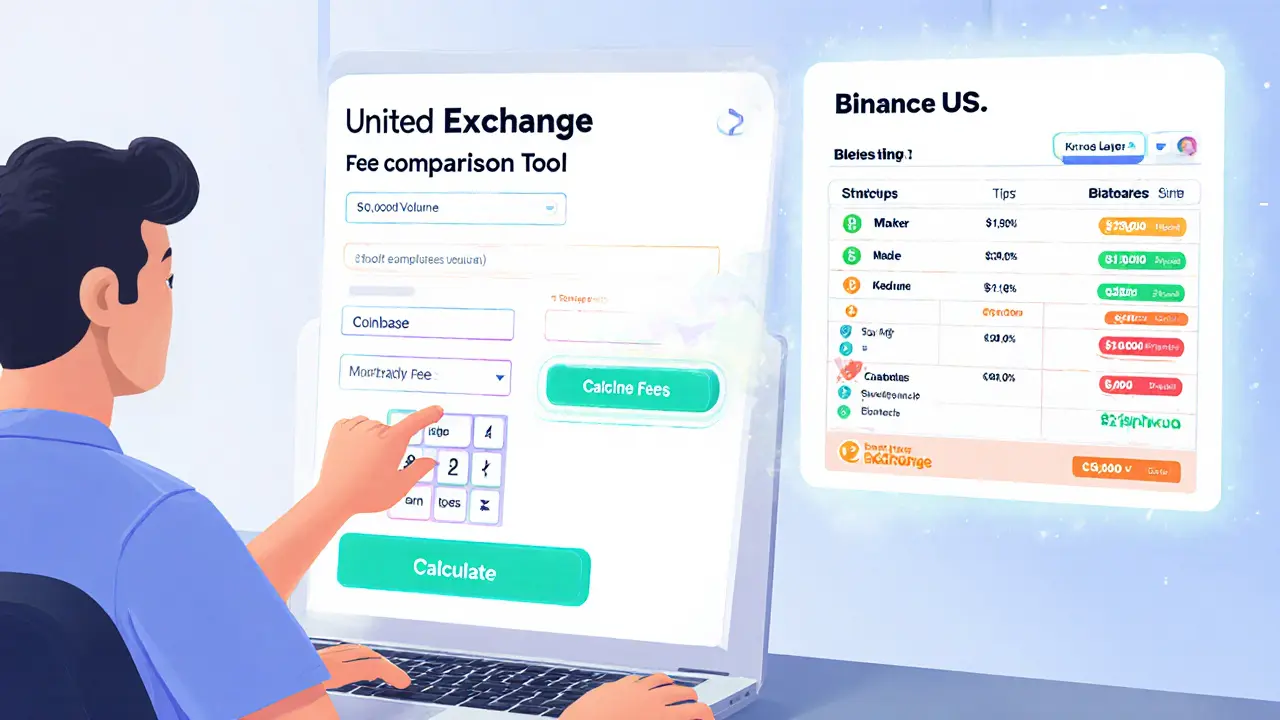

United Exchange Fee Comparison Tool

This tool helps you compare United Exchange's fee structure with major U.S. exchanges to understand trading costs and transparency.

Your Trading Volume

Fee Comparison Overview

| Exchange | Maker Fee | Taker Fee | Risk Level |

|---|---|---|---|

| United Exchange | 0 - 0.5% | 0 - 0.5% | High |

| Coinbase | 0 - 0.5% | 0 - 0.5% | Medium |

| Kraken | 0 - 0.16% | 0 - 0.26% | Low |

| Binance US | 0 - 0.1% | 0 - 0.1% | Low |

| Crypto.com | 0 - 0.1% | 0 - 0.4% | Medium |

Estimated Trading Costs

Enter your trading volume and click "Calculate Estimated Fees" to see detailed cost analysis.

Important Notes About United Exchange

- United Exchange does not publish a detailed fee schedule

- Fees range from 0-0.5% depending on trading volume

- No tiered fee structure makes cost prediction difficult

- Higher fees may apply for credit card purchases

- Transparency regarding fees is lower compared to major exchanges

When it comes to picking a crypto exchange, most traders start by Googling the name, scanning a handful of feature lists, and hoping the platform lives up to the hype. United Exchange review tackles exactly that question: does United Exchange deliver a trustworthy, easy‑to‑use experience, or is it just another name on a long list of obscure services?

TL;DR - Quick Takeaways

- United Exchange offers basic buying, selling, and storage for major coins but lacks clear fee tables and regulatory info.

- Features include fiat‑on‑ramp, credit‑card purchases, margin trading, a token launchpad, and OTC desks.

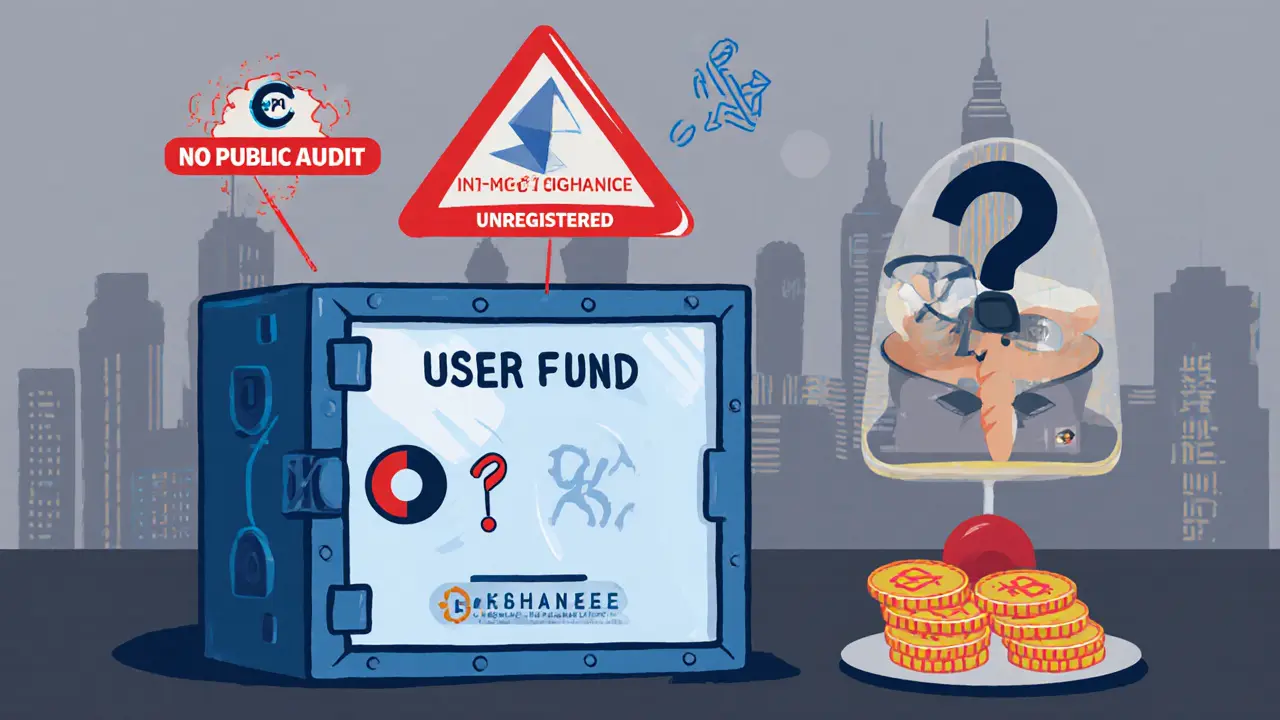

- Security details are vague; no public audit reports or insurance coverage are disclosed.

- Compared to Coinbase, Kraken, Binance US and others, United Exchange trails on asset count, transparency, and user community.

- Best suited for low‑volume traders who need a simple gateway and don’t mind limited support.

What Is United Exchange?

United Exchange is a cryptocurrency trading platform that promises a streamlined way to buy, sell, and store digital assets. It markets itself as a hybrid service that blends centralized exchange (CEX) simplicity with decentralized exchange (DEX) flexibility, offering both web and mobile interfaces.

Core Features at a Glance

- Fiat gateway: Convert AUD, USD, EUR into crypto via bank transfers.

- Credit‑card purchases: Instant crypto acquisition using Visa or Mastercard.

- Margin & leverage: Trade with up to 5× leverage on major pairs.

- Launchpad: Participate in early‑stage token sales directly on the platform.

- OTC desk: Private deals for orders over $100,000.

- Hybrid CEX/DEX: Ability to move assets between on‑chain DEX pools and the internal order book.

Supported Cryptocurrencies

United Exchange lists the biggest names-Bitcoin (BTC), Ethereum (ETH), and a handful of altcoins such as Litecoin, Ripple, and Cardano. The exact count is undisclosed, but it falls far short of the 300+ assets available on Binance US or Crypto.com.

Fees & Cost Structure

One of the biggest red flags is the lack of a publicly posted fee schedule. The platform’s FAQ merely states “fees range from 0‑0.5% depending on volume.” Without tiered tables, users can’t accurately forecast trading costs.

For comparison, here’s a snapshot of fee models from major U.S. exchanges (as of 2025):

| Exchange | Number of Cryptos | Maker Fee | Taker Fee | Notes |

|---|---|---|---|---|

| United Exchange | ~30 (estimated) | 0‑0.5% | 0‑0.5% | Exact tiers not published |

| Coinbase | 235 | 0‑0.5% | 0‑0.5% | Spread varies by market |

| Kraken | 350+ | 0‑0.16% | 0‑0.26% | Volume‑based discounts |

| Binance US | 158 | 0‑0.1% | 0‑0.1% | BNB discount applied |

| Crypto.com | 313 | 0‑0.1% | 0‑0.4% | Staking discounts |

Security & Custody

Security is a make‑or‑break factor for any exchange. United Exchange does claim to use “secure wallet infrastructure,” but the details are minimal:

- No public audit reports or third‑party attestations.

- Cold‑storage percentage is not disclosed (compare 95% cold‑storage for OKX).

- Multi‑signature support is mentioned, but implementation specifics are missing.

- No insurance coverage statement for user funds.

In contrast, established players like Coinbase are registered MSBs, undergo regular SOC 2 audits, and provide FDIC‑insured cash balances.

Regulatory & Compliance Status

Public records do not show United Exchange registered with any U.S. financial regulator (FinCEN, SEC, or state‑level). The platform’s terms of service hint at “compliance with applicable laws,” but no licensing numbers are listed. Absence of such information raises compliance uncertainty, especially for users needing KYC/AML documentation for large trades.

User Experience & Support

First‑hand accounts are scarce, but the website’s UI appears clean: a simple dashboard, one‑click fiat‑on‑ramp, and a mobile app that mirrors the web view. However, support options are limited to a generic email form and a chatbot that offers scripted answers. No phone line, no live chat, and no public response time metrics.

Pros & Cons Summary

- Pros

- Easy fiat‑on‑ramp for beginners.

- Integrated launchpad for early token sales.

- Margin trading available without separate accounts.

- Hybrid CEX/DEX gives flexibility for on‑chain swaps.

- Cons

- Opaque fee schedule - hard to estimate trading costs.

- Lack of public security audits or insurance.

- No clear regulatory registration.

- Small asset selection versus major competitors.

- Limited community feedback - hard to gauge reliability.

Who Should Consider United Exchange?

If you’re a hobbyist trader looking for a quick way to turn a few dollars into Bitcoin or Ethereum, United Exchange’s straightforward UI and credit‑card purchase option might be attractive. It also appeals to token‑enthusiasts eager to join launchpad sales without opening multiple accounts.

Professional or high‑volume traders should probably stick with exchanges that publish transparent fee tiers, hold regular audits, and offer robust customer support.

Bottom Line

United Exchange ticks many boxes on paper - fiat gateway, margin, launchpad, and hybrid trading. In reality, the platform suffers from a transparency deficit. Without disclosed fees, security audits, or regulatory credentials, it’s a gamble compared to the well‑documented alternatives that dominate the 2025 market.

Frequently Asked Questions

What cryptocurrencies can I trade on United Exchange?

United Exchange lists the major coins - Bitcoin (BTC), Ethereum (ETH), Litecoin, Ripple (XRP), and Cardano (ADA) - plus a limited number of smaller altcoins. The exact count isn’t published, but it’s estimated to be around 30 assets.

Does United Exchange charge a fee for buying crypto with a credit card?

The platform states that fees range from 0‑0.5% based on volume, but it does not break out a specific surcharge for credit‑card purchases. Users should assume the higher end of that range until the fee schedule is clarified.

Is United Exchange regulated in the United States?

Public information does not show any registration with FinCEN, the SEC, or state money‑transmitter licenses. The lack of disclosed regulatory status means users should perform extra due diligence before depositing large sums.

How secure are funds stored on United Exchange?

United Exchange mentions secure wallet infrastructure and multi‑signature storage, yet it provides no audit reports, cold‑storage percentages, or insurance details. Compared with platforms that publicly share such data, the security picture remains vague.

Can I access United Exchange on mobile?

Yes, United Exchange offers both iOS and Android apps that sync with the web dashboard. System requirements are not extensively documented, but the apps run on Android 8.0+ and iOS 13 or newer.

Bro just tried United Exchange to buy some ETH with my card and got charged 0.45% + a $10 'convenience fee' that wasn't listed anywhere. Like wtf? I'm already paying Coinbase 1.5% and at least they're upfront about it.

They don't publish audits because they're not audited. They're a front for a shell company registered in the Caymans. The 'hybrid CEX/DEX' is just a fancy way of saying they move your coins into a black box and pray nothing happens. I've seen this movie before - it ends with a Twitter DM saying 'we're under maintenance' forever.

USA again with their 'transparency' obsession. In India we don't need 17 pages of fee schedules - we just want it to work. United Exchange gives you access to launchpads and margin without the bureaucratic nightmare of KYC hell. If you're too scared to use it, maybe stick to your bank account and cry about inflation.

Hey everyone - I know this exchange seems sketchy, but if you're just dipping your toes in, it’s actually kinda nice. The UI is clean, the app works great, and I was able to buy my first $50 of BTC in under 2 minutes. I’d never put my life savings here, but for a beginner? It’s a gentle on-ramp. Just don’t forget to withdraw to your own wallet ASAP.

This is why people lose money. No insurance. No regulation. No fee transparency. You're literally gambling with your crypto on a platform that doesn't even have a public address for legal complaints. If you use this, you deserve to get rug pulled. Period.

Why is no one talking about the fact they don’t even list Solana?

It is my professional opinion that the absence of publicly accessible audit documentation, combined with the non-disclosure of regulatory compliance status, constitutes a material risk factor for any entity operating within the United States financial ecosystem. Users are advised to exercise due diligence commensurate with the severity of the aforementioned deficiencies.

Guys I totally get the concerns but let’s be real - United Exchange is like that small local cafe that doesn’t have a website but makes the best chai in town. Yeah, you don’t know where the beans come from, but the taste? Perfect. I’ve used it for 6 months, never had an issue, and got into 3 launchpads before they blew up. Maybe it’s not Kraken, but it’s got heart. And hey, if it ever goes down, I’ll buy everyone a coffee.

Just skimmed the whole thing. Looks like a scam. I’m out.

Wait i just checked and they have DOGE? But not SHIB? That’s weird. Also their mobile app crashes on my Redmi Note 10, but works fine on my friend’s iPhone. Maybe its a device thing? Or maybe its just buggy lol

If you're thinking about using United Exchange, here's what I'd do: start with $20. Use it to buy a little BTC, test the withdrawal, see how long it takes. If it works smoothly, maybe use it for small trades. But never keep more than you're willing to lose. And always, always move your coins to a hardware wallet. This isn't about fear - it's about being smart. You don't need to trust the exchange. Just trust your own process.