Imagine you walk into a store to trade your apples for oranges. But there’s no one there to trade with. You wait. Maybe you leave. This is what decentralized exchanges (DEXs) looked like before liquidity providers showed up. Now, thanks to people who lock up their crypto in pools, you can swap ETH for USDC in seconds-no middleman, no waiting. That’s the power of liquidity providers in DeFi.

What Exactly Is a Liquidity Provider?

A liquidity provider (LP) is someone who deposits two crypto tokens into a smart contract on a decentralized exchange like Uniswap or Curve. These deposits form a liquidity pool, which lets other users swap tokens instantly. Instead of matching buyers and sellers like a traditional exchange, DeFi uses math-specifically, an Automated Market Maker (AMM)-to set prices automatically.For example, if you add $1,000 worth of ETH and $1,000 worth of USDC to a Uniswap pool, you’re now a liquidity provider. In return, you get LP tokens-digital receipts that prove your share of the pool. If the pool has $1 million total and you own $1,000 worth of LP tokens, you own 0.1% of the pool. That’s how rewards are calculated.

Liquidity providers are the unsung heroes of DeFi. Without them, DEXs wouldn’t work. There’d be no trades, no price discovery, no DeFi ecosystem. They’re the market makers of crypto, but anyone with a wallet and some tokens can do it.

How Do Liquidity Providers Make Money?

LPs earn two main things: trading fees and token rewards.Every time someone swaps tokens in a pool, a small fee is charged-usually 0.3% on Uniswap v2. That fee gets split among all LPs in that pool based on their share. So if $1 million in trades happens in your pool in a day, you’d earn 0.3% of that, or $3,000, divided among all providers. If you control 0.1% of the pool, you get $3.

On top of that, many protocols give out extra tokens as incentives. Curve, for example, rewards LPs with CRV tokens. Yearn Finance and other yield aggregators automatically compound these rewards, boosting returns. Some pools offer 5-15% APY just from fees. Add token emissions, and you could see 20%+ returns-especially on newer, less stable pairs.

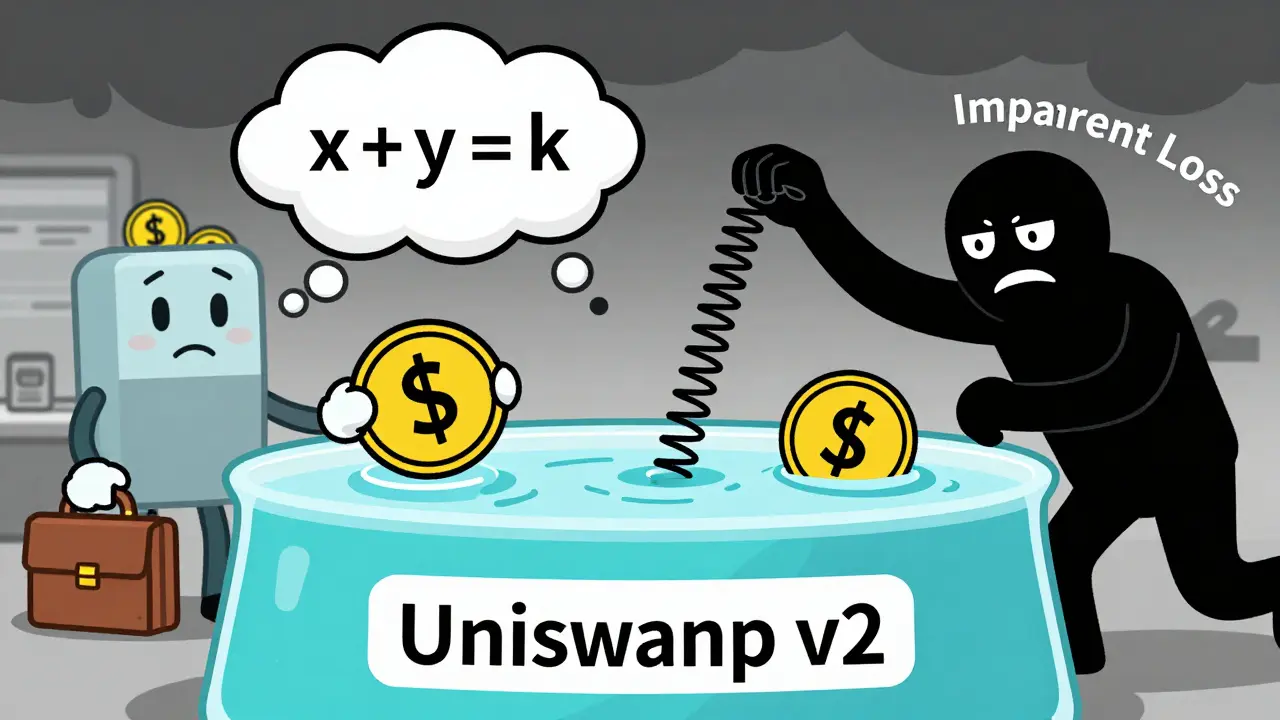

But here’s the catch: high returns often come with high risk. The most dangerous one? Impermanent loss.

Impermanent Loss: The Hidden Cost of Providing Liquidity

Impermanent loss isn’t a hack. It’s math. It happens when the price of the two tokens in your pool changes after you deposit them.Let’s say you deposit 1 ETH and 2,000 USDC when ETH is $2,000. Your pool value is $4,000. Now ETH jumps to $3,000. The AMM rebalances the pool to keep the product (x * y = k) constant. So now you have less ETH and more USDC than you started with. If you’d just held your ETH instead of putting it in the pool, you’d have $3,000 in ETH alone. But because of the rebalancing, you might only have $2,940 total value in your pool. That $60 difference? That’s impermanent loss.

It’s called “impermanent” because if the price goes back to where it started, the loss disappears. But if you withdraw while prices are off, it becomes permanent. According to Keyrock’s 2023 analysis, a 3x price move can cause over 13% impermanent loss. For volatile pairs like ETH/SHIB, that’s a real threat.

Stablecoin pools (like USDC/USDT) rarely see impermanent loss because their prices stay near $1. That’s why many experienced LPs stick to stable pairs during market swings. They earn steady fees without the rollercoaster.

Uniswap v2 vs. v3 vs. Curve: Which Pool Should You Choose?

Not all liquidity pools are built the same. Here’s how the big three compare:| Protocol | Model | Best For | Capital Efficiency | Impermanent Loss Risk |

|---|---|---|---|---|

| Uniswap v2 | Constant Product (x*y=k) | General token swaps | Low | High |

| Uniswap v3 | Concentrated Liquidity | Experienced LPs | Up to 4,000x higher | Very High (if outside range) |

| Curve Finance | StableSwap Invariant | Stablecoin pairs | High for stable pairs | Negligible |

Uniswap v2 is simple but inefficient. Most of your capital sits unused if the price moves even a little. Uniswap v3 fixes this by letting you pick a price range-say, $1,800 to $2,200 for ETH. Your capital only works within that range, but if the price stays there, you earn way more fees. The catch? If ETH moves outside your range, you earn nothing until it comes back. It’s like running a store that only opens during business hours-you save costs, but you miss sales outside those times.

Curve is the opposite. It’s built for stablecoins. Its math keeps prices tightly pegged, so slippage stays under 0.01% even for $100,000 swaps. That’s why big players like Coinbase and Binance route stablecoin trades through Curve. For LPs, it’s low-risk, low-reward-but reliable.

Who’s Actually Providing Liquidity?

You might think DeFi is open to everyone. And it is-but not equally.Chainalysis found that the top 1% of liquidity providers control nearly half of all DeFi TVL. These aren’t random users. They’re hedge funds, market makers like Jump Crypto, and institutional players with $100 million+ to deploy. They use bots, algorithms, and real-time data to optimize positions and hedge risk.

Meanwhile, retail LPs often lose money. Gauntlet Network’s 2022 study showed 68% of Uniswap v2 LPs lost more to impermanent loss than they earned in fees during volatile periods. Reddit users report losing 20%+ on ETH/USDC positions after a 30% ETH swing-even with 8% in fee income.

The gap is growing. New tools like Yearn and Zapper make it easier for beginners to deposit, but they don’t teach risk. Many users don’t understand that adding liquidity isn’t like staking. You’re not earning interest. You’re running a mini-market. And markets move.

How to Start as a Liquidity Provider

If you want to try it, here’s how to do it safely:- Start with stablecoin pairs: USDC/USDT or DAI/USDC. These have near-zero impermanent loss.

- Use Uniswap v3 on Arbitrum or Polygon. Gas fees on Ethereum can eat 15-20% of small deposits. On Arbitrum, a transaction costs $0.15.

- Deposit equal values. Never put in more of one token than the other unless you’re hedging.

- Set a narrow price range. For ETH/USDC, try $1,900-$2,100 if ETH is trading at $2,000.

- Use Zapper.fi or DeFi Saver to track your position. Watch for price drift.

- Don’t compound rewards unless you understand tax implications. In Australia, LP rewards are treated as income.

Beginners should start with $100-$200. Treat it like a learning exercise. You’ll make mistakes. That’s okay. The goal isn’t to get rich overnight. It’s to understand how DeFi really works.

Big Risks You Can’t Ignore

Liquidity provision isn’t risk-free. Here are the real dangers:- Smart contract hacks: Over $2.8 billion was lost to DeFi exploits in 2022. Even big protocols like Harmony and Pangolin got hacked. Always check if a pool has been audited by firms like CertiK or OpenZeppelin.

- Regulatory risk: The SEC is watching. In 2023, they sued Uniswap Labs, claiming LP tokens are unregistered securities. If that ruling spreads, many pools could be shut down or forced to change.

- Gas wars: On Ethereum, fees spike during NFT drops or major news. Use layer-2s. They’re faster and cheaper.

- Token emissions drying up: Many high-yield pools pay in new tokens. Once the rewards stop, APY crashes. Don’t chase 100% APY unless you’re okay with losing it all.

There’s also the “vampire attack” risk-when a new protocol steals liquidity from an old one by offering better rewards. This happened with Curve and then with SushiSwap. It’s a race to the bottom.

What’s Next for Liquidity Providers?

The future is getting smarter. Uniswap v4, launching in early 2024, lets developers build custom fee structures and automated rebalancing. Imagine a pool that shifts your capital automatically when prices move. That’s coming.“Liquidity as a Service” (LaaS) platforms like Ambient Finance are letting protocols manage LP positions for users. No more manual range adjustments. Bots do it for you.

Delphi Digital predicts concentrated liquidity will make up 85% of DeFi TVL by 2025. That means more power to skilled LPs-and more risk for beginners who don’t adapt.

For now, the best strategy is simple: stick to stablecoins, use low-fee chains, and don’t over-leverage. The goal isn’t to be the richest LP. It’s to be the one still here when the hype fades.

Are liquidity providers the same as market makers?

In function, yes-they both provide the buy and sell orders that make trading possible. But traditional market makers like Jump Crypto use high-frequency algorithms, massive capital, and direct exchange access. DeFi LPs use smart contracts and earn fees passively. Anyone can join, but the big players dominate volume and profits.

Can I lose more than I deposit as a liquidity provider?

No, you can’t lose more than what you put in. Impermanent loss reduces your total value compared to holding, but your LP tokens still represent real assets. Even if ETH crashes 80%, you still own your share of the remaining ETH and USDC in the pool. The worst-case scenario is your position becomes worthless because the protocol fails or the tokens lose all value-but that’s not your fault. You didn’t borrow money. You didn’t leverage. You just deposited.

Do I need to pay taxes on liquidity provider rewards?

Yes. In most countries, including Australia, LP rewards are treated as income. Every time you earn fees or new tokens, it’s a taxable event. Compounding rewards means you’re taxed multiple times. Keep detailed records. Use tools like Koinly or TokenTax to track your transactions. Many LPs get hit with big tax bills because they didn’t plan ahead.

Is it better to use Uniswap v2 or v3 as a beginner?

Start with Uniswap v2 if you’re new. It’s simpler-you don’t need to pick price ranges. Once you understand how prices move and how impermanent loss works, then try v3. Many beginners lose money on v3 because they set their ranges too tight and miss out on fees entirely. Don’t rush into concentrated liquidity.

What’s the safest liquidity pool to join right now?

The safest option is a stablecoin pair on a low-fee chain-like USDC/USDT on Curve Finance via Arbitrum. These pools have minimal impermanent loss, high trading volume, and strong audits. Avoid new tokens, meme coins, or pools with APY over 20%. If it sounds too good to be true, it usually is.

Just started with $150 in USDC/USDT on Arbitrum. No drama, no stress. Just watching the fees roll in like a slow drip faucet. Feels good to be learning without losing my shirt.

Still don’t get why people chase 50% APY on meme coins. That’s not investing. That’s gambling with a DeFi label.

I used to think LPing was passive income. Then I lost 18% on an ETH/SHIB pool because I didn’t understand concentrated liquidity.

Turns out, you’re not earning interest-you’re running a tiny, automated market that gets wrecked by volatility. Now I only do stable pairs. No regrets.

Also, tax season was brutal. Every time I claimed rewards, the IRS treated it like I’d won the lottery. Keep records. Seriously.

Don’t let anyone tell you this is easy money. It’s not. It’s math, timing, and emotional discipline wrapped in a blockchain.

I’ve watched friends get rich and then lose it all chasing yield. The ones who stick around? They’re the ones who treat it like a job, not a lottery ticket.

Oh wow, another ‘DeFi is fair’ fairy tale. Let me guess-you think retail LPs stand a chance against Jump Crypto’s bots that front-run trades and manipulate price ranges?

Uniswap v3? More like ‘Uniswap for suckers.’ The top 1% own half the TVL and the rest of us are just fee-farming bait.

And don’t even get me started on Curve. It’s not ‘safe’-it’s a corporate liquidity sinkhole where hedge funds park their cash and laugh at your 0.01% APY.

Real talk: DeFi isn’t decentralized. It’s just a new way for the rich to get richer while you clean up their volatility mess.

Also, the SEC is coming. You think your LP tokens are safe? They’re unregistered securities. You’re already in legal gray zone. Enjoy your tax bill in 2025.

For anyone new: start small. Like, $50 small.

I put $100 into USDC/DAI on Polygon last year. Made $6 in fees. Didn’t lose anything. Learned how the interface works.

Then I tried v3. Set my range too wide. Earned nothing for 3 weeks. Lesson learned.

Now I stick to stable pools, use Zapper to track, and never touch anything with APY over 10%.

It’s not glamorous. But I’m still here. And that’s the win.

Wow. So you’re telling me the ‘open finance revolution’ is just a game of hot potato where the rich pass the volatility to the poor while collecting fees?

And the ‘safest’ option is a stablecoin pool on a chain that’s technically owned by a centralized entity?

Let me get this straight-we built a whole ecosystem to remove intermediaries… only to replace them with algorithmic market makers and institutional bots?

It’s like replacing a bank with a robot that steals your lunch money and calls it ‘yield.’

And you want me to trust this with my life savings? Because ‘it’s decentralized’?

Bro. It’s not decentralized. It’s just… branded differently.

Correction: You can lose more than you deposit if you use leverage or borrow against your LP position. The post correctly states you can't lose more than your initial deposit when providing liquidity without leverage. However, many users confuse LPing with margin trading or borrowing against LP tokens on protocols like Aave or MakerDAO. That’s where real losses occur. Always distinguish between pure liquidity provision and leveraged DeFi strategies. Precision matters.

I think people forget that liquidity provision isn’t just about math-it’s about psychology.

When the price moves, you feel like you’re losing… even if you’re not, yet.

And that fear? It makes you withdraw too early.

I watched a friend pull out of a USDC/ETH pool after a 15% dip. He lost 7% impermanent loss, but then ETH went up 40%.

He cried. I didn’t. I just shrugged. He was emotionally invested. I was mathematically invested.

Also, gas fees on Ethereum are a scam. Why are we still using it? Arbitrum, Polygon, Base-these are the real DeFi now.

And don’t even get me started on tax software that doesn’t understand LP rewards. I had to manually track 87 transactions last year. I’m not joking.

It’s not a hobby. It’s a part-time job with a crypto twist.

Impermanent loss? Please. That’s just the polite term for ‘you got rekt by a bot.’

The whole system is rigged. Big players use MEV bots to front-run your trades and drain your pool while you sleep.

And you think Curve is safe? LOL. They’re just a front for institutional wash trading.

Meanwhile, you’re out here checking your balance every 10 minutes like a gambler at a slot machine.

DeFi isn’t finance. It’s a casino with a whitepaper.

And you’re the sucker who keeps buying chips because the lights are pretty.

The true existential question isn’t about impermanent loss or APY-it’s about ontology.

Are you a liquidity provider… or are you a node in a distributed economic organism?

When you deposit ETH and USDC, you’re not just supplying capital-you’re participating in the emergence of a new financial topology.

The AMM isn’t an algorithm-it’s a proto-consciousness, a decentralized will that balances value without hierarchy.

And yet, we reduce it to ‘fees’ and ‘taxes’ and ‘ranges’.

We’ve lost the poetry of DeFi.

We turned transcendence into a spreadsheet.

And now we wonder why the system feels hollow.

Maybe the real impermanent loss… is our capacity to dream.

USDC? You’re kidding right? It’s backed by a company that works with the Fed. You think you’re decentralized? You’re just a digital serf paying fees to Wall Street 2.0.

And you call this ‘freedom’? Please. The only thing open here is your wallet.

Real crypto is Bitcoin. Everything else is a distraction for dumb people who want to feel smart.

Stop wasting your time. Go buy BTC and HODL. That’s the only real DeFi.

Everyone’s so focused on fees and impermanent loss, but no one talks about the moral decay.

You’re turning human trust into algorithmic collateral.

You’re not building a financial system-you’re automating greed.

And you call this innovation?

Where’s the soul in this? Where’s the community?

It’s all just numbers on a screen, and the only thing growing is the gap between the elite and the peasants who think they’re ‘earning yield’.

What are we becoming?

For beginners: if you don’t know what an AMM is, don’t touch v3.

Start with stablecoins. Use Zapper. Set a reminder to check your position once a month.

Don’t chase APY. Don’t read Reddit threads that say ‘100% APY guaranteed.’

And if you’re not sure? Wait.

It’s not a race. The money isn’t going anywhere.

DeFi will still be here next year. So will you-if you’re patient.

I’ve seen too many people rush in, panic out, and blame the system.

The system’s fine. You just weren’t ready.

That’s okay. You’re learning.

And that’s what matters.

Why are we even doing this? The government is gonna shut it all down anyway

and then we’ll all be broke and the rich will laugh

and you’ll be sitting there like ‘but I earned 15% APY’

lol

you’re not a financier you’re a lab rat

and the cheese is fake

and the cage is just a little prettier now

so enjoy your ‘yield’ while it lasts

because it’s not yours

it’s theirs

and they’re already planning the exit

THEY’RE WATCHING YOU. EVERY SINGLE TRANSACTION. THE FED, THE SEC, THE CIA-THEY’RE TRACKING YOUR LP TOKENS.

YOU THINK YOU’RE DECENTRALIZED? YOU’RE ON A BLOCKCHAIN THAT’S MONITORED BY A CENTRALIZED NODE OPERATOR.

YOUR ‘SAFE’ STABLECOIN? IT’S BACKED BY A COMPANY THAT REPORTS TO THE IRS.

THEY’RE BUILDING A DIGITAL ID SYSTEM AND DEFI IS THE TRAP.

ONE DAY YOU’LL LOG IN AND YOUR WALLET WILL BE FROZEN.

AND THEY’LL SAY ‘IT WAS FOR YOUR OWN GOOD’.

YOU THINK THIS IS FREEDOM?

IT’S A GATED COMMUNITY WITH A BLOCKCHAIN WALL.

WAKE UP.

BUY BITCOIN. GO OFF GRID.

OR STAY HERE AND GET RUSTLED.

YOUR CHOICE.

😈

They say LPs are the heroes of DeFi but I know the truth

the real heroes are the ones who stayed out

and watched everyone else get scammed

and laughed

and bought BTC at $30k

and now they’re rich

while you're still trying to figure out why your USDC/ETH pool lost 12%

and you think it's impermanent loss

but it's just the system working as designed

to take your money

and give you a tax form

and a false sense of accomplishment

you're not earning yield

you're paying for the privilege of being a data point

in someone else's algorithm

and you're proud of it

how sad

Start small. Learn. Don’t rush. That’s it.

DeFi is not a get-rich-quick scheme.

It’s a tool.

Like a hammer.

Use it right, it helps.

Use it wrong, you break your thumb.

Simple.

Been doing this for 2 years. Made some money. Lost some. Learned a ton.

Best advice? Never put more than you can afford to lose.

And always, always check the audit reports.

One time I deposited into a pool that said ‘audited by CertiK’.

Turned out it was a fake audit.

Lost $800.

Worst part? I didn’t even know until 3 weeks later.

Now I triple-check everything.

Not because I’m paranoid.

Because I’m smart.

impermanent loss? more like permanent dumbass loss

why do people still use uniswap v2? its like using a flip phone in 2024

and curve? yeah right. its just a honeypot for whales

and dont even get me started on tax

i forgot to report my crv rewards and now the irs is after me

lol

thanks for nothing defi

im out

going back to binance

Everyone’s acting like LPing is rocket science.

It’s not.

It’s just a trade-off: you give up control for fees.

And if you don’t understand that, you shouldn’t be doing it.

Stop reading Reddit threads and open the docs.

It’s not that hard.

Also, if you’re using Ethereum mainnet for small deposits, you’re just throwing money away.

Use Arbitrum.

It’s cheaper.

It’s faster.

It’s not magic.

It’s just better.

In Nigeria, we call this ‘digital farming’-you plant your tokens, water them with patience, and wait for the yield.

But here, people treat it like a stock market gamble.

DeFi isn’t about speed.

It’s about sustainability.

Start with stable pairs.

Use low-fee chains.

Don’t chase hype.

And never, ever borrow against your position.

Many of my friends lost everything because they thought ‘more leverage = more profit’.

It’s not.

It’s just a faster way to lose.

Be like the tortoise.

Not the hare.

They say liquidity providers are the backbone of DeFi

but who really owns the backbone?

Not you.

Not me.

It’s the same hedge funds that owned Wall Street.

They just changed their suits for smart contracts.

And you think you’re part of the revolution?

You’re just the battery.

Charging their machines.

While they laugh.

And take your fees.

And your taxes.

And your dreams.

DeFi is not decentralized.

It’s just… more efficient exploitation.

My first LP position? I put in $200 on Uniswap v2. Got $3 in fees. Thought I was rich.

Then I saw how much the whales made.

Didn’t feel rich anymore.

So I switched to stablecoins.

Now I earn $1 a week.

It’s not sexy.

But I sleep at night.

And I didn’t lose a cent.

That’s the win.

Don’t let the hype fool you.

Small and steady wins the race.

Always.

just started and i think i messed up my range on v3

like… i set it from 1800 to 2200 but eth went to 2400

now im just sitting here with usdc

and feeling dumb

but hey at least i didnt lose money

just missed out

learning curve is real

also why does everyone on here sound like a finance bro?

can we just say ‘oops’ and move on?

it’s crypto

not a phd thesis

There is a fundamental misunderstanding in the post: liquidity provision is not equivalent to staking. Staking involves locking tokens to secure a network and earning block rewards. Liquidity provision involves providing paired assets to facilitate trading and earning transaction fees. The risk profiles are entirely different. Confusing the two leads to poor decision-making. Always verify the mechanism before depositing. Clarity is essential.

Just joined a USDC/USDT pool on Base with $50.

Got 0.003 ETH in fees after a week.

Not rich.

But I’m in.

And I’m learning.

And I’m not scared.

That’s more than most people can say.

Keep it simple.

Stay consistent.

Don’t chase the moon.

Just be here.

And watch.

And learn.

That’s all you need.

Someone said they lost money on ETH/SHIB. Yeah, that’s not LPing. That’s gambling with leverage and no exit plan.

Stick to stable pairs. It’s boring. But it’s safe.

And safe is how you survive.