DeFi TVL Manipulation Detector

How This Tool Works

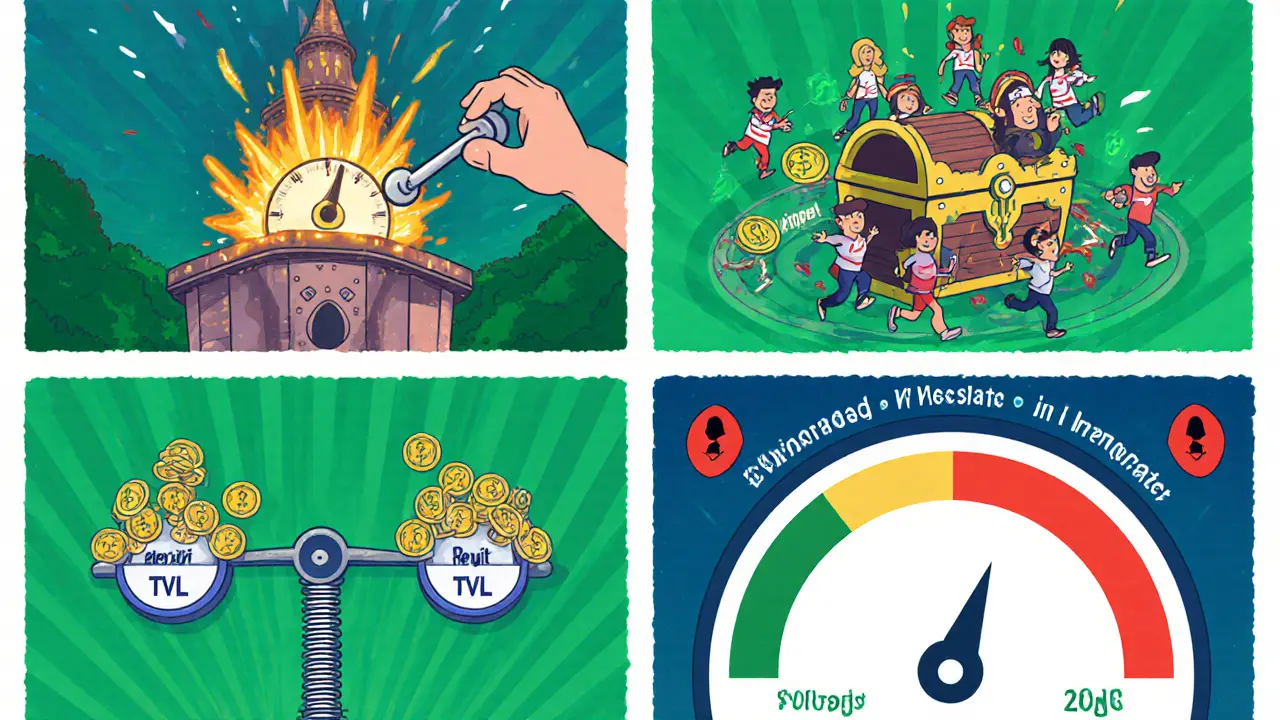

This analyzer evaluates key indicators that may suggest TVL manipulation:

- Price Volatility: Sudden price spikes correlating with TVL increases

- Reward Programs: Short-term lock-ups driven by incentives

- Activity Metrics: Low user engagement despite high TVL

- Collateral Ratios: Unusually low requirements suggesting overvaluation

When you see a DeFi protocol bragging about a $10billion total value locked, you instinctively think the project is thriving. Yet that number can be a carefully crafted illusion. TVL manipulation lets platforms paint a rosier picture than reality, luring investors and users into a false sense of security. This article unpacks how the metric is calculated, the tricks scammers use, the red flags you can spot, and the tools emerging to keep the ecosystem honest.

Key Takeaways

- TVL is a snapshot of locked asset value, but it ignores risk, revenue, and genuine user activity.

- Manipulators exploit price oracles, reward schemes, and collateral tweaks to inflate numbers.

- Cross‑checking multiple data aggregators, monitoring token price stability, and analysing activity metrics can reveal inflated TVL.

- Emerging standards for transparent TVL calculations are still in early stages.

Understanding TVL: The Core Formula

TVL is defined as the aggregate USD value of all assets locked in a DeFi protocol, whether those assets are supplied as liquidity, staked, or used as collateral. The basic calculation looks simple:

TVL = Σ (Token Amount × Current Market Price)

Three variables drive the result:

- Amount of each token held by the protocol.

- Real‑time price of each token (usually taken from on‑chain oracles).

- Any extra valuation tweaks, such as wrapped assets or synthetic tokens.

Because the formula leans heavily on market prices, a sudden price surge can make a protocol appear dramatically larger overnight, even if no new capital has entered the system.

Why TVL Became the DeFi Reputation Metric

Investors, developers, and media outlets treat TVL as a proxy for trust and adoption. Higher TVL suggests more liquidity, lower slippage, and a larger community of users. That perception fuels a virtuous loop: big TVL attracts more users, which in turn boosts TVL further. The downside? It creates a lucrative incentive for groups to game the metric.

Common Manipulation Tactics

Below are the most frequent tricks observed across the ecosystem.

| Technique | How It Works | Red Flag for Analysts |

|---|---|---|

| Oracle Price Pumping | Protocol stakes its own token on a low‑liquidity exchange, then uses a price‑inflated oracle to value the token. | Sudden TVL spikes coinciding with erratic price spikes on thinly traded pairs. |

| Reward‑Driven Lock‑Up | Generous liquidity mining rewards lure users to deposit assets that are immediately withdrawn after the reward window. | High inflow/outflow volume within the reward period, low net user growth. |

| Wrapped/Synthetic Asset Loops | Protocol creates a wrapped version of its own token, then counts both the original and the wrapper as separate assets. | Duplicated token symbols in the asset breakdown, unusually high proportion of wrapper tokens. |

| Collateral Ratio Tweaking | Lowering required collateral ratios inflates the "locked" value without increasing actual risk exposure. | Collateral requirement drops sharply while TVL climbs. |

| Self‑Staking Pools | Protocol’s own treasury stakes its token in its own liquidity pool, counting the pool’s value toward TVL. | Large internal wallet balances feeding directly into TVL calculations. |

Each technique exploits a blind spot in the TVL formula. By understanding the mechanics, analysts can spot inconsistencies that ordinary observers miss.

Real‑World Signals of Inflated Metrics

Beyond the table, here are actionable checks you can run on any protocol.

- Cross‑Aggregator Comparison: Compare TVL figures from DeFiLlama, a leading DeFi analytics aggregator, DappRadar and L2Beat. Large divergences often hint at custom valuation methods.

- Price Volatility Correlation: Plot TVL against the protocol’s native token price. If TVL mirrors price spikes exactly, the platform may be double‑counting price.

- Active User Metrics: Check daily active addresses, transaction counts, and gas usage. High TVL with low activity is a classic warning sign.

- Reward Distribution Transparency: Examine reward contract source code. Hidden or adjustable reward rates can mask short‑term lock‑up schemes.

- Collateral Health Checks: Look at the protocol’s loan‑to‑value ratios. If collateral requirements are unusually low, the TVL figure may be overstated.

Mitigation & Detection Strategies

Industry participants are already building safeguards.

- Standardized Oracle Frameworks: Projects like Chainlink are promoting open‑source price feeds that are hard to manipulate without market‑wide impact.

- Multi‑Source TVL Calculation: Aggregators now pull price data from at least three independent sources before publishing TVL.

- Audit‑Driven Disclosure: Reputable protocols publish audit reports that detail exactly how TVL is derived, including any wrapped asset handling.

- Community‑Driven Monitoring: Open‑source dashboards let anyone overlay TVL with activity metrics, creating a transparent “health score.”

- Regulatory Guidance: While still nascent, some jurisdictions are drafting requirements for DeFi platforms to disclose methodology behind key metrics.

Adopting these practices doesn’t eliminate manipulation overnight, but it raises the cost for bad actors and equips users with the data needed to make informed decisions.

Looking Ahead: Toward More Meaningful DeFi Metrics

TVL will likely remain a headline figure because it’s easy to understand. However, the next wave of analytics will blend TVL with risk‑adjusted metrics, such as:

- Capital Efficiency Ratio: Yield generated per dollar of TVL, adjusting for protocol risk.

- Active User Ratio: Percentage of TVL held by addresses that transact at least once a week.

- Protocol Risk Score: A composite of code audit findings, collateral health, and tokenomics stability.

When these layers sit alongside raw TVL numbers, investors can differentiate between genuine growth and superficial inflation.

Bottom Line

TVL manipulation exploits the metric’s simplicity. By recognizing the common tricks-price oracle gaming, reward‑driven lock‑ups, wrapped asset loops, and collateral tweaks-readers can avoid being misled. Pair TVL with cross‑aggregator checks, activity data, and emerging risk scores to get a clearer picture of a protocol’s true health.

Frequently Asked Questions

Is a high TVL always a good sign?

Not necessarily. TVL shows how much value is locked, but it says nothing about risk, profitability, or real user engagement. A protocol can have billions locked yet generate negative returns or be riddled with hidden vulnerabilities.

How can I verify a protocol’s TVL calculation?

Start by checking multiple analytics platforms (DeFiLlama, DappRadar, L2Beat). Then, review the protocol’s public documentation or audit reports to see which price feeds and asset classifications they use. If there’s a mismatch, dig deeper into the contract code or ask the community for clarification.

What role do price oracles play in TVL manipulation?

Oracles provide the market price for each token in the TVL formula. If a protocol can influence an oracle-by feeding it low‑liquidity data or using its own token as a price source-it can artificially inflate the USD valuation of its holdings.

Can rewards programs cause temporary TVL spikes?

Yes. Generous liquidity mining or staking incentives can cause a rush of deposits that quickly reverse once the reward period ends. If TVL is reported only during the peak, it gives a misleading impression of sustained growth.

What emerging metrics should I track alongside TVL?

Watch for capital efficiency (yield per TVL), active user ratio (percentage of TVL held by transacting addresses), and protocol risk scores that combine audit results, collateral health, and tokenomics stability. These give a more nuanced view of a project's health.

TVL is just the tip of the iceberg. I always check daily active addresses and gas usage first-if those are flat but TVL’s spiking, it’s a red flag. Real growth doesn’t need fancy math to look impressive.

Let’s be real-TVL is a glorified vanity metric cooked up by degens who think bigger numbers = better projects. You’re not investing in a protocol; you’re betting on whether their oracle is rigged or if their treasury is just pumping its own token like a Ponzi ATM. Chainlink’s good, but it’s not magic. If the token’s price is being whispered by a 50k liquidity pool, you’re already dead money.

I’ve seen protocols with $3B TVL where 80% came from self-staking. The team’s wallet holds more than the entire liquidity pool. And yet, YouTube influencers are still calling them ‘blue chips.’ Wake up. This isn’t finance-it’s performance art with smart contracts.

And don’t get me started on wrapped token loops. They count the same asset twice-once as the original, once as the wrapper-and call it ‘liquidity.’ That’s not innovation; that’s accounting fraud dressed in Web3 clothing.

Until we standardize risk-adjusted TVL with real user activity baked in, this whole ecosystem is just a casino with a whitepaper.

Ohhh, so now we’re pretending TVL is ‘manipulated’ like it’s some shocking revelation? Did you just discover that people lie to get attention? Wow. Groundbreaking. Next you’ll tell me that people who say ‘10x or GTFO’ are also bad at math.

Every metric can be gamed. Market cap? Gamed. Trading volume? Gamed. Even ‘daily active users’-if you pay bots $0.02 per login, you got yourself a thriving platform. TVL is just the latest shiny object for the gullible to worship.

Stop looking for ‘signals.’ Start looking for teams with skin in the game. If the devs aren’t locked in, if the treasury isn’t multisig’d, if the tokenomics don’t punish speculation-then none of your ‘cross-aggregator checks’ matter. You’re just rearranging deck chairs on the Titanic.

I appreciate how thorough this breakdown is. It’s easy to get swept up in the hype, especially when you’re new to DeFi. I used to chase high TVL projects until I started digging into the activity metrics-and realized most of the ‘liquidity’ was just temporary rewards.

Now I look for projects that show consistent usage, even if their TVL is modest. It’s not sexy, but it’s safer. Thanks for the practical checklist-I’m saving this one.

bro this is so true!! i just lost money on a project with 2b tvl and only 500 daily txns. now i check defillama + dappradar + see if people are actually using it. no more hype!!

Man, this is the kind of post I wish I saw before I dumped my ETH into that ‘blue-chip’ farm that vanished in 3 weeks 😅

TVL is like judging a restaurant by how many napkins they have-looks fancy, but what’s on the plate? I’m all for tracking capital efficiency and active users now. No more FOMO on inflated numbers 🙌

TVL is just a number. Real value is in usage.

Let me guess-you’re one of those people who thinks DeFi should be ‘regulated’ to protect you from your own greed? Newsflash: If you need a 12-point checklist to avoid getting scammed, you shouldn’t be in DeFi at all.

This whole ‘TVL manipulation’ narrative is just a fancy way of saying ‘I lost money because I didn’t do my homework.’ There’s no such thing as a safe yield farm. There’s only risk-takers and regret-takers.

Stop trying to make DeFi safe. Make yourself smarter.

I love how this post doesn’t just point out the problem-it gives actual tools to fight back. I’ve started using the DeFiLlama + L2Beat comparison trick, and it’s saved me from two sketchy projects already.

Also, the idea of a ‘Protocol Risk Score’? That’s the future. TVL should be one data point among many-not the headline. Let’s push for that standardization. The community can make this happen if we all demand transparency.

Could you please clarify whether the term ‘self-staking pools’ refers exclusively to protocol-owned treasury wallets, or whether it also encompasses staking by early investors who are affiliated with the team? The distinction is critical for assessing centralization risk.

Why are we even talking about this? America built the internet. China is building blockchain. And here we are, arguing about ‘TVL manipulation’ like it’s some kind of moral failing. Get real. This isn’t finance-it’s a global race for dominance. If you can’t handle the heat, go back to your 401(k).

The deeper issue here isn’t just TVL manipulation-it’s the entire cultural dependency on a single, reductive metric to evaluate complex systems. We’ve outsourced our critical thinking to a number, and now we’re shocked when the number lies.

This is the same pattern we saw in the dot-com bubble with pageviews, in the housing crisis with appraisals, and in social media with follower counts. We crave simplicity in a world that refuses to be simple.

What’s needed isn’t just better data aggregation-it’s a cultural shift in how we measure value. We must move from ‘how much is locked’ to ‘how much is actually functioning.’ Capital efficiency, user retention, governance participation-these are the real indicators of health.

And yes, I’m aware that these metrics are harder to calculate. But so was climate science in the 1970s. We didn’t abandon it because it was complex-we built better tools.

Let’s stop treating DeFi like a casino scoreboard and start treating it like a public utility. The future of finance depends on it.

im not sure if i got this right but if the oracle is fed fake price data then the tvl is wrong but then if the protocol is using its own token as the price source then its like measuring your height with a ruler you made yourself? i think i need to sleep on this

Oh, so now you’re the DeFi police? Who gave you the authority to decide what’s ‘manipulated’ and what’s ‘real’? You think your little checklist makes you smarter than the devs? Newsflash: they’re five steps ahead. You’re just chasing shadows with DeFiLlama.

And don’t pretend you care about ‘transparency.’ You just want to feel safe while you gamble. The truth? The system is rigged. Always has been. Your ‘risk scores’ won’t save you. Only cold, hard HODLing will.

Stop pretending this is finance. It’s a war. And you’re not even on the battlefield-you’re reading the manual while the bullets fly.