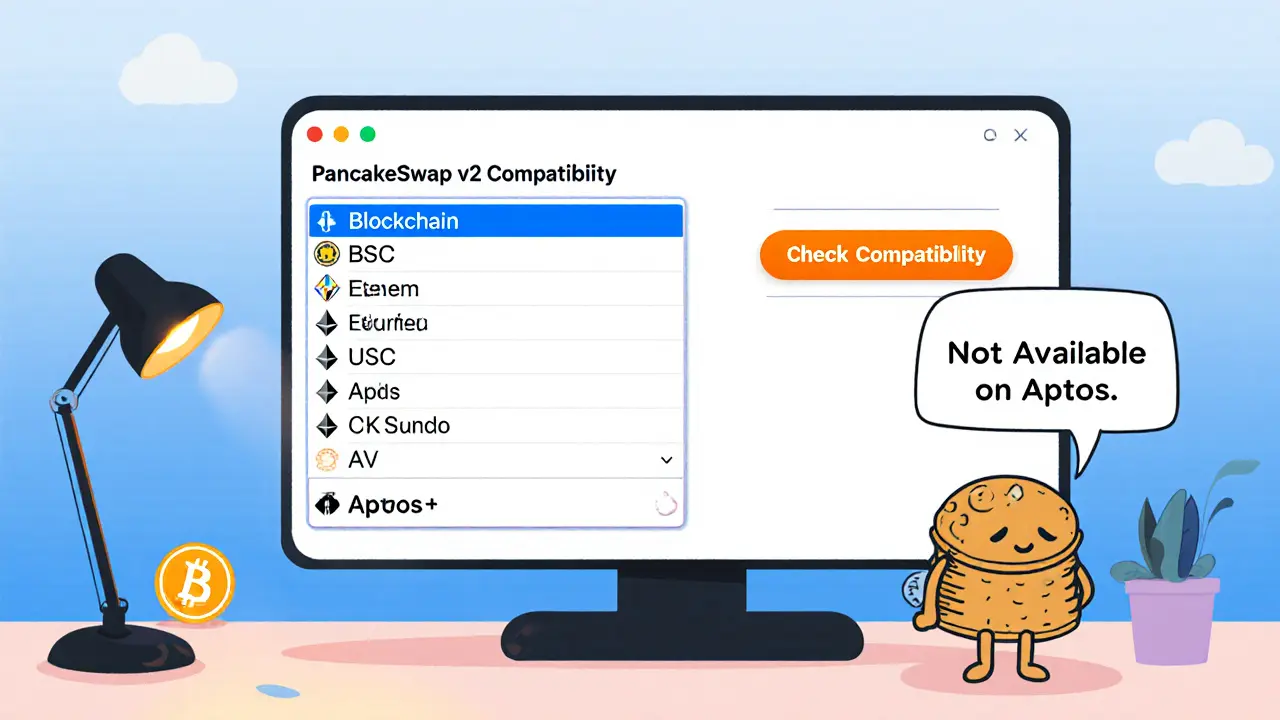

PancakeSwap v2 vs Aptos Compatibility Checker

Key Features of PancakeSwap v2

Spot Swaps

Instant token swaps via AMM pools with 0.25% fee

Yield Farming

Provide liquidity and earn CAKE rewards

Syrup Pools

Stake CAKE for flexible or fixed-term yields

Alternative DEX Options on Aptos

Pontem

Native AMM with Move-based contracts

Martian DEX

Low-fee swaps and small farming module

Venus on Aptos

Experimental lending/borrowing with swap interface

Quick Take

- PancakeSwap v2 is the flagship DEX on Binance Smart Chain, offering swaps, farming, staking, futures and NFTs.

- There is no official PancakeSwap deployment on the Aptos blockchain as of October2025.

- If you need Aptos‑native trading, consider native Aptos DEXes such as Pontem and Martian.

- Fees on PancakeSwap v2 are 0.25% per swap, far lower than most CEXs.

- Security is bolstered by regular audits and a full‑node validation model.

PancakeSwap v2 is a decentralized exchange (DEX) that runs as an automated market maker (AMM). It lets users swap tokens, earn yields, and access on‑chain derivatives without handing over private keys. While the platform now spans nine blockchains, the Aptos network is not among them.

What is PancakeSwap v2?

Launched in 2020, PancakeSwap quickly became the go‑to DEX on Binance Smart Chain (BSC). Version2 introduced a redesigned router, lower slippage, and a suite of new financial products. At its core, the protocol uses the Automated Market Maker model: liquidity providers deposit paired assets into a pool, and the smart contract prices trades based on the constant‑product formula (x*y=k).

The native governance token, CAKE, powers staking, voting, and fee distribution. Holders can lock CAKE in PancakeSwap v2 “Syrup Pools” for flexible or fixed‑term yields ranging from roughly 8% to 45% APY, depending on lock‑up length.

Current Multi‑Chain Footprint

PancakeSwap’s recent expansion covers BSC, Ethereum, Base, Avalanche, Polygon, Arbitrum, Optimism, Solana and Cosmos. Each deployment retains the same core contracts, with minor adjustments for the underlying chain’s gas model and address format. The platform reports over 3,000 active trading pairs and more than 150 listed tokens across these networks.

The typical trading fee is 0.25% for both maker and taker, split between liquidity providers and the protocol treasury. This fee is substantially lower than fees on centralized exchanges (often 0.5%-0.7%).

Aptos Integration - What’s the Real Story?

As of October2025, PancakeSwap has not launched a dedicated version on the Aptos blockchain. All publicly available documentation, audit reports, and the official roadmap reference BSC and the eight other supported chains, but Aptos is omitted.

Why does this matter? Aptos boasts sub‑second finality, a parallelized execution engine, and low transaction costs - features that would theoretically benefit a high‑throughput DEX. However, the lack of PancakeSwap on Aptos means users cannot directly trade PancakeSwap‑listed tokens using Aptos wallets, nor can they benefit from the platform’s liquidity on that chain.

The most plausible explanations are:

- Technical onboarding: moving the AMM codebase to Aptos’s Move language requires a rewrite, and the development team may be prioritizing other chains with larger user bases.

- Strategic focus: PancakeSwap’s growth is still heavily tied to BSC’s ecosystem; shifting resources to a newer chain could dilute momentum.

- Regulatory caution: newer Layer‑1s sometimes face uncertain compliance landscapes, prompting cautious rollout.

Until an official announcement appears, the safest bet is to use PancakeSwap on its supported chains or explore native Aptos DEXes.

Core Features You’ll Find on PancakeSwap v2

- Spot Swaps: Instant token swaps via AMM pools with 0.25% fee.

- Yield Farming: Provide liquidity and earn CAKE rewards; risk of impermanent loss applies.

- Syrup Pools: Stake CAKE for flexible (no lock‑up) or fixed‑term (up to 52weeks) bonuses.

- Limit Orders: Set price‑triggered orders that execute when market reaches your target.

- TWAP Orders: Break large orders into time‑weighted slices to reduce market impact.

- Perpetual Futures: Trade leveraged contracts up to 1:100, with funding rates to balance longs and shorts.

- Initial Farm Offerings (IFOs): Participate in token launches directly from the platform.

- NFT Marketplace: Buy, sell, and mint NFTs; includes collection‑wide launchpad features.

Security and Audits

PancakeSwap runs a full‑node validation system: every swap, farm or stake interacts with on‑chain smart contracts that are publicly verified. The protocol undergoes periodic security audits from firms such as PeckShield and CertiK. While no platform is immune to bugs, PancakeSwap’s track record shows no major loss events since the V2 migration.

Pros and Cons - Especially Regarding Aptos

| Aspect | PancakeSwap v2 (BSC & other supported chains) | Aptos‑Native DEX (e.g., Pontem, Martian) |

|---|---|---|

| Liquidity depth | High - thousands of pools, multi‑chain aggregation | Emerging - lower total value locked |

| Fees | 0.25% per swap | Typically 0.10%-0.20% |

| Feature set | Swaps, farms, syrup pools, futures, NFTs, IFOs | Basic AMM swaps, limited farming, few derivatives |

| Security audits | Regular third‑party audits | Fewer formal audits, community‑driven reviews |

| Aptos compatibility | Not available | Native, uses Move language |

Bottom line: PancakeSwap offers a richer toolkit, but if you are locked into the Aptos ecosystem, you’ll have to use a native DEX.

How to Use PancakeSwap v2 Today

- Install a compatible wallet (e.g., MetaMask for BSC, Trust Wallet, or WalletConnect‑enabled apps).

- Configure the network: add BSC Mainnet (RPC: https://bsc-dataseed.binance.org/, Chain ID 56).

- Visit the PancakeSwap UI and click “Connect Wallet”.

- For a swap, select the token pair, enter the amount, review the price impact, and confirm the transaction in your wallet.

- To farm, navigate to “Liquidity”, add assets to a pool, then go to “Farms” and stake your LP tokens to earn CAKE.

- To stake CAKE, choose a Syrup Pool, decide on lock‑up length, and confirm.

The whole flow usually takes under a minute, and transaction fees are a few cents on BSC.

Alternatives on Aptos

If you’re looking for DEX functionality native to Aptos, consider the following options:

- Pontem: Offers a native AMM with Move‑based contracts; supports basic swaps and liquidity provision.

- Martian DEX: Integrates with the Martian wallet, focusing on low‑fee swaps and a small farming module.

- Venus on Aptos: Experimental lending/borrowing platform that also provides a simple swap interface.

These platforms lack the extensive feature set of PancakeSwap but benefit from Aptos’s fast finality and sub‑dollar gas fees.

Frequently Asked Questions

Is PancakeSwap v2 officially available on Aptos?

No. As of the latest update (October2025), PancakeSwap has not launched a dedicated contract suite on the Aptos blockchain. The platform continues to operate on BSC and eight other chains.

Can I trade PancakeSwap tokens using an Aptos wallet?

You can only swap tokens that exist on the chain where PancakeSwap is deployed. Since there is no Aptos deployment, you must switch your wallet to a supported network (e.g., BSC) to interact with PancakeSwap.

What are the main advantages of using PancakeSwap over a centralized exchange?

Lower fees (0.25% vs. 0.5%+), self‑custody of funds, no KYC, access to on‑chain yields (farming, staking), and a broader suite of DeFi tools.

Is it safe to deposit funds into PancakeSwap farms?

The platform undergoes regular third‑party audits and has a robust bug‑bounty program. However, liquidity provision always carries impermanent loss risk; only allocate assets you can afford to lose.

Will PancakeSwap ever launch on Aptos?

The team has not announced any concrete plans. Keep an eye on official blog posts and community channels for future updates.

Next Steps and Troubleshooting

• If you encounter a “wrong network” error, double‑check that your wallet RPC points to the correct chain.

• High price‑impact warnings usually mean the pool is thin; consider splitting the trade or using a different pair.

• For stuck transactions, increase the gas limit or use the “speed up” function in your wallet.

• To stay updated on a possible Aptos launch, follow PancakeSwap’s official Twitter, Discord, and the GitHub repo’s release notes.

I just tried Pontem last week-super smooth! Honestly, I didn’t miss PancakeSwap at all. The gas fees are practically nothing, and the UI? So clean. I’m sold.

While I appreciate the thoroughness of this analysis, I must emphasize that the absence of PancakeSwap on Aptos is not merely a technical oversight-it reflects a strategic prioritization grounded in ecosystem maturity and user base density. One must consider the opportunity cost of resource allocation in decentralized infrastructure development.

This is actually a great breakdown. I’ve been using Martian for a while now, and honestly? It’s more than enough for my daily swaps. No need to force PancakeSwap onto Aptos-native solutions are growing fast. Keep supporting the local teams-they’re building something real.

Honestly, I’m just waiting for the Move language to mature enough to handle PancakeSwap’s complex AMM logic-right now, the tooling is still in its infancy compared to Solidity. Also, the CAKE tokenomics are so deeply tied to BSC’s ecosystem that porting it would require a full re-architecture-not just a redeployment. Plus, Aptos users are more into low-friction, high-speed swaps than yield farming sprees. The cultural fit? Not there yet. But I’m hopeful-watch the Aptos Foundation’s grant pipeline; they’ve already funded three AMM forks. The real question isn’t if, but when-and whether CAKE can adapt to Move’s resource-centric model without losing its soul.

I just use what works. If I’m on Aptos, I use Pontem. If I want futures or NFTs, I hop to BSC. No big deal. It’s like having two kitchens-you don’t need one to do everything.

I’ve been on both sides-used PancakeSwap on BSC for months, now I’m all-in on Martian. The truth? Aptos DEXes are catching up fast. They don’t have 3000 pools yet, but they don’t need to. Speed and cost matter more than quantity. And honestly? The community here is way more helpful. No shady tokens, no rug pulls-just real builders. Keep it simple, folks.

It is patently absurd to suggest that native Aptos DEXes are viable alternatives to PancakeSwap v2. The former are essentially beta-stage prototypes with negligible liquidity depth, rudimentary smart contract design, and no formal audit trail. To equate them is to misunderstand the very definition of a mature decentralized exchange. One does not substitute a Ferrari with a bicycle merely because the latter is 'faster' on a flat road. The absence of PancakeSwap on Aptos is not a flaw-it is a testament to the blockchain’s current immaturity.