Every day, hundreds of new memecoins launch on decentralized exchanges. Some are jokes. Others are scams. And right now, a lot of them are designed to trick you into buying at the peak - then vanish before you can sell. If you’ve ever bought a coin because a Telegram group said it was going to 100x, only to watch it crash 90% in hours, you’ve been caught in a memecoin pump and dump.

What Exactly Is a Memecoin Pump and Dump?

A memecoin pump and dump isn’t a glitch. It’s a planned robbery. A small group of people - often anonymous - buy a ton of a brand-new, low-value token. Then they flood social media with fake hype: influencers posting screenshots of fake profits, bots spamming Twitter with "100x ALERT," Discord servers exploding with "BUY NOW BEFORE IT’S TOO LATE."

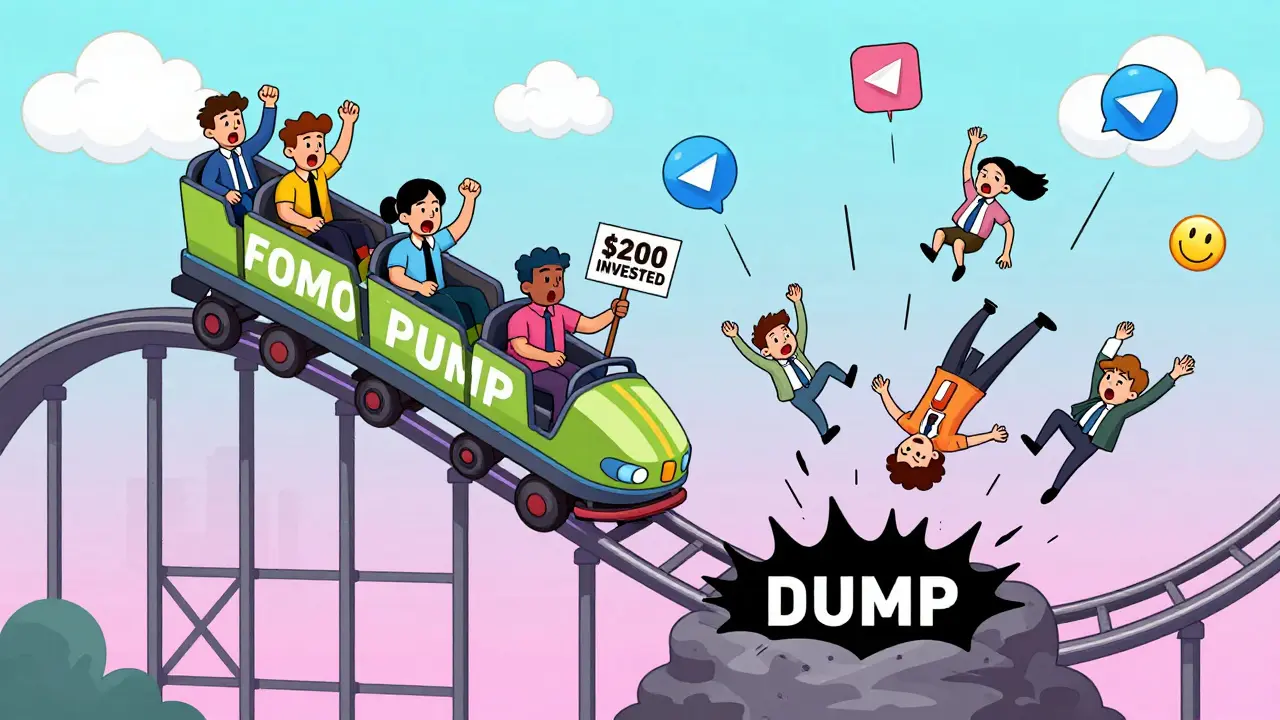

People see the price rising, panic, and jump in. More buyers = higher price. That’s the pump.

Then, when the price hits a peak, the original buyers dump their entire holdings. Suddenly, there’s no one left to buy. The price crashes. The people who bought late are stuck with a coin worth pennies. The orchestrators? They’ve already cashed out with real profits.

This isn’t speculation. It’s manipulation. And it’s happening every single day.

How These Schemes Work - Step by Step

These aren’t random events. They follow a strict, repeatable pattern:

- Accumulation: The group quietly buys up as much of the token as possible while the price is still near zero. They’re buying from early creators or low-volume traders.

- Promotion: This is where the noise starts. Fake news, fake partnerships, fake team members. You’ll see "Just got 500x on this coin!" posts. Influencers post memes with no disclosure that they’re being paid. Telegram channels with 50,000 members all post the same coin at the same time.

- Pump: FOMO takes over. New investors pour in. Trading volume spikes. The price might go from $0.00001 to $0.0001 in 30 minutes. Charts look like rockets. Everyone’s talking about it.

- Dump: The original buyers start selling. Big orders hit the market. The price stalls. Then it drops. Fast.

- Crash: Liquidity dries up. No one wants to buy. The coin can lose 80-99% of its value in under an hour. The people who bought at the top are left holding the bag.

Research from the University of Chicago shows these groups often send out their first signal 24 to 48 hours before the pump. Premium members get the signal early. Regular members? They get it right before the dump.

Red Flags You Can’t Ignore

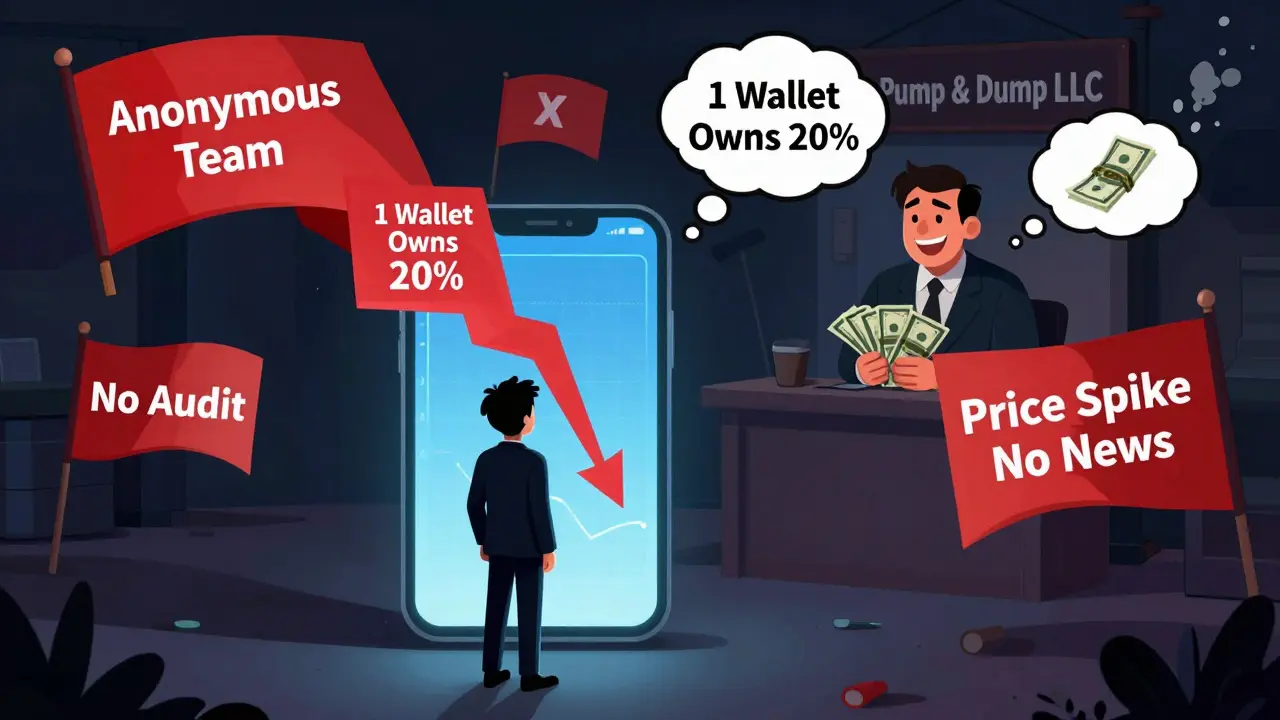

You don’t need to be a crypto expert to spot these scams. Look for these five signs:

- Market cap under $1 million: If the coin’s total value is less than what a single Tesla costs, it’s easy to manipulate. Real projects don’t start here.

- Less than 30 days old: New coins are the most vulnerable. Legit projects take months to build. Scams launch overnight.

- Anonymous team: No LinkedIn profiles? No real names? No whitepaper? That’s not a startup. That’s a shell.

- Price spike with no news: If the price jumped 200% but there’s zero update from the team, no exchange listing, no partnership announcement - it’s a pump.

- One wallet holds over 20% of supply: Check token distribution on Etherscan or BscScan. If one address owns most of the coins, that’s the pump group. They control the price.

Also watch for this: if the coin’s name is posted as an image (not text), or if multiple coins are listed in one message with checkmarks, that’s a tactic to avoid bot detection. Real projects don’t hide their names.

Pump and Dump vs. Rug Pull - What’s the Difference?

People mix these up. They’re both scams, but they work differently.

A pump and dump is about price manipulation. The team doesn’t vanish. They just sell. The smart contract still works. The coin still exists - it’s just worthless.

A rug pull is total theft. The team drains the liquidity pool. The coin becomes untradeable. No one can sell. The contract is locked or changed. The project disappears.

Both target meme coins. Both prey on FOMO. But in a rug pull, you lose everything - even the ability to try to sell. In a pump and dump, you might still be able to sell… but at 5% of what you paid.

Why Memecoins Are Perfect for This

Why do these scams target memecoins and not Bitcoin or Ethereum?

Because memecoins have no fundamentals. There’s no revenue. No technology. No use case. Their value is pure hype. That makes them easy to manipulate.

Anyone can create a memecoin in minutes using tools on Binance Smart Chain, Solana, or Ethereum. No code review. No audit. No approval. All you need is a funny name - like "DogeSlayer 2.0" or "CatCoin AI" - and a Discord server.

And because they’re so cheap, people think they’re "safe." You can buy 10 million tokens for $5. It feels like a gamble you can afford. But it’s not. It’s a trap.

How to Protect Yourself

You don’t have to avoid memecoins entirely. But you need to treat them like fireworks - fun to watch, dangerous to touch.

- Never buy based on social media hype. If you see a post saying "100x in 24 hours," it’s a red flag. Real projects don’t make promises like that.

- Check the token contract. Go to Etherscan or BscScan. Look for: locked liquidity, audited code, and developer wallet locks. If none of these exist, walk away.

- Watch the trading volume. A pump happens when volume spikes suddenly. If volume was 10k in the last 24 hours and jumps to 500k overnight - that’s a warning.

- Use a small amount. If you’re going to gamble, only use money you can afford to lose. And treat it like casino cash - not an investment.

- Exit early. If you bought during a pump and the price is up 50%, don’t wait for 100x. Sell half. Take your profit. The longer you hold, the more likely you are to get dumped on.

The Bigger Problem: No One’s Watching

Most memecoins aren’t listed on Coinbase or Binance. They trade on decentralized exchanges like Uniswap or PancakeSwap. That means no regulation. No oversight. No protection.

The Commodity Futures Trading Commission (CFTC) has issued warnings about these schemes. But they can’t shut them down. There are too many coins, too many platforms, and too many anonymous operators.

Even when exchanges try to flag suspicious activity, scammers adapt. They use new blockchains. They change names. They post in images. They recruit through private Telegram groups.

The only real defense? You.

Real Stories from Real Victims

Reddit users report the same pattern over and over:

- "Bought $200 of DogeSlayer after a Twitter influencer said it was going to $1. Sold at $0.0002. Lost everything."

- "Joined a Telegram group with 100k members. They told us to buy at $0.00005. Price hit $0.0003. We all sold. Then it crashed to $0.00001. The group vanished."

- "Thought the team was legit because they had a website. Turns out the site was made in 10 minutes with Canva. No code, no team, no future."

These aren’t rare cases. They’re the norm.

What’s Next?

These scams aren’t going away. They’re getting smarter. AI-generated memes. Deepfake influencer videos. Coordinated bot networks. The tools to manipulate markets are cheaper and easier than ever.

But so are the tools to detect them. Blockchain analytics firms now track wallet clusters. They flag sudden dumps. They trace coordinated buying patterns.

Until regulators step in - and they will - your best protection is knowledge. Don’t trust hype. Don’t chase 100x. Don’t believe the people shouting the loudest.

If it feels too good to be true - it is.

Can you make money from memecoin pump and dumps?

Technically, yes - if you’re one of the early buyers. But that’s not investing. It’s gambling with insider information you don’t have. Most people who join these schemes are the last ones in. They’re the ones who lose. The people making money are the ones who started the pump. If you’re not in that group, you’re the target.

Are all memecoins scams?

No. Some memecoins are just jokes with real communities - like Dogecoin in its early days. But the vast majority of new memecoins launched today are designed to be pumped and dumped. If a memecoin has no team, no audit, no liquidity lock, and no real purpose beyond being funny - it’s likely a scam waiting to happen.

How long does a memecoin pump and dump usually last?

It can be as short as 15 minutes or as long as 48 hours. But most last under 6 hours. The pump happens fast - often within an hour. The dump follows shortly after. If a coin spikes and stays up for more than a day, it’s either a rare exception or a very slow-moving scam.

Is it illegal to run a pump and dump?

Yes. In most countries, including the U.S., Australia, and the EU, pump and dump schemes are illegal market manipulation. But enforcement is nearly impossible in decentralized crypto markets. Most scammers operate anonymously from overseas. Even if you report them, chances are nothing will happen.

What should I do if I’ve been scammed?

Unfortunately, recovering lost funds is extremely rare. Don’t pay anyone who claims they can "get your money back" - that’s another scam. Report the incident to your local financial regulator (like ASIC in Australia) and share your story on crypto forums to warn others. Learn from it. Don’t invest based on hype again.

Bro, I bought $50 of Shiba Inu 2.0 last week because some guy in Discord said it was gonna moon. Lost it all in 40 minutes. Now I just stare at my phone like a zombie wondering if I’m the dumbest person alive. 🤡

Let me guess - the ‘team’ had a LinkedIn profile that said ‘Crypto Guru’ and a photo of a guy in a suit holding a rocket. Classic. These guys don’t even code. They just copy-paste Solidity from GitHub and call it a ‘DeFi protocol.’ The whole system is rigged. I swear, the only thing more manipulated than crypto is your ex’s Instagram.

I used to think memecoins were funny until I saw my cousin cry because he spent his rent money on ‘DogeSlayer.’ Now I just tell people: if it’s named after a meme and has no whitepaper, it’s not an investment - it’s a confession of poor life choices. I’m not judging. I’ve been there.

Y’all need to check token distribution on BscScan BEFORE you buy!! I caught a pump last week because one wallet had 78% of the supply - I sold my 0.01 ETH for 0.03 in 12 minutes and walked away. 🚀💸 Don’t be the last one holding the bag!

you know what's wild? people think they're 'investing' when they're basically playing russian roulette with a loaded gun labeled 'FOMO'. the real scam isn't the pump and dump - it's the lie that you can get rich quick without skill, patience, or risk management. we've turned finance into a tiktok dance. and now we're surprised when people get hurt?

Memecoins = digital slot machines. Same odds. Same thrill. Same regret.

It is, frankly, a profound indictment of contemporary financial literacy that individuals willingly surrender their capital to entities with no legal accountability, no fiduciary duty, and no verifiable origin story. The absence of regulatory oversight is not a feature - it is a catastrophic failure of institutional governance. One must ask: are we witnessing market evolution… or societal regression?

Always check if the liquidity is locked. If it’s not, walk away. No exceptions. I’ve lost money before. I won’t do it again.

They don’t even need to be smart. Just rich. And connected. I’ve seen the inside of these Telegram groups - they’re run by ex-bankers who got kicked out for laundering crypto. They don’t care if you lose. They care if you share. The more you post, the more people fall. It’s not a scheme. It’s a cult. And you’re the acolyte.

I used to think I was immune to this stuff. I read the whitepapers. I checked the contracts. I even ran the numbers. Then I bought a coin called ‘PuppyAI’ because the dev said it would ‘learn to predict the market.’ I lost $800. I still laugh about it now - but only because I don’t have the money to cry anymore. The real tragedy? I wasn’t even the dumbest person in the group. Someone bought 10x more than me. And they still believe it’s gonna moon.

From a blockchain analytics standpoint, the concentration of liquidity in early-stage memecoins is a red flag for front-running bots and whale manipulation. The absence of a multisig wallet or time-locked vesting schedules indicates high-risk governance structures. You're not just gambling - you're enabling systemic arbitrage.

Look, I get it. We all want to win. But if you’re chasing 100x on a coin with a cat as a logo, you’re not investing - you’re just trying to escape your 9-to-5. I’ve been there. Now I just watch. Sometimes, doing nothing is the smartest trade.

so i bought this coin called 'NFTCat' and it went up 300% in 2 hrs and then poof. i thought i was a genius until i checked the contract and it was made by '0x0000...dead' lmao. why do i keep doing this??

The distinction between pump-and-dump and rug pull is critical. One is market manipulation; the other is outright theft. Both are unethical, but the legal implications differ significantly. Always verify liquidity locks, team verifiability, and contract permissions before engaging with any token.

While the speculative nature of memecoins may appear frivolous, the underlying infrastructure - decentralized exchanges, smart contracts, and community-driven marketing - represents a genuine innovation in financial democratization. The challenge lies not in the technology, but in the human tendency to conflate hype with value. We must educate, not demonize.

Why are we even talking about this like it’s a surprise? Americans are stupid. You let a guy in a Discord server with a fake crypto logo convince you to spend your paycheck? You’re not a victim - you’re a liability to the species. Get a job. Learn to budget. Stop chasing free money. The only thing that’s pumping here is your ego.

I know, I know - I’m the one who bought DogeSlayer too… but here’s what changed for me: I stopped thinking of crypto as ‘money’ and started thinking of it as ‘entertainment.’ I set a $20 limit. If I lose it? Oh well. If I win? Cool, I bought coffee for a week. It’s not investing. It’s a theme park ride. And I’m not paying $200 for a bumper car.

Hey, I used to be the guy who chased 100x. Then I started helping my mom invest in index funds. She made more in 6 months than I did in 2 years of memecoins. I’m not saying don’t have fun - just don’t bet your future on a meme. You’re worth more than a coin with a dog’s face.