When Russia legalized cryptocurrency mining in early 2025, it wasn’t just about energy efficiency or tech innovation. It was a calculated move to build a financial backdoor around Western sanctions. The goal? Keep money flowing, buy weapons, pay suppliers, and keep its economy running - all while staying under the radar of U.S. and European regulators.

How Crypto Mining Became a Sanctions Tool

Russia didn’t suddenly wake up one day and decide crypto was cool. After the invasion of Ukraine in 2022, Western nations froze Russian bank accounts, kicked banks out of SWIFT, and blocked access to dollar and euro payments. Russia’s traditional financial lifelines were cut. So it turned to something it already had: cheap electricity, idle data centers, and a growing pool of tech-savvy engineers. By 2025, Russia had become the world’s third-largest crypto mining nation. That’s not because miners there are especially ethical or environmentally conscious. It’s because the government gave them legal cover. Mining rigs now operate openly in Siberia, the Urals, and even near Moscow, powered by surplus natural gas and nuclear plants. The electricity is cheap. The hardware? Imported before sanctions tightened. The profits? Kept out of reach of Western banks. But mining alone doesn’t move billions. That’s where the real innovation - or deception - kicks in.The A7A5 Stablecoin: Russia’s Secret Financial Pipeline

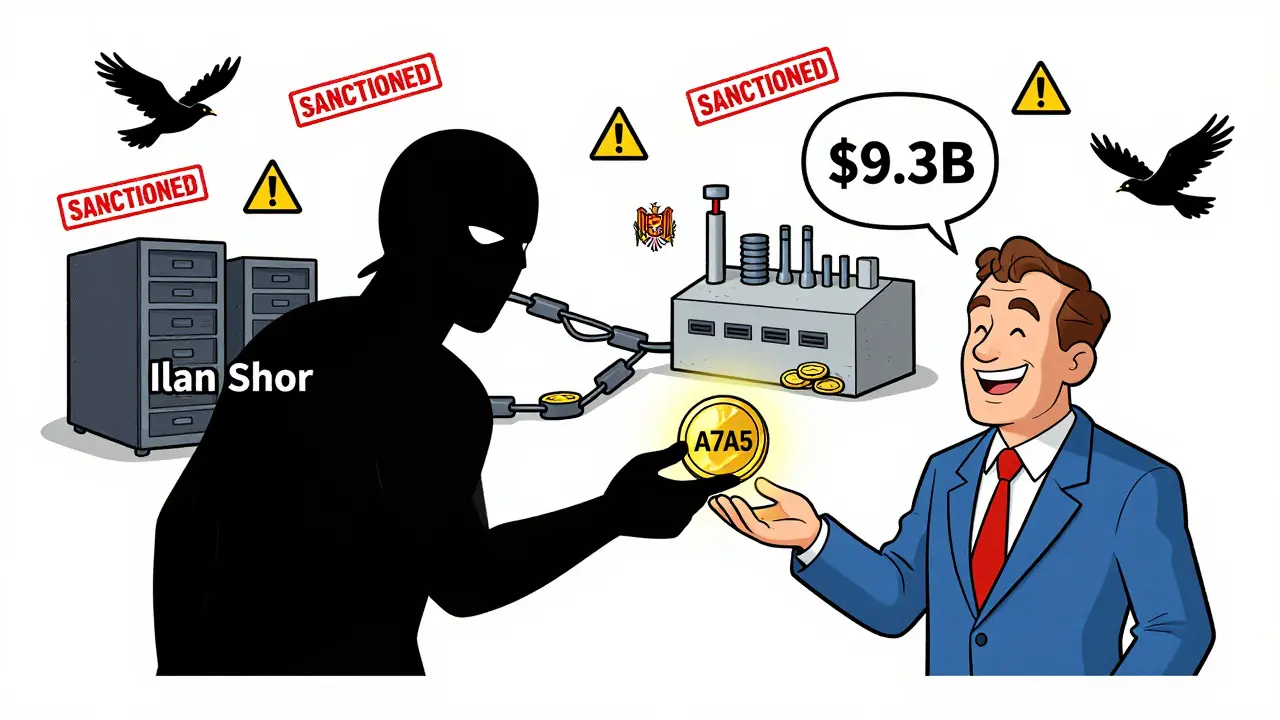

The star of Russia’s sanctions evasion system isn’t Bitcoin. It’s A7A5, a ruble-backed stablecoin launched in February 2025 by a Kyrgyzstan-based company called Old Vector. Old Vector is owned by Ilan Shor, a Moldovan oligarch under U.S. sanctions, and backed by Promsvyazbank, a Russian state-owned bank. A7A5 isn’t traded on Binance or Coinbase. It moves through a closed network of sanctioned exchanges like Garantex and Grinex - both blacklisted by the U.S. Treasury. Grinex was even created in 2024 by former Garantex staff specifically to bypass sanctions. These platforms don’t ask for ID. They don’t report to regulators. They operate on a handful of servers, mostly outside Western jurisdiction. By July 2025, A7A5 had processed over $51 billion in transactions. In its first four months alone, it moved $9.3 billion. That’s not retail users buying coffee. That’s factories paying for German machine parts, oil traders swapping crude for digital tokens, and military suppliers receiving payments through layers of shell companies. What makes A7A5 hard to track? Unlike USDT or USDC, which are tied to U.S. banking systems, A7A5 moves entirely within Russia’s shadow ecosystem. It’s not backed by U.S. reserves. It’s not audited by Western firms. And it’s designed to look like normal crypto trading - but every transaction leaves a blockchain trail.Who’s Getting Hit by Sanctions - and Why

Western governments didn’t sit still. On August 20, 2025, the U.S. Treasury’s OFAC made history by sanctioning a crypto mining company for the first time. The target? A Russian mining farm in Krasnoyarsk that was directly linked to A7A5 transactions. The message was clear: mining isn’t just a tech hobby anymore. It’s part of the financial war. The UK followed suit, sanctioning Grinex, Old Vector, and four Kyrgyz entities tied to the stablecoin’s operations. Eight individuals, including bankers in Luxembourg and Kyrgyzstan, were also blacklisted. These weren’t random names. They were the people who moved money between Russian banks, crypto exchanges, and overseas suppliers. One of the most telling targets was Transkapitalbank - a small Russian bank that quietly handled crypto-to-ruble conversions for sanctioned companies. The bank’s CEO was linked to Konstantin Malofeyev, a Russian oligarch who’s been under sanctions since 2014 for funding separatists in eastern Ukraine. His network included over 40 entities worldwide, all working to keep Russian trade alive through crypto.

Why Crypto Isn’t a Magic Bullet

Despite all this, crypto hasn’t replaced the dollar. Not even close. Russia’s annual exports before the war were around $400 billion. Bitcoin’s entire market cap at its peak in 2025 was about $800 billion. That sounds big - until you realize that Bitcoin’s price swings wildly. One day it’s $70,000. The next, $50,000. No exporter wants to ship a $10 million shipment of wheat and get paid in a coin that could lose 30% of its value by the time it clears customs. The Bitcoin Policy Institute calls Bitcoin “ill-suited” for sanctions evasion. It’s too volatile, too slow, and too small. A7A5 fixes the volatility problem by pegging to the ruble. But now it’s stuck in a tiny, isolated network. No major global buyer accepts A7A5. No Chinese manufacturer wants to be paid in a token tied to a sanctioned Russian bank. So Russia’s system works - but only within its own bubble. Chainalysis, a blockchain analytics firm, found that while Russia’s crypto networks are sophisticated, they’re also fragile. Every transaction is on a public ledger. Every wallet address can be traced. Every exchange that touches A7A5 gets flagged. The U.S. and UK aren’t trying to shut down all crypto. They’re targeting the specific nodes that feed Russia’s war machine.The Bigger Picture: A Global Trend

Russia isn’t alone. North Korea uses crypto to fund its missile program. Venezuela uses Petro tokens to bypass U.S. oil sanctions. Iran trades oil for Bitcoin on darknet markets. These are all examples of authoritarian states trying to outmaneuver financial controls. But here’s the irony: blockchain, the very tech meant to be anonymous, is making these operations easier to catch. Every A7A5 transfer leaves a digital fingerprint. Every time a Russian miner sends coins to Grinex, it’s recorded. Every time a Kyrgyz bank converts crypto to rubles, it’s logged. Western agencies aren’t using AI to guess who’s doing what. They’re using public blockchain data to map connections. They’re linking wallet addresses to real names through leaked documents, insider tips, and bank records. The transparency of crypto is turning into its biggest weakness.

What This Means for the Future

Russia’s legalization of crypto mining isn’t a victory. It’s a desperate adaptation. The country is building a financial fortress - but it’s a fortress with no doors to the outside world. It can trade with itself. It can pay its own soldiers. But it can’t buy advanced chips from Taiwan or precision tools from Germany without risking exposure. The U.S. and UK response shows they’re learning fast. Sanctioning mining farms? Targeting Kyrgyz banks? Naming individuals? That’s not just policy. That’s strategy. They’re not trying to ban crypto. They’re trying to isolate the parts that help Putin. For everyday users, this means one thing: crypto isn’t a tool for freedom. Not anymore. It’s becoming a battleground. And the winners won’t be the ones with the most coins. They’ll be the ones who can trace them the fastest.What’s Next?

Russia will keep expanding its crypto network. More stablecoins are likely. More mining rigs will be added. More shell companies will pop up in places like Kazakhstan, Armenia, and the UAE. But each new move brings more attention. Each new wallet address is a new target. Each new transaction is a new data point for investigators. The cat-and-mouse game isn’t over. It’s just getting more dangerous - and more visible.Is crypto mining legal in Russia?

Yes. In early 2025, Russia officially legalized cryptocurrency mining and cross-border crypto payments as part of its strategy to bypass Western sanctions. Mining operations now operate openly, supported by state-backed energy infrastructure and financial channels.

What is the A7A5 stablecoin?

A7A5 is a ruble-backed stablecoin launched in February 2025 by Old Vector, a Kyrgyzstan-based company linked to Russia’s Promsvyazbank and sanctioned Moldovan oligarch Ilan Shor. It has processed over $51 billion in transactions by July 2025 and is used primarily to move money outside Western financial systems, avoiding SWIFT and dollar-based controls.

Why is the U.S. sanctioning crypto mining companies?

The U.S. Treasury sanctioned a Russian mining farm in August 2025 - the first time it has targeted a mining operation. The reason: these farms are directly tied to laundering proceeds from sanctioned crypto transactions, including those involving the A7A5 stablecoin. Mining is no longer seen as passive tech activity - it’s part of a financial warfare system.

Can crypto really replace the dollar for international trade?

No. Bitcoin’s market cap is too small and too volatile to replace the dollar in large-scale trade. Russia’s annual exports were around $400 billion before the war - roughly half of Bitcoin’s peak value. But price swings, slow transaction speeds, and lack of global acceptance make crypto impractical for replacing traditional currencies in global commerce.

Are Russian crypto networks anonymous?

No. Despite claims of anonymity, every crypto transaction is recorded on a public blockchain. U.S. and UK agencies use blockchain analytics tools to trace wallet addresses, link them to real-world entities, and identify key players in the network - like bank employees, exchange operators, and oligarchs. The transparency of crypto is making these networks easier to track, not harder.

What’s the role of Kyrgyzstan in Russia’s crypto sanctions evasion?

Kyrgyzstan has become a key hub for Russia’s shadow crypto economy. Its weak financial regulations and proximity to Russia make it ideal for hosting sanctioned exchanges like Grinex and issuing stablecoins like A7A5. Four Kyrgyz entities were sanctioned by the UK in 2025 for their role in facilitating crypto transfers linked to Russian military procurement and sanctions evasion.

This is just crypto theater.

Russia's playing 4D chess while the West keeps playing checkers. 😏

The irony is that blockchain, built for liberation, is now the most transparent surveillance tool ever invented.

Crypto didn't break the dollar-it exposed how fragile the dollar's dominance really is.

I never thought I'd see a nation turn its excess power into a digital currency pipeline. It's like watching a medieval kingdom forge gold coins from cathedral bells-brilliant, desperate, and kinda beautiful.

Let’s be honest-this is just sanctions arbitrage dressed up as innovation. And the West is slow to react because they still think in terms of banks, not blockchains.

I’ve spent the last three weeks digging into A7A5’s transaction graphs. It’s wild how clean the trail is-every wallet, every exchange, every conversion point. The Russians didn’t try to hide; they just assumed no one would care enough to follow. Turns out, we care a lot. And we’ve got tools that can map this stuff in real time. The real story isn’t the mining rigs-it’s the fact that every single one of those transactions is now a forensic target. This isn’t evasion. It’s a suicide note written in public ledger.

Honestly? This is the most fascinating thing I’ve seen in finance since the 2008 crash. It’s not about money anymore-it’s about survival. And Russia’s building a whole new financial ecosystem from scratch. Kinda respect that, even if I hate what they’re using it for.

You ever notice how every time a country tries to bypass the dollar, they end up creating something even more dependent on it? Russia’s stablecoin is pegged to the ruble, which is pegged to oil, which is priced in… yep, dollars. The whole thing’s a house of cards built on a foundation of legacy systems. It’s not a revolution-it’s a remix.

crypto is just a way for rich guys to hide money from other rich guys and pretend its revolutionary

This is the future of finance-decentralized, dark, and totally traceable 😅🔥

The United States government has been clear: financial sovereignty is non-negotiable. To permit such a system to operate unchecked would be a dereliction of duty to global financial integrity. This is not a technical issue-it is a moral one.

I don’t know who wrote this article but they’re either a spy or a grad student who binge-watched The Matrix. A7A5? Really? That’s the name of a stablecoin? Sounds like a typo. And don’t get me started on ‘Kyrgyzstan-based company’-like that’s some secret vault. It’s a server farm in Bishkek with a VPN.

Oh wow, so the Russians are using crypto to fund war crimes and you’re shocked? Did you think the West was the only side playing dirty? Let’s not pretend this is a moral victory-it’s just the next round in the oldest game in history: who can outmaneuver whom with a bigger stick.

The systemic vulnerability lies not in the technology but in the epistemological framework of Western sanctions enforcement. Blockchain’s immutability, far from being a liability, is an ontological trap: every node becomes a metadata vector, every transaction a topological signature. The state’s failure is not in oversight-it’s in the ontological assumption that anonymity equals evasion. It does not. It equals exposure.

This is exactly why crypto should be banned. Not because it’s evil-but because it’s dangerous. Unregulated, unaccountable, and utterly irresponsible. And now it’s being weaponized by authoritarians. The world doesn’t need more financial chaos. It needs order.

So… you’re telling me that Russia is using blockchain to avoid sanctions… but the blockchain is PUBLIC?? And you think this is a PLAN?? Like… are you serious?? Who thought this was a good idea??

the fact that they're using a stablecoin pegged to the ruble is actually kinda smart... but also so obviously traceable?? 😅 maybe they just want us to know they're doing it? like a middle finger in code?