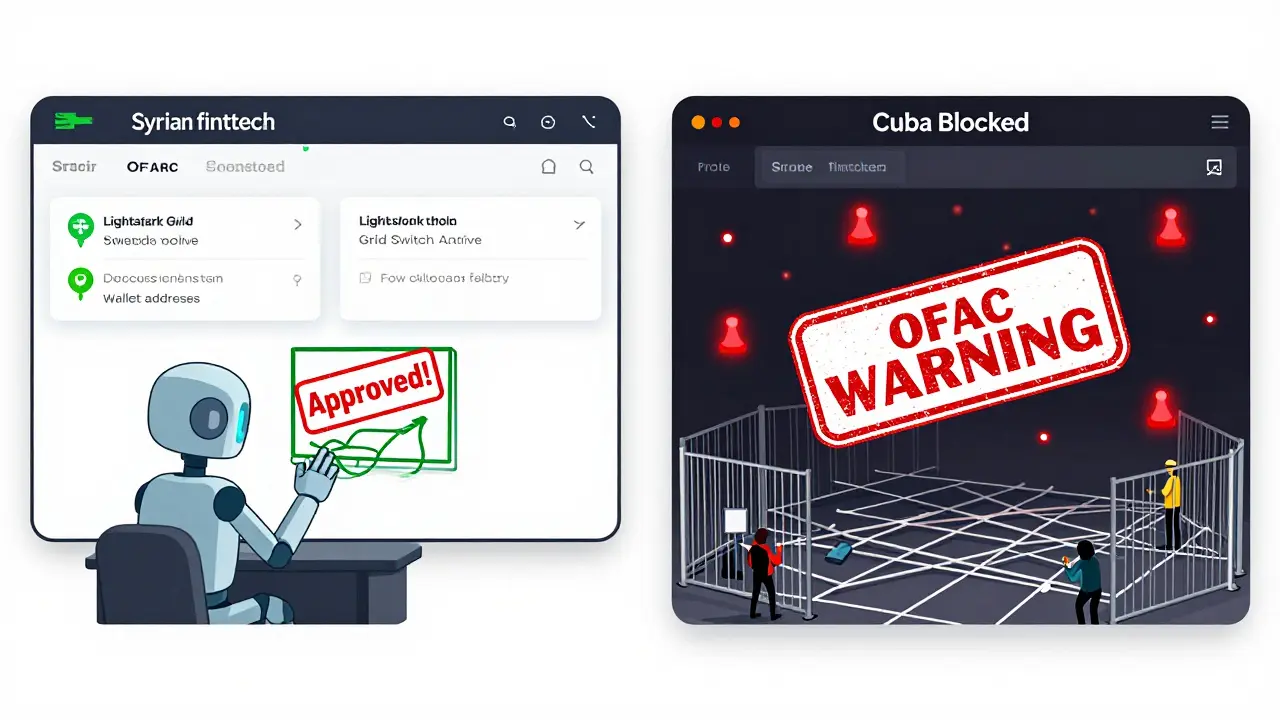

By early 2026, the rules around cryptocurrency in Syria and Cuba couldn’t be more different. One country is opening up. The other is tightening the screws. And it’s all because of a sudden, dramatic shift in U.S. foreign policy last year.

Syria’s Crypto Opening: What Changed in July 2025

Before July 1, 2025, doing business with Syria meant jumping through layers of U.S. sanctions. Any transaction-bank transfer, wire, even a crypto trade-could trigger a violation. That all changed with Executive Order 14312 a landmark U.S. policy reversal that revoked six decades of comprehensive sanctions against Syria, effective July 1, 2025. The move lifted the broad embargo that had blocked U.S. companies from providing services, making investments, or even opening bank accounts with Syrian institutions.

The impact was immediate. The Central Bank of Syria the state-owned financial authority that was previously listed on the OFAC Specially Designated Nationals (SDN) List was removed from the sanctions list. U.S. banks could now legally open correspondent accounts with Syrian banks. Major crypto exchanges like Binance a global cryptocurrency exchange that saw a surge in Syrian user activity after July 2025 lifted restrictions on Syrian accounts. People in Syria could finally buy, sell, and hold Bitcoin and Ethereum without fear of U.S. penalties.

But here’s the catch: the sanctions relief wasn’t total. Targeted sanctions remain in place against specific individuals and entities tied to the Assad regime, including President Ahmed al-Sharaa’s inner circle, members of the Assad family, and those involved in the illicit captagon drug trade. If you’re sending crypto to someone on that list-even unknowingly-you’re still breaking the law. That’s why compliance teams at fintech firms like Lightspark a financial technology company that developed Grid Switch to enable regulated cross-border payments without direct crypto exposure are now using real-time screening tools to verify wallet addresses against updated OFAC lists.

And Syria still has no crypto law. Not one. No licensing rules. No tax guidelines. No consumer protections. That’s not freedom-it’s a legal gray zone. Banks abroad still hesitate. Payment processors freeze transactions. Businesses fear being caught in the crosshairs of overzealous compliance. So while crypto is technically accessible, the real-world flow of money remains choppy.

Cuba: The Tightening Noose

While Syria got a green light, Cuba got a red one. In July 2025, the Trump administration issued National Security Presidential Memorandum 5 (NSPM-5) a policy directive that reasserted and strengthened the U.S. embargo on Cuba, reversing Biden-era relaxations. The Cuba Assets Control Regulations (CACR) the U.S. regulatory framework that prohibits most financial transactions with Cuban entities and individuals became stricter than they’d been in years.

One case made headlines: Key Holding, LLC a U.S.-based logistics company fined $608,825 in July 2025 for managing 36 freight shipments from Colombia to Cuba. The company didn’t intend to violate sanctions. Its subsidiary just handled cargo. But under CACR, even non-U.S. subsidiaries of U.S. companies are bound by the embargo. That’s a global reach most countries don’t have.

Crypto? It’s not explicitly banned-but it’s not safe. Any crypto transaction involving a Cuban entity, even through a third-party exchange, carries risk. U.S. regulators don’t need proof of intent. If a wallet address ties back to a sanctioned Cuban bank, or if funds pass through a Cuban intermediary, enforcement kicks in. The Office of Foreign Assets Control (OFAC) the U.S. Treasury agency responsible for enforcing economic and trade sanctions has made it clear: they’re watching. And they’re punishing.

For Cubans, this means crypto isn’t a lifeline-it’s a liability. Local exchanges are scarce. Peer-to-peer trading is risky. Even sending Bitcoin to a cousin in Havana could trigger a compliance alert if the sender is a U.S. citizen or uses a U.S.-based wallet. The result? Crypto adoption in Cuba has stalled, not grown.

Why the Difference? The Geopolitical Logic

Why lift sanctions on Syria but double down on Cuba? It’s not random. Syria’s shift was tied to a political deal. In June 2025, President Ahmed al-Sharaa announced the dissolution of Hay'at Tahrir al-Sham (HTS) a militant group formerly designated as a foreign terrorist organization by the U.S., which was officially dissolved and replaced by a new governance structure. The U.S. responded by revoking its Foreign Terrorist Organization (FTO) a legal designation under U.S. immigration law that imposes sanctions on terrorist groups status for HTS and easing sanctions. It was a reward for perceived cooperation.

Cuba? No such deal. The U.S. government still views the island’s leadership as a threat to regional stability. There’s no sign of political reform. No move toward democratic elections. So the embargo stays. And crypto? It’s seen as a potential tool for sanctions evasion. That’s why OFAC is more aggressive with Cuba than with any other country where crypto is used.

What This Means for Crypto Users

If you’re a trader or business owner:

- In Syria: You can now trade crypto without U.S. restrictions-but verify every counterparty. Use wallets that integrate OFAC screening. Avoid addresses linked to any former Assad regime figures. The lack of law means you’re on your own.

- In Cuba: Don’t assume crypto is a workaround. Every transaction is a risk. Even using a non-U.S. exchange doesn’t protect you if you’re connected to a U.S. entity. The penalty isn’t just a fine-it’s a federal investigation.

For crypto platforms, the challenge is clear: build compliance into every transaction. Blockchain analytics tools software systems like Chainalysis and Elliptic that track cryptocurrency flows and flag sanctioned addresses are no longer optional. They’re essential. Companies that ignore this are setting themselves up for a $600,000 fine.

The Bigger Picture: Sanctions Are Evolving

This isn’t just about Syria and Cuba. It’s about how sanctions are adapting to digital assets. The U.S. is no longer just blocking bank accounts. It’s tracking wallets. Monitoring on-chain activity. And using crypto intelligence to enforce old rules in new ways.

Meanwhile, other countries are watching. The European Union is still tightening sanctions on Russia. Iran’s oil smuggling networks are turning to crypto to bypass detection. China is quietly testing its own digital yuan for cross-border trade with sanctioned nations.

One thing is clear: crypto doesn’t make sanctions obsolete. It makes them smarter. And more dangerous-if you don’t know the rules.

What’s Next?

By late 2026, we’ll likely see:

- More fintech firms offering Syria-focused payment rails using crypto as a settlement layer-without ever touching crypto on the user’s end.

- OFAC releasing its first-ever list of sanctioned crypto addresses tied to Cuban entities.

- Exchanges like Binance and Kraken adding automatic geo-blocks for Cuba, even if they’re not legally required.

For now, the message is simple: Syria is open-but watch your steps. Cuba is closed-and the walls are getting higher.

Can I send Bitcoin to someone in Syria now?

Yes, you can. U.S. sanctions on Syria were lifted in July 2025, which means crypto transactions with Syrian individuals and businesses are no longer prohibited. But you must still avoid sending funds to any person or wallet linked to the Assad regime, the captagon trade, or human rights abusers. Always screen wallet addresses using OFAC-compliant tools before sending.

Is crypto legal in Cuba?

Crypto isn’t officially banned in Cuba, but U.S. sanctions make it extremely risky. If you’re a U.S. citizen, resident, or use a U.S.-based exchange, any crypto transaction involving a Cuban entity could violate the Cuba Assets Control Regulations. Even non-U.S. users face scrutiny if funds pass through U.S.-linked infrastructure. There’s no safe way to use crypto with Cuba under current rules.

Why did the U.S. lift sanctions on Syria but not Cuba?

The U.S. lifted sanctions on Syria after President Ahmed al-Sharaa dissolved the militant group HTS and committed to counterterrorism efforts. It was a diplomatic move tied to political change. Cuba, however, has made no such concessions. The U.S. still views its government as a threat, so the embargo remains-and has even been strengthened.

Can I use Binance to trade with Syria?

Yes, Binance and other major exchanges lifted restrictions on Syrian users after July 2025. However, they still block transactions to addresses tied to sanctioned individuals. You must ensure your counterpart isn’t on OFAC’s list. Some users report delays due to cautious compliance checks by banks handling fiat deposits.

What happens if I accidentally send crypto to a sanctioned address in Syria?

If you’re a U.S. person or use a U.S.-regulated service, you could face penalties-even if you didn’t know the address was sanctioned. OFAC doesn’t require intent. The best defense is using wallet screening tools that check against the SDN list in real time. Always verify before sending.

Are there any crypto exchanges that allow Cuba?

No major global exchange currently allows Cuban users. Even if an exchange doesn’t explicitly block Cuba, U.S. sanctions apply to any transaction that touches U.S. infrastructure, including payment processors, servers, or bank clearing systems. Most exchanges auto-block Cuban IP addresses and wallet patterns to avoid legal risk.