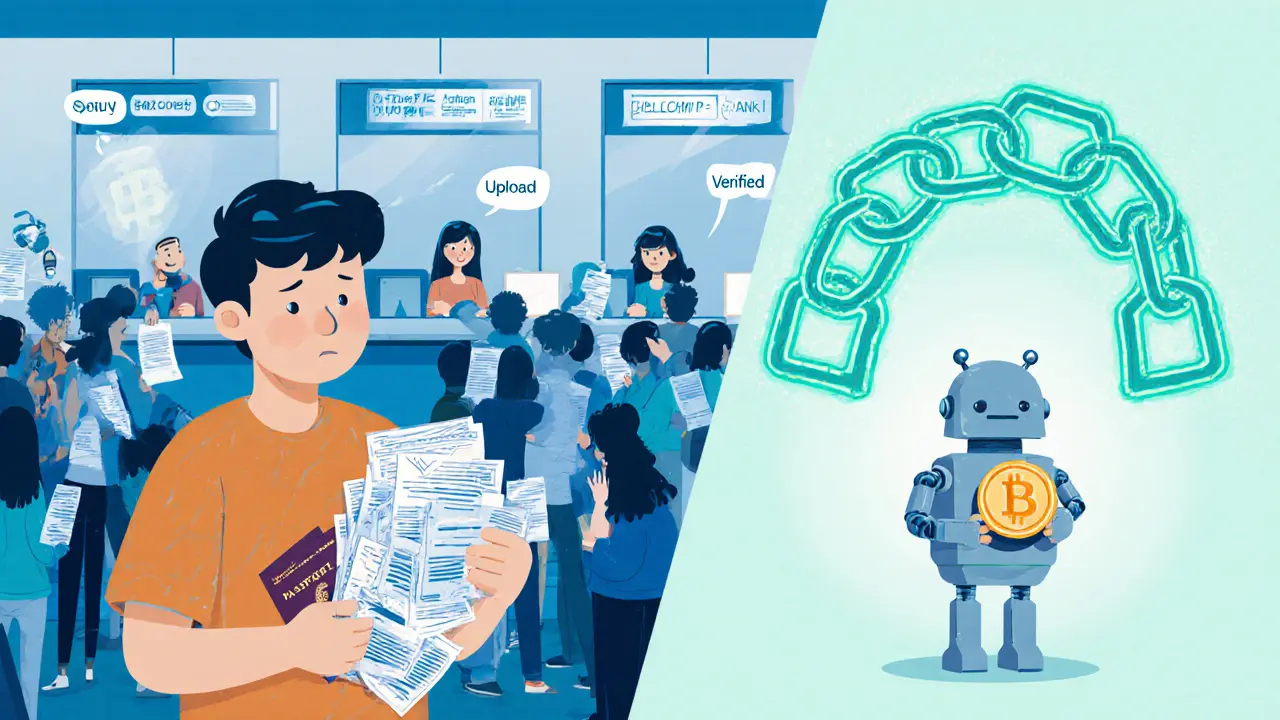

Imagine signing up for a new bank account, a crypto exchange, or a loan platform and having to upload the same passport, utility bill, and selfie every single time. That repetitive grind is the pain point of traditional Know Your Customer (KYC) processes. blockchain KYC promises to end that loop by letting you verify your identity once and share the proof securely with any service that needs it. This article walks through what that looks like, why it matters, and how you can actually set it up.

Key Takeaways

- Blockchain creates a single, immutable digital identity that can be reused across institutions.

- Smart contracts automate compliance, cutting onboarding time from days to minutes.

- Permissioned networks like Hyperledger Fabric keep sensitive data off‑public chains while still enabling shared verification.

- Implementation requires a mix of on‑chain logic, off‑chain storage (e.g., IPFS), and strict consent management.

- Scalability, regulatory alignment, and user education are the main hurdles to wide adoption.

KYC Verification with Blockchain is a decentralized approach that stores a cryptographically‑secured digital identity on a distributed ledger, allowing multiple service providers to confirm a user’s identity with the user’s explicit consent. Instead of each bank maintaining its own siloed database, the blockchain acts as a shared, tamper‑proof source of truth.

Understanding the Core Pieces

Before diving into how to build a solution, let’s break down the building blocks. Each block is a separate entity that you’ll need to understand and, in many cases, implement.

KYC is the regulatory requirement for financial institutions to verify the identity of their customers to prevent fraud, money laundering, and terrorist financing. It typically involves collecting documents, running checks, and storing the results.

Blockchain is a distributed ledger technology that records transactions in a chain of blocks, each linked by cryptographic hashes, providing immutability and transparency. In the KYC context, the ledger stores proof‑of‑verification rather than raw personal data.

Smart Contract is self‑executing code on a blockchain that runs automatically when predefined conditions are met, enabling trust‑less automation of compliance rules. For KYC, a smart contract can award a “verified” token once a user’s documents pass all checks.

Hyperledger Fabric is an open‑source permissioned blockchain framework designed for enterprise use, offering modular consensus and private channels for confidential data. It is the go‑to platform for many banks because it keeps transaction data within a trusted consortium.

Permissioned Blockchain is a blockchain where only approved participants can read or write data, providing controlled access and compliance‑friendly governance. This contrasts with public chains like Bitcoin where anyone can participate.

Cryptographic Hash Function is an algorithm that converts input data into a fixed‑size string of characters, producing a unique fingerprint that cannot be reversed. In KYC, the hash of a user’s verified document set is stored on‑chain; any change to the underlying data breaks the hash match, alerting the network.

IPFS is the InterPlanetary File System, a peer‑to‑peer protocol for storing and sharing large files off‑chain while using content‑addressed hashes for retrieval. Sensitive documents can be kept on IPFS with the hash recorded on the blockchain, preserving privacy.

Why Switch to Blockchain‑Based KYC?

- Eliminates Redundancy: A single verification event satisfies multiple institutions, cutting customer onboarding time dramatically.

- Cost Savings: Banks save on duplicate compliance staff and IT development - research suggests up to 30% reduction in KYC‑related operational expenses.

- Enhanced Security: Immutable hashes and encrypted off‑chain storage reduce the attack surface compared to centralized databases that are prime targets for breaches.

- Transparency & Auditing: Every access request is logged on the ledger, giving regulators a tamper‑proof audit trail.

- Customer Empowerment: Users control who sees their data through consent flags embedded in smart contracts.

Technical Architecture Overview

The typical flow looks like this:

- Customer uploads identity documents to a front‑end portal.

- The portal encrypts the files and stores them on IPFS. The resulting content hash is returned.

- A smart contract on a permissioned blockchain records the IPFS hash together with a cryptographic hash of the verified data.

- Regulatory or compliance services run automated checks (e.g., AML screening). Once passed, the contract updates the user’s status to “verified”.

- When a financial institution needs to confirm identity, it reads the on‑chain status and, if given consent, retrieves the encrypted files from IPFS to perform any additional verification.

This architecture keeps personal data off‑chain, meeting privacy regulations while still leveraging blockchain’s trust model.

Step‑By‑Step Guide to Building a Blockchain KYC Solution

- Define Governance Model: Assemble a consortium of banks, fintechs, and possibly a regulator. Decide on membership rules, endorsement policies, and channel structures.

- Set Up a Permissioned Network: Deploy Hyperledger Fabric clusters for each member. Configure private data collections for high‑sensitivity fields.

- Design the Smart Contract (Chaincode):

- Function

submitDocument(hash, ipfsCID)stores the encrypted document pointer. - Function

verifyUser(userId)marks the user as verified after off‑chain checks. - Function

grantAccess(userId, requesterId)records consent events.

- Function

- Integrate Off‑Chain Services: Build REST APIs that handle document upload, encryption (AES‑256), IPFS pinning, and AML screening. The API returns the IPFS CID to the chaincode.

- Implement Consent Management: Store consent flags in the ledger. Users can revoke access via a simple UI, triggering a new transaction that updates the consent status.

- Develop Front‑End Portal: Provide a clean onboarding flow (e‑signature, document capture) and a dashboard where users see which institutions have access.

- Test for Performance: Run load tests simulating 10,000 concurrent onboarding requests. Aim for sub‑5‑second confirmation times; tune Fabric’s endorsement policy and block size accordingly.

- Audit & Regulatory Review: Generate the immutable audit log from Fabric’s block explorer and share with the regulator for compliance sign‑off.

Traditional KYC vs. Blockchain KYC

| Aspect | Traditional KYC | Blockchain KYC |

|---|---|---|

| Data Storage | Centralized databases owned by each institution | Encrypted off‑chain files (IPFS) + immutable on‑chain hashes |

| Customer Effort | Multiple document submissions per service | One‑time upload, reusable across all participants |

| Security | Target for large‑scale breaches | Tamper‑proof ledger, cryptographic verification |

| Compliance Auditing | Manual logs, prone to gaps | Automated, timestamped ledger entries |

| Cost | High per‑onboarding cost due to duplication | Lower long‑term cost after network setup |

Real‑World Use Cases

Several banks in Europe have piloted a Hyperledger Fabric consortium where a shared KYC ledger reduced onboarding time from an average of 3 days to under an hour. In Southeast Asia, a fintech startup used an anonymous AES key‑sharing protocol to let users prove age without revealing exact birthdate, satisfying both regulatory KYC rules and privacy concerns.

Challenges You’ll Face

- Scalability: Permissioned networks can handle thousands of transactions per second, but adding more participants can increase endorsement latency.

- Regulatory Divergence: Different jurisdictions demand different data‑retention periods; your smart contracts must be flexible enough to honor each rule.

- Technical Complexity: Teams need expertise in Fabric, chaincode development, cryptography, and cloud‑based off‑chain storage.

- User Adoption: Convincing end‑users to trust a new digital identity model requires clear education and intuitive UI.

- Interoperability: Not all legacy systems can consume blockchain data directly; middleware APIs become essential.

Best Practices & Pro Tips

- Start with a pilot consortium of 2‑3 trusted banks before scaling.

- Keep personally identifiable information (PII) off‑chain; store only cryptographic references.

- Leverage private data collections in Fabric to limit visibility of sensitive fields to specific parties.

- Implement a robust key‑management system (KMS) for AES encryption keys; rotate regularly.

- Document every smart contract upgrade; use Fabric’s channel configuration to enforce multi‑org endorsement.

- Design a clear consent revocation flow-once a user revokes, immediately block further data reads.

- Run periodic compliance simulations with regulators to ensure the audit trail meets local AML/KYC statutes.

Future Outlook

As data‑privacy laws tighten worldwide (e.g., GDPR, CCPA, Australia's Privacy Act), the demand for consent‑driven, immutable identity solutions will grow. Expect standards bodies to publish interoperable schemas for blockchain KYC, making it easier for a new bank to plug into an existing network. Meanwhile, advances in zero‑knowledge proofs could allow verification of age or citizenship without ever exposing the underlying document, pushing privacy even further.

Frequently Asked Questions

What exactly is stored on the blockchain in a KYC solution?

Only cryptographic hashes of the verified data and consent flags are placed on‑chain. The actual documents (passport scan, utility bill) stay encrypted off‑chain-usually on IPFS or a secure cloud bucket-so the ledger never holds raw personal information.

Can a user revoke access after granting consent?

Yes. A revocation triggers a new transaction that updates the consent status in the smart contract. Subsequent read attempts by the same requester are automatically denied, and the audit log records the change.

How does a permissioned blockchain differ from a public one for KYC?

A permissioned chain limits participation to vetted entities (banks, regulators). This control satisfies compliance requirements, reduces exposure to malicious actors, and allows private channels for confidential data-features that public chains like Ethereum don’t provide out of the box.

What are the main costs involved in launching a blockchain KYC network?

Initial expenses include infrastructure (servers or cloud nodes for the Fabric network), development of chaincode, integration with existing KYC databases, and legal counsel for regulatory alignment. Ongoing costs drop significantly after launch because onboarding is automated and data duplication is eliminated.

Is blockchain KYC ready for mass adoption?

Pilot projects prove the concept, but broader rollout hinges on standardization, cross‑border regulator cooperation, and solving scalability bottlenecks. Many experts predict mainstream use within the next 3‑5 years as those gaps close.

One must question the true motivations behind the push for blockchain KYC, as the shadowy cabals of finance seem eager to entrench their own surveillance frameworks under the guise of innovation. The so‑called "decentralization" is merely a veneer, allowing the elite to monitor every transaction while pretending to empower the masses. It is hardly a coincidence that these proposals surface whenever regulators tighten their grip.

Imagine a world where the tedious dance of ever‑repeating identity checks finally bows out, replaced by a single, elegant verification that lives on a tamper‑proof ledger. The philosophical implication is profound: we shift from a paradigm of suspicion to one of mutual trust, underpinned by cryptographic certainty. By storing only immutable hashes on chain and keeping raw documents safely off‑chain, we honor both privacy and transparency-a balance many have long sought but never achieved.

From a systems‑thinking perspective, this reduces redundant data pipelines, slashing operational overhead and freeing resources for innovation rather than compliance drudgery. Moreover, the audit trail becomes an immutable narrative, allowing regulators to verify compliance without wading through endless spreadsheets.

Yet the journey is not without its valleys. Scalability concerns demand thoughtful architecture-perhaps sharding or layer‑2 solutions-to ensure transaction throughput keeps pace with global onboarding demand. Interoperability standards must coalesce, lest each consortium become an isolated island of verification.

Regulators, traditionally wary of decentralization, can find solace in permissioned models like Hyperledger Fabric, where membership is vetted and data channels are private. Such frameworks preserve the confidentiality required by law while still delivering the benefits of a shared ledger.

In practice, a user would upload encrypted documents to IPFS, receive a content‑addressed CID, and invoke a smart contract that records the hash. Upon successful AML checks, the contract flips a "verified" flag, emitting an event that any participating institution can listen to. Consent flags, stored on‑chain, empower users to grant or revoke access with a single transaction, ensuring agency remains firmly in the individual's hands.

Ultimately, the promise of blockchain KYC lies not merely in cost savings-though those are significant-but in redefining the relationship between institutions and individuals. It transforms KYC from a burdensome gatekeeper into a collaborative identity ecosystem, where trust is algorithmically enforced and personal data remains under the owner's control.

As we stand on the cusp of this transformation, the onus is on us-developers, regulators, and users alike-to craft standards, foster cross‑border collaboration, and educate the broader public. Only then can the lofty ideals of immutable identity become a lived reality for everyone.

Thank you for sharing this insightful overview! I truly believe that empowering users with control over their data can alleviate a lot of the frustration associated with repeated KYC checks :)

All this utopian babble ignores the harsh reality that blockchain introduces new attack vectors, and the so‑called "security" is merely an illusion crafted for marketing.

Don't be fooled.

While the ideas are intriguing, developers should start with a small pilot to gauge performance before committing to a full rollout.

I agree with the need for caution-testing interoperability with legacy systems early on can prevent costly rewrites later.

I've seen a few fintech startups experiment with this model, and the user feedback has been overwhelmingly positive. People love not having to resubmit docs for every new service.

Wow, this is the future! Can't wait to see my bank just scan a QR code and I'm good to go.

It's ethically dubious to hand over your most personal documents to a network of unknown entities, even if they're "permissioned". Morality matters.

Honestly, the hype around blockchain KYC feels like a smokescreen to divert attention from deeper systemic issues in finance. It's all flash, no substance.

Start with a clear governance model and define who can read what data. That keeps compliance simple.

From a technical standpoint, integrating IPFS with Hyperledger Fabric requires careful handling of content identifiers to avoid stale references. Use lifecycle management for CIDs.

Look, if you can't even get a single bank to trust a decentralized ledger, then your whole premise is a joke. Get real.

Philosophically, identity is a narrative; blockchain merely records the plot.

Dear community, let us remember that cultural nuances influence how users perceive consent. We must design interfaces that respect regional expectations; otherwise adoption will be hindered.

Seriously, if you don't understand how hash functions work, you shouldn't be building this. It's basic crypto 101.

It's truly inspiring to see a technology that could democratize identity verification, yet we must tread carefully. The balance between empowerment and oversight is delicate, and we should foster an inclusive dialogue that incorporates diverse stakeholder perspectives, from regulators to end‑users, ensuring that the solutions we build are not only technically sound but also socially responsible. By doing so, we pave the way for a future where trust is built on transparent, immutable systems rather than opaque bureaucratic processes.