QuickSwap v2 on Base isn’t just another crypto exchange. It’s a high-speed, ultra-low-cost way to trade tokens without handing your keys to anyone. If you’re tired of paying $5-$15 in gas fees on Ethereum or waiting minutes for a trade to confirm, this might be your new go-to. Launched on August 12, 2025, QuickSwap v2 on Base brings the same decentralized trading model as Uniswap-but with near-zero fees and trades that settle in under 3 seconds. No middlemen. No KYC. Just you, your wallet, and a blockchain built for speed.

How QuickSwap v2 on Base Works

QuickSwap runs on Coinbase’s Base chain, a Layer 2 network built on Ethereum. It uses an automated market maker (AMM) system, meaning there are no order books. Instead, trades happen directly from liquidity pools-groups of tokens locked in smart contracts. When you swap ETH for USDC, you’re not selling to another person. You’re trading against a pool that has both tokens in it. The price adjusts automatically based on supply and demand.

What makes QuickSwap v2 special is its use of concentrated liquidity. Unlike older DEXs that spread your funds across a wide price range, QuickSwap lets you choose exactly which price range your tokens will be active. This means you can earn more fees with less capital. If you think WBTC will trade between $60,000 and $65,000, you can lock your liquidity only in that range. It’s like being a market maker instead of just a pool contributor.

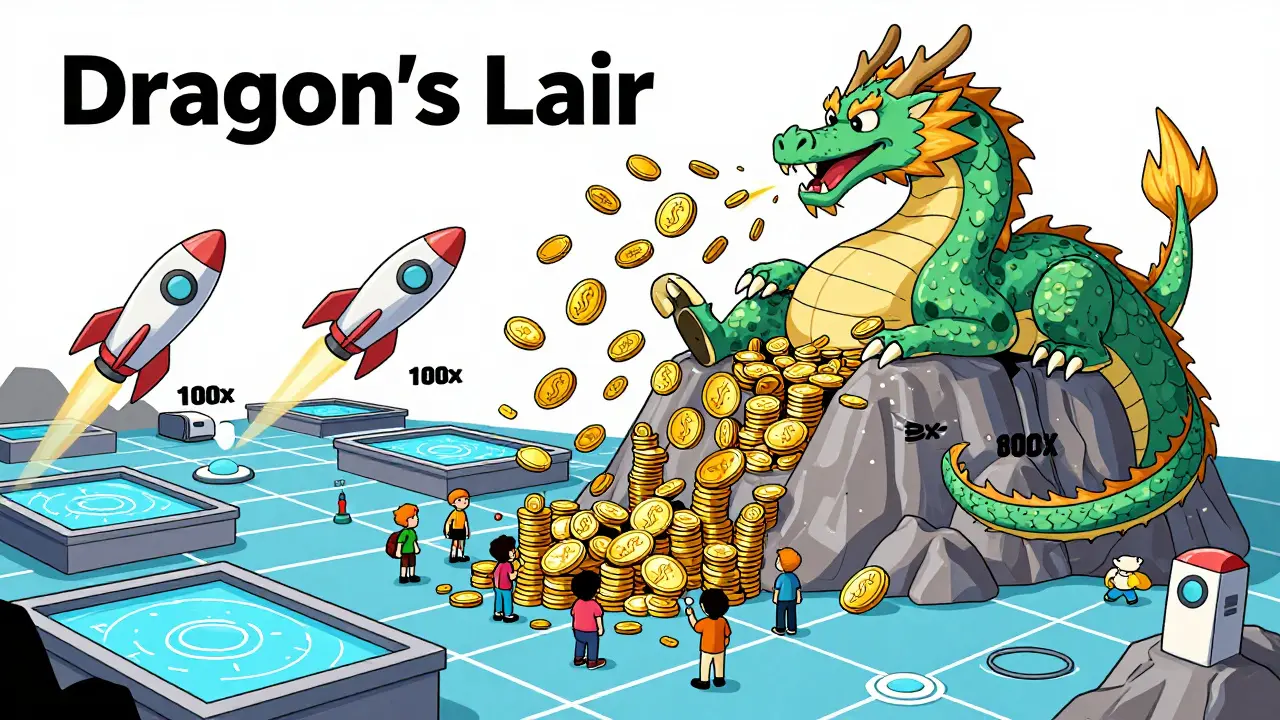

Every trade on QuickSwap v2 pays a 0.25% fee. Half of that goes to liquidity providers, and the other half goes into a treasury that rewards QUICK token stakers. If you stake your QUICK tokens in the Dragon’s Lair program, you get 50% of all protocol fees across all chains. That’s not just a bonus-it’s a direct cut of the platform’s revenue.

Why It’s Faster and Cheaper Than the Rest

On Ethereum, even a simple swap can cost $3-$15 in gas. On Base, it’s $0.005-sometimes less than a penny. Transaction times? Around 2 seconds. Compare that to Uniswap on Ethereum, where you might wait 15-30 seconds during peak hours. For traders who make dozens of swaps a day, that adds up to hundreds of dollars in saved fees and hours of lost time.

QuickSwap v2 also supports up to 100x leverage on perpetual contracts with zero gas fees for trading. That’s rare for a DEX. Most platforms charge gas on every position open, close, or adjustment. QuickSwap doesn’t. It’s built for active traders who need speed and low costs above all else.

It’s not just fast-it’s connected. QuickSwap works across 10 blockchains, including Polygon, Immutable zkEVM, and Ethereum. But Base is where it’s growing fastest. As of October 2025, QuickSwap holds $385 million in total value locked (TVL) on Base, making it the second-largest DEX on the chain after Aerodrome Finance. That’s more than Camelot DEX, which sits at $210 million.

What You Can Do Beyond Swapping

QuickSwap isn’t just a swap tool. It’s a full DeFi hub. You can:

- Provide liquidity and earn trading fees

- Stake QUICK tokens to earn 50% of protocol fees

- Trade perpetual futures with up to 100x leverage

- Farm yield by locking LP tokens in farming pools

- Use the API to connect trading bots like HaasOnline or Build Alpha

The API is fast-120ms average response time-and used by algorithmic traders who need reliable execution. If you’re running a bot that makes hundreds of trades a day, QuickSwap’s low fees and speed make it one of the few DEXs that won’t eat into your profits.

There’s also a staking program called Dragon’s Lair. You don’t need to be a whale to benefit. Even staking $100 in QUICK gives you a share of the fees. Rewards are distributed daily, and the APR has hovered between 8% and 15% since the Base launch, depending on trading volume.

Who It’s For-and Who Should Stay Away

QuickSwap v2 on Base is perfect for:

- Active traders who swap daily

- DeFi users who want to earn yield without centralized exposure

- Bot traders who need low-latency execution

- Anyone tired of Ethereum’s high fees

But it’s not for everyone.

If you’re new to crypto, the interface can be overwhelming. Concentrated liquidity, slippage settings, and token approvals aren’t explained well. Reddit users report spending 20 minutes just figuring out how to set up a liquidity position. There’s no guided onboarding. You’re expected to know what impermanent loss is before you start.

Also, there’s no direct fiat on-ramp. You can’t buy crypto with a credit card here. You need to first buy on Coinbase or Binance, then bridge your assets to Base using Coinbase’s official bridge-which takes 2 to 15 minutes. That’s a barrier for beginners.

And if you’re trading large amounts-say, over $500,000-you’ll run into slippage issues. QuickSwap’s liquidity, while strong, doesn’t match Binance’s order book depth. For big institutional trades, centralized exchanges still win.

Security and Risks

QuickSwap is non-custodial. That means your funds never leave your wallet. No exchange holds your keys. That’s a huge plus. But multi-chain bridges are complex. QuickSwap connects to 10 blockchains, and each bridge is a potential point of failure. Security researcher Samczsun warned in August 2025 that cross-chain messaging “introduces risks beyond standard AMM setups.”

There’s also the QUICK token. It’s used for governance and fee sharing, but the SEC is watching. On September 18, 2025, QuickSwap submitted arguments to the SEC claiming QUICK is a utility token, not a security. That’s still untested. If the SEC rules otherwise, staking rewards could be restricted.

Finally, slippage protection isn’t as smart as Balancer’s weighted pools. During volatile markets, you might get worse prices than expected. Always set your slippage tolerance manually-don’t rely on defaults.

Real User Experiences

On Reddit, users like CryptoDragon42 say they get 0.8% better rates on WBTC/USDC trades than on Uniswap on Base. Others praise the speed: “Transactions confirm in under 3 seconds, every time.”

But newcomers struggle. DeFiNewbie88 wrote: “Took me 20 minutes to figure out how to add liquidity. The interface assumes you already know how this works.”

Trustpilot and SourceForge give it 3.9/5 and 4.1/5 respectively. The most common complaints? Complex staking, lack of beginner guides, and confusing UI. The good? “Near-zero gas fees” is mentioned in 78% of positive reviews. “Responsive Telegram support” is cited by 63%.

QuickSwap’s support team answers Telegram and Discord questions in about 22 minutes during business hours. That’s better than most DEXs. Their knowledge base has 147 articles, but they’re written for intermediate users. Beginners are left to figure things out on their own.

How to Get Started

Here’s how to use QuickSwap v2 on Base in five steps:

- Install a Web3 wallet: MetaMask, Coinbase Wallet, or WalletConnect.

- Buy ETH or USDC on a centralized exchange like Coinbase or Binance.

- Use the Coinbase Bridge to move your assets to Base. Wait 2-15 minutes.

- Go to quickswap.exchange and connect your wallet.

- Choose your trade: swap, add liquidity, or stake QUICK.

Pro tip: Always set your slippage tolerance to 0.5%-1% for stablecoins and 3%-5% for volatile tokens. Default settings can get you bad prices.

The Bigger Picture

Base chain is growing fast. As of October 2025, it has 12.4 million monthly active wallets. QuickSwap is capturing 14.3% of DEX volume on Base-second only to Aerodrome. If it hits its 2026 roadmap goals-AI-powered routing, institutional API, cross-chain futures-it could grab 22-25% of the market.

But it’s not without risks. If Base adoption slows, QuickSwap’s TVL could drop. If the SEC cracks down on QUICK, staking rewards could vanish. And competition is heating up. Uniswap might launch its own Layer 2 version. If it does, QuickSwap’s speed advantage could vanish overnight.

Right now, QuickSwap v2 on Base is the best choice for traders who want speed, low fees, and decentralization. It’s not the easiest. It’s not the safest. But for those who know what they’re doing, it’s one of the most powerful tools in DeFi.

Future Roadmap

QuickSwap isn’t standing still. Here’s what’s coming:

- Q1 2026: AI-powered liquidity routing-automatically finds the best price across 1,000+ tokens

- Q2 2026: Institutional API with FIX protocol support for hedge funds and quant firms

- Q4 2026: Cross-chain perpetual futures-trade derivatives across multiple chains without bridging

If these deliver, QuickSwap could become the go-to DEX for professional traders-not just retail users.

Is QuickSwap v2 on Base safe to use?

Yes, as long as you understand the risks. QuickSwap is non-custodial, so your funds stay in your wallet. But multi-chain bridges and smart contracts can have bugs. Always check contract audits before interacting. QuickSwap’s code is open-source and has been reviewed by multiple teams, but no system is 100% foolproof. Never invest more than you’re willing to lose.

Do I need to pay gas fees on QuickSwap v2 on Base?

Yes, but they’re extremely low-usually under $0.01 per transaction. This is because Base is a Layer 2 chain that reduces Ethereum’s congestion. You’ll pay a tiny fee to confirm your swap or add liquidity, but it’s nowhere near the $5-$15 you’d pay on Ethereum.

Can I buy crypto with a credit card on QuickSwap?

No. QuickSwap doesn’t support direct fiat on-ramps. You need to buy crypto on a centralized exchange like Coinbase or Binance, then bridge it to Base using Coinbase’s official bridge. Once your funds are on Base, you can trade on QuickSwap.

What’s the difference between QuickSwap v2 and v3?

QuickSwap v2 on Base is the current live version. There is no v3 yet. The "v2" refers to the upgraded version launched on Base in August 2025, which added concentrated liquidity, improved routing, and API enhancements. It’s not a version number like Uniswap v3-it’s a chain-specific upgrade. Don’t confuse it with the original Polygon version.

How do I earn rewards on QuickSwap?

You can earn in two ways: First, by providing liquidity to trading pools-you earn 0.25% of every trade in that pool. Second, by staking QUICK tokens in Dragon’s Lair-you earn 50% of all protocol fees across all chains. Both rewards are paid in QUICK tokens and distributed daily. Staking requires no lock-up period.

Is QuickSwap better than Uniswap on Base?

For most retail traders, yes. QuickSwap offers lower fees, faster execution, and better rewards for liquidity providers. Uniswap on Base is newer and has less liquidity overall. QuickSwap also has concentrated liquidity and a more advanced routing engine. Unless you’re trading very rare tokens that only exist on Uniswap, QuickSwap is the better choice.

Final Thoughts

QuickSwap v2 on Base is a game-changer for active crypto traders. It’s not for beginners. It’s not for people who want to buy crypto with a credit card. But if you’re comfortable with wallets, bridges, and slippage settings-it’s one of the most efficient decentralized exchanges you can use today. The fees are almost nothing. The speed is unmatched. And the rewards for staking and providing liquidity are real.

It’s not perfect. The interface is clunky. The learning curve is steep. And the SEC could change everything. But right now, for traders who want to move fast and keep control of their assets, QuickSwap v2 on Base is hard to beat.

Another ‘decentralized’ platform that’s just Ethereum with a cheaper coat of paint. Concentrated liquidity? Cool. But who’s auditing the bridge contracts? Samczsun already called this a ‘risk multipler’-and nobody’s listening. Again.

And don’t get me started on the SEC watching QUICK like a hawk. Utility token my ass. It’s a security waiting to be sued.

Also, 100x leverage on a DEX? That’s not innovation. That’s gambling with a blockchain-shaped veneer.

One must question the epistemological foundations of this ‘revolution.’ The assumption that low fees equate to superior utility is a fallacy rooted in neoliberal technocratic fetishism. Decentralization without institutional guardrails is not liberation-it is fragility dressed as empowerment.

The notion that retail users are ‘empowered’ by interfaces designed for quant traders is a grotesque misrepresentation of financial inclusion. One does not democratize finance by making it more opaque.

Yo, if you’re still paying $5 in gas on Ethereum for a simple swap-you’re leaving money on the table. QuickSwap on Base is a game-changer for active traders.

I’ve been running bots on it since August. 120ms API latency, near-zero fees, and the Dragon’s Lair staking is giving me 11% APR with zero lock-up. That’s not hype-that’s math.

And yes, the UI is clunky. But if you’re serious about DeFi, you learn it. The rewards are real. Stop complaining about onboarding and start using the damn thing.

Pro tip: Always set slippage manually. Defaults will eat your profits. Trust me, I’ve lost $200 doing it wrong once.

Let’s be honest: this is just another ‘DeFi 2.0’ bubble wrapped in a Layer 2 bow. You think you’re saving money? You’re just subsidizing Coinbase’s infrastructure while pretending it’s ‘decentralized.’

And the ‘no KYC’ claim? That’s a legal time bomb. The SEC doesn’t care if you ‘own your keys’-they’ll come for the protocol. And when they do, your ‘rewards’ will vanish like a rug pull.

OMG YES THIS IS THE FUTURE!!! 🚀

I swapped 5 ETH for USDC in 1.8 seconds for $0.003. My wallet didn’t even blink. I cried. No joke.

Dragon’s Lair is giving me free QUICK every day. I’m not rich, but I’m making passive income while watching Netflix. This is what crypto was supposed to be. Thank you, QuickSwap. You’re my hero. 💙

Let me guess-you all think this is ‘innovation’ because it’s cheaper than Ethereum? Please. This isn’t DeFi. It’s a casino with a blockchain sticker. Concentrated liquidity? That’s just market-making with extra steps.

And you’re all acting like this is the endgame? Nah. This is the beginning of the next 10x rug pull. The SEC is already drafting the indictment. The bridges are a single point of failure waiting to collapse. And the API? It’s just a glorified WebSocket with a fancy dashboard.

Y’all are the ones who got burned in 2021. And now you’re doing it again. Welcome back to the wheel.

How can anyone take this seriously? The UI is designed by a bot that failed UX 101. The documentation assumes you’ve already read the whitepaper of every Layer 2 ever built. And yet, you call this ‘accessible’?

Meanwhile, Binance offers one-click fiat on-ramp, 24/7 support, and $100B in liquidity. You trade on this because you believe in ideology? Or because you’re too lazy to learn how to use a centralized exchange?

Base is a Coinbase project. Coinbase is a regulated entity. This isn’t decentralized. It’s a controlled environment with a crypto aesthetic.

Real DeFi runs on Ethereum mainnet or Solana. Not on a chain that answers to a Silicon Valley VC firm. This is crypto for people who want the illusion of freedom without the risk.

And you call this ‘innovation’? It’s corporate rebranding with smart contracts.

14.3% market share? That’s not dominance. That’s a footnote.

Aerodrome has 80% of Base’s volume. QuickSwap is the second-tier option for people who don’t know better.

And the ‘100x leverage’? That’s a death trap. 95% of users who trade leveraged positions on DEXes lose everything. You’re not a trader-you’re a statistic waiting to happen.

Also, the SEC will kill QUICK. Mark my words.

Been using this for 3 months. No regrets.

Yeah, the first time felt like solving a puzzle blindfolded. Took me 45 minutes. But now? I do 15 swaps a day. Fees are so low I forget I’m even paying.

Staking $200 in QUICK nets me $18/month. That’s a coffee a week for free.

It’s not perfect. But it’s the best tool I’ve got for active trading. If you’re scared of the UI, watch a YouTube tutorial. It’s not rocket science.

Bro, this is fire 🔥

I came from Polygon, and the gas difference? Night and day. I used to wait 10 seconds for a swap. Now it’s instant. And the APR on Dragon’s Lair? 12% is nothing compared to what I made last month.

And yeah, the interface is messy-but once you get past the first 3 clicks, it’s smooth. I even built a little script to auto-set slippage. It’s not perfect, but it’s free and fast.

If you’re new, just follow the 5-step guide. Don’t overthink it. Just do it. You’ll thank yourself later.

‘Near-zero fees’? Cute. You mean ‘fees so low they’re negligible’? Or do you mean ‘fees that still exist, but you’re too excited to notice’?

And ‘no KYC’? That’s not freedom-it’s a liability. Every regulator in the world is watching. This isn’t 2017 anymore. The party’s over. You’re just the last one dancing.

so i tried this out yesterday… and honestly?? it was kinda wild 😅

i didn’t know what concentrated liquidity meant, so i just clicked ‘add liquidity’ and hoped for the best… and then my 50 usdc turned into 51.2… and i was like… wait, did i just make money??

the ui is confusing but the results? not bad. i’m gonna keep playing with it. maybe i’m dumb but i like learning by breaking things 💪

Man, this whole thing feels like someone took a toaster, glued a crypto logo on it, and called it a spaceship.

Low fees? Sure. Fast? Yep. But you’re trading on a chain built by a company that also runs a credit card service. That’s not decentralization. That’s marketing.

Still… I use it. Because why not? The cost is less than my morning coffee. And if it blows up? I lost less than $10. So… why not ride the wave? 🌊

100x leverage on a DEX? You’re not a trader. You’re a casino dealer’s dream.

And ‘Dragon’s Lair’? Sounds like a fantasy novel. Meanwhile, your ‘rewards’ are just more QUICK tokens that’ll crash when the SEC files.

Also, ‘API for bots’? Cute. You think your HaasOnline bot is smarter than the whales? Nah. They front-run you before you even click ‘swap’.

Okay, so-just to be clear: you can swap tokens for pennies. You can earn rewards just by holding a token. You don’t need to trust anyone. That’s huge.

Yes, the UI is confusing. Yes, you need to bridge your funds. Yes, it’s not for beginners.

But if you’re ready to take control of your money? This is one of the best tools out there. Don’t let the complexity scare you. Just take it slow. Read the guide. Try small. You’ll get it.

And if you’re still using Ethereum for daily swaps? You’re paying too much. Period.

One wonders whether the pursuit of efficiency has eclipsed the essence of decentralization. Is speed the ultimate virtue? Or merely a distraction from the erosion of trustless architecture?

This platform is a monument to transactional pragmatism. It solves a problem-cost-but at the cost of ideological purity. The user is no longer a sovereign actor. They are a data point in a liquidity optimization matrix.

And yet… I use it. Because the alternative is worse. The paradox is not lost on me.

There’s a quiet poetry in this: a decentralized exchange built on a corporate blockchain, offering leverage to retail traders, rewarding token holders with protocol fees, while regulators circle like vultures.

We are not witnessing innovation. We are witnessing evolution under pressure.

QuickSwap v2 on Base is not the future of DeFi. It is the present-a messy, brilliant, contradictory present where efficiency and fragility dance on the edge of a regulatory cliff. And we, the users, are the ones holding the match.

Let us not mistake speed for safety. Or low fees for wisdom.