Bitcoin Mining Profit Calculator

Calculate Your Mining Profitability

Enter your mining parameters to see if you could profit from Bitcoin mining with Iran's subsidized electricity rates.

Iran vs. Global Mining

How Iran's electricity subsidies compare to other major mining locations:

| Country | Electricity Cost ($/kWh) | Cost per Bitcoin | Profit Margin |

|---|---|---|---|

| Iran | $0.01-$0.05 | $1,300 | ~2600% |

| Kazakhstan | $0.07-$0.10 | $5,000 | ~600% |

| Italy | $0.30-$0.35 | $306,000 | ~10% |

Grid Strain Warning: Iran's mining operations consume 5-20% of the grid's capacity. Summer months (June-August) often see power restrictions as domestic demand spikes by 30-40% with air conditioning usage.

Key Insights from Iran's Mining Policy

Based on your inputs:

- Legal miners pay $0.04-$0.07/kWh, but illegal miners get household rates of $0.01-$0.02/kWh

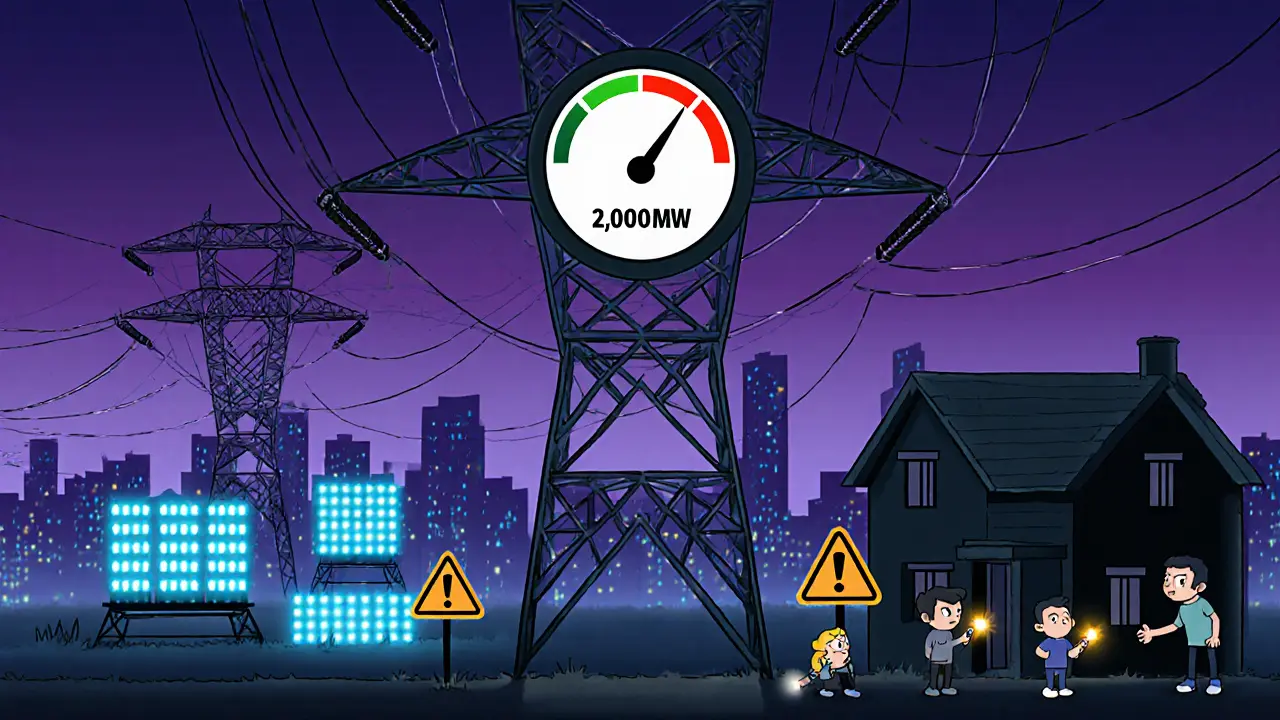

- Iranian mining farms draw about 2,000 MW (5% of total grid), but cause 15-20% of grid imbalance

- The government generates ~$800 million in foreign exchange from mining annually

- Summer shutdowns occur to protect households from 30-40% higher air conditioning demand

Iranian crypto mining subsidies are a government-backed program that sells electricity to mining farms at rates as low as $0.01‑$0.05 per kWh. This tiny price tag turns the cost of producing a Bitcoin into roughly $1,300, while the global market trades between $30,000 and $40,000. The subsidy scheme sits at the crossroads of energy policy, sanctions evasion, and the country’s desperate need for foreign currency.

Why the subsidies exist in the first place

The Iranian government legalized crypto mining in 2018 to capture hard‑currency earnings after sanctions crippled oil revenues. By keeping industrial electricity tariffs high but offering deep discounts to approved miners, the state creates a lucrative export channel without violating sanctions. Energy Minister Ali Akbar Mehrabian said the approach generates around $800 million in foreign exchange each year, offsetting the electricity cost.

How the price advantage stacks up globally

When you compare Iran’s $1,300 per Bitcoin to Italy’s $306,000, the gap is a jaw‑dropping 235‑fold. Kazakhstan comes closer at $5,000 per coin, but even there the price is five times higher than Iran’s. The table below sums up the key numbers:

| Country | Electricity cost (per kWh) | Average Bitcoin cost | Profit margin @ $35K price |

|---|---|---|---|

| Iran | $0.01‑$0.05 | $1,300 | ~2600% |

| Kazakhstan | $0.07‑$0.10 | $5,000 | ~600% |

| Italy | $0.30‑$0.35 | $306,000 | ~10% |

What the subsidies cost the grid

Mining a single Bitcoin demands over 300 MWh of electricity - roughly the daily consumption of 35,000 Iranian households. According to the deputy director of Tavanir, Mohammad Allahdad, mining farms draw about 2,000 MW, which is 5 % of the nation’s total electricity consumption but accounts for 15‑20 % of the grid’s imbalance. When a July 2025 internet shutdown forced 900,000 illegal devices offline, the grid instantly shed 2,400 MW, confirming the sheer scale.

Legal vs. illegal mining: the hidden battlefield

To run legally, operators need three approvals: a Ministry of Industry import license, a quota from Iran Power Generation Company (Tavanir), and a Central Bank of Iran (CBI) permit for crypto export. Only about 40 % of applicants clear the process, and they pay industrial tariffs of $0.04‑$0.07/kWh - still cheaper than most global rates.

Illegal miners, however, tap into household rates ($0.01‑$0.02/kWh) and avoid all licensing fees. The Energy Ministry estimates illegal farms consume up to 2 GW daily - the same power needed to run Tehran’s entire grid. This dual system fuels a black market where the IRGC (Islamic Revolutionary Guard Corps) allegedly controls 55‑65 % of all mining capacity.

Impact on everyday Iranians

Power cuts have become routine. Social‑media users report 8‑12 hour blackouts during summer, and a sentiment analysis of 1,450 Reddit comments showed 92 % blaming mining for the outages. When Bitcoin prices spike, blackout reports jump by 30‑40 % within two days, according to a Telegram channel with 187 k members.

Former energy minister Reza Ardakanian warned in 2024 that mining could gobble up nearly 10 % of Iran’s total electricity generation. The result is a seasonal pattern: miners flourish in winter when demand is low, but the government shuts them down in summer to protect households from air‑conditioning loads that can raise demand by 30‑40 %.

Why the government keeps the subsidies despite the pain

Beyond the cash flow from foreign‑currency earnings, the regime sees crypto mining as a sanctions‑busting tool. In 2023 the Central Bank allowed mined coins to settle cross‑border trade, funneling roughly $700 million into import payments. Energy Minister Mehrabian argues that the $800 million in foreign exchange outweighs the electricity subsidy, especially when the country’s oil income is throttled by sanctions.

Nevertheless, international bodies warn of long‑term damage. The International Energy Agency projects that without massive grid upgrades, Iran could see power shortages rise by 25‑30 % by 2027, driven largely by mining growth.

What the future might hold

Two trends are shaping the next chapter:

- Stricter monitoring: Early 2025 regulations mandate smart meters for all mining sites, enabling real‑time detection of abnormal consumption.

- Incentivised reporting: Citizens receive a 10 % rebate on reported illegal usage, leading to over 8,400 reports and 2,150 shutdowns in the first half of 2025.

If these measures cut illegal drawdown by even 20 %, the grid could recover roughly 400 MW - enough to power 150,000 homes during peak summer months.

However, the IRGC’s deep involvement means any crackdown will be measured. The most likely scenario is a continuation of seasonal bans, paired with a modest increase in legal, well‑monitored farms that feed foreign‑exchange earnings without choking the grid.

Key takeaways for investors and analysts

- The subsidy creates a massive cost advantage, making Iran one of the cheapest Bitcoin mining locations on the planet.

- Grid strain and frequent summer shutdowns introduce significant operational risk for any miner relying on Iranian power.

- Legal licensing is a bottleneck; most of the profitable activity happens in the grey market.

- Sanctions‑evasion benefits keep the policy alive despite domestic backlash.

Frequently Asked Questions

How much does electricity cost for a licensed miner in Iran?

Licensed operators pay industrial rates of $0.04‑$0.07 per kilowatt‑hour, which is still far below the global average.

What percentage of Iran’s electricity is used by mining?

Official estimates put legal mining at about 5 % of total consumption, while illegal farms may add another 5‑10 %.

Why does the government shut down miners in summer?

Air‑conditioning and domestic demand surge by 30‑40 % in the hottest months, so the grid can’t sustain mining’s heavy load without risking widespread blackouts.

Can foreign investors own mining farms in Iran?

Direct foreign ownership is prohibited. Investors typically partner with local entities that hold the required licenses.

What are the penalties for illegal mining?

Authorities can seize equipment, impose hefty fines, and pursue criminal charges. Recent crackdowns have taken over 1,000 devices in a single operation.

Cheap Iranian power looks like a crypto jackpot, but it’s probably a trap set by unseen hands.

Looks like the government decided to hand out electricity like candy, assuming the miners will politely tip the state with foreign cash. The irony of subsidizing a profit‑making industry while households sit in the dark is almost comedic. One can only applaud such elegant policy gymnastics.

Iran’s energy subsidies create a unique market niche that attracts both legitimate operators and those skirting the rules. When you compare the cost per kilowatt‑hour, the advantage is crystal clear. However, the strain on the grid is a real concern for everyday citizens. It’s a classic case of short‑term gain versus long‑term stability.

From a technical standpoint, the sub‑$0.05/kWh tariff slashes the operational expenditure (OPEX) for ASIC farms, pushing the break‑even hash rate down to absurd levels 😎. With a 2 GW draw, the network’s total hashrate can spike by billions of GH/s, effectively squeezing out competitors in regions with $0.10+/kWh costs. Smart‑meter rollout will add a layer of telemetry that could enable real‑time throttling based on load profiles. The ROI curves are now almost vertical for investors with deep pockets.

While the subsidies undeniably boost mining profitability, they also spotlight the need for smarter energy allocation. If the government can channel a fraction of those earnings into grid upgrades, the blackout cycles could be mitigated. A balanced approach would protect households while preserving the foreign‑exchange windfall. Optimism lies in policy evolution, not in static subsidies.

It’s hard to justify the moral cost of stealing power from families who can’t afford a single light bulb, even if the state claims foreign‑currency gains. When the grid flickers, children go without studies, and elders lose their heat. That’s not progress; that’s exploitation. 😔

The fact that Iran can sell electricity for a few cents while the rest of the world pays much more is something that anyone can see from the numbers. It shows a government that is willing to sacrifice its own people for a quick cash influx. The mining farms take a huge chunk of power, and the ordinary citizen is left holding the bag when the lights go out. The article mentions 2,000 MW being used, which is a huge slice of the national grid. It is also mentioned that this causes 5 % of total consumption, but the real impact is felt in the homes that lose power for hours. The subsidies are advertised as a way to get foreign currency, yet they ignore the social cost. People complain about blackouts, and the government just says “we need the money”. This is a classic case of short‑term profit over long‑term welfare. The illegal miners make things even worse by tapping household lines, showing how the policy creates a black market. The IRGC’s involvement suggests that the state itself is profiting from the chaos. The article says that power cuts are routine, and that is exactly what you get when you let a high‑energy industry run unchecked. The seasonal bans in summer are a half‑measure that does not solve the underlying problem. Grid upgrades would cost money, but the government seems to think the crypto gains cover it. In reality, the subsidies cost more than they earn when you factor in lost productivity and health impacts. The narrative that crypto mining is a lifeline for the economy ignores the human price paid daily. Ultimately, without a balanced energy policy, the country risks a deeper crisis.

We can all agree that the profit margins are insane, so why not push for stricter licensing and keep the bad actors out? A coordinated effort from miners, regulators, and citizens can tighten the loopholes. Let’s crank up the pressure on the IRGC‑linked farms and force transparency. The market can thrive without sacrificing the grid.

The shadowy hands pulling the strings in Tehran are laughing all the way to the bank while ordinary families huddle in darkness. It reads like a scene from a dystopian novel, yet it’s happening right now. The subsidies are a smokescreen to funnel crypto wealth into secret pockets. Every blackout is a reminder of the power play at work.

Stop pretending this is normal mining just crank up enforcement now

Wow, that was a marathon of points, and I appreciate the stamina! 😅 You highlighted how the subsidies bleed the grid, and that’s exactly the angle many overlook. The long‑term risk you mention is real – the country could face cascading failures if the load isn’t balanced. Your breakdown of illegal mining’s impact is spot on. Keep those insights coming, they’re gold for anyone trying to understand the bigger picture. 👍

Great suggestion on tightening licensing. In practice, clear guidelines and regular audits can weed out the unauthorized farms. Providing a modest incentive for compliant operators could also shift the balance. This approach would protect households while preserving the foreign‑currency inflow.

Indeed; the narrative is riddled with intrigue!!! The clandestine networks operating under the veil of state policy are nothing short of a geopolitical chess game!!! One must question how many layers of bureaucracy are merely façades for hidden profit streams!!! The blackout episodes serve as a dramatic reminder of the costs incurred by the common citizen!!!

Man, reading about those blackouts feels like watching a thriller where the hero never shows up. I’m low‑key shook that people are forced to choose between mining rigs and a fridge. This whole thing is wild.

It’s obvious that the sanctions pressure forced the regime into this crypto scheme; the numbers don’t lie; the power draws are a veiled method to bypass financial walls; everything aligns with a hidden agenda; stay alert; the truth is surfacing;

Yo guys we can actually push for better policies lets keep the convo goin and maybe get some real change happen!

That cascade of conspiratorial claims sparks curiosity-how deep does the IRGC’s involvement really go? If the state is using crypto earnings to sidestep sanctions, there must be a sophisticated ledger behind the scenes. Unraveling that network could reveal patterns useful for analysts worldwide.

From an Indian perspective, it’s a cautionary tale of misusing natural resources. Nations must guard their energy grid against profit‑driven exploits that jeopardize citizens.

Honestly, I could write an essay but I’m too bored-this whole crypto‑subsidy circus is just another excuse for power elites to hold lights over us while we stare at empty outlets.

Thats the thing bruh-when you peel the layers you see the same old game of power vs popullace. The philosophic thread? Greed always wins till it dont. Get real, stop feeding the beast that keeps the grid in shreds.

Wake up! The subsidies are just a front for a massive data harvest, feeding crypto wallets while the government watches every flick of a switch.