Venezuela Mining Tax Calculator

Calculate Your Venezuela Mining Tax Obligations

Estimate your tax liabilities and compliance costs based on Venezuela's state-licensed mining system. This tool helps you understand the financial impact of SUNACRIP regulations, tax requirements, and compliance costs.

Key Takeaways

- All crypto miners in Venezuela must obtain a license from SUNACRIP (the National Superintendency of Crypto Assets and Related Activities) and join the government‑run National Digital Mining Pool.

- Licensing takes 3‑6months and requires a formal business entity, a detailed technical plan, and 10‑year record‑keeping.

- Taxes include the Large Financial Transactions Tax (IGTF) up to 20%, Income Tax (ISLR) on mining profits, and a 16% VAT on exchange fees.

- Non‑compliance can lead to equipment confiscation, frozen payouts, and heavy fines.

- Regulatory stability remains uncertain; miners should stay agile and keep legal counsel close.

Venezuela’s crypto mining scene is unlike any other country’s - the government runs a fully state‑licensed system that forces every miner into a single, centrally‑controlled pool. If you’re thinking about setting up a mining operation or navigating an existing one, you need to know exactly what the law demands, how to stay compliant, and where the biggest risks lie.

What the State‑Licensed System Actually Is

Venezuela state‑licensed crypto mining (a government‑mandated framework that requires all mining entities to obtain a license, register in the Integral Miners Registry, and operate through the National Digital Mining Pool) was formalized by a decree published on 22September 2023. The regime is overseen by SUNACRIP, which replaced the older SUPCACVEN agency in 2019.

The core idea is simple on paper: put every miner under one roof, track every hash, and tax the rewards directly. In practice it means you can’t mine independently, can’t export hardware without approval, and can’t keep your earnings private.

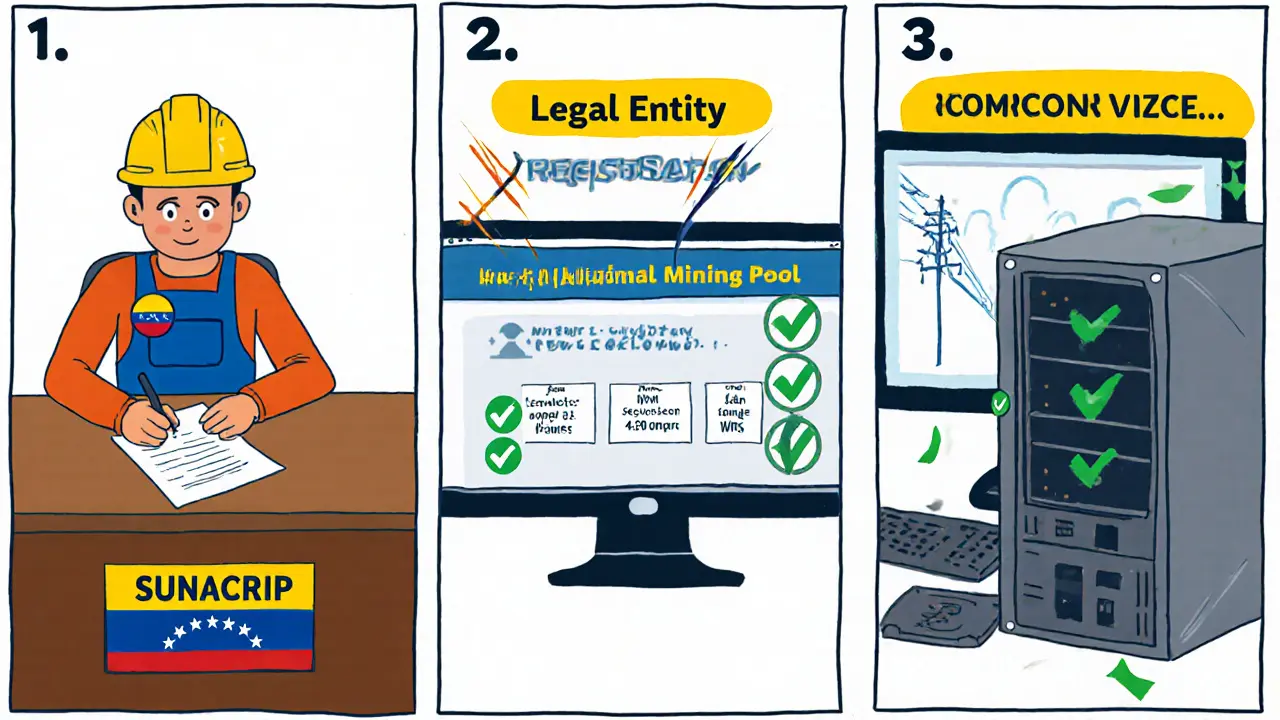

Step‑by‑Step Licensing Process

- Form a legal entity. Register a corporation or LLC with the Venezuelan Mercantile Registry. The entity must have a Venezuelan tax ID (RIF) and a bank account in bolívars or Petro.

- Prepare the application dossier. Include:

- Business plan and financial projections (minimum 1‑year outlook).

- Technical specifications of mining hardware (hash rate, power consumption, model numbers).

- Proof of electricity supply contracts and location details.

- AML/KYC compliance procedures for any future token sales or exchanges.

- Submit to SUNACRIP. Applications are filed online through the SUNACRIP portal. Expect a 3‑6month review period, during which officials may request additional documentation or site visits.

- Enroll in the Integral Miners Registry (RIM). Once the license is granted, you must be listed in the Integral Miners Registry (RIM). The registry acts as a master list of all approved miners.

- Integrate with the National Digital Mining Pool. Install the pool’s client software, configure your mining rigs to point to the government‑controlled server, and set up automated reporting of hash contribution and power usage.

- Maintain ongoing compliance. Submit monthly reports, keep detailed logs for ten years, and renew the license annually (renewal fee ~0.5% of declared hash power).

The National Digital Mining Pool - How It Works

The National Digital Mining Pool is a single, state‑run pool where all legal miners send their hash power. The pool aggregates rewards, deducts taxes, and distributes payouts according to each miner’s contribution record.

- Payment freezes. Authorities can halt payouts at any moment, often citing “audit” or “tax verification” reasons.

- Direct taxation. A flat 20% IGTF is deducted before any payout reaches the miner’s wallet.

- Transparency (for the state). Every hash, power draw, and reward is logged in real‑time, allowing the government to track individual earnings.

Operating outside the pool is illegal and can result in equipment confiscation and criminal charges.

Tax Landscape for Venezuelan Miners

Taxes are applied at several points in the mining lifecycle. Below is a quick reference of the main levies:

| Tax | Base | Rate | Who Collects |

|---|---|---|---|

| IGTF (Large Financial Transactions Tax) | Crypto transactions not in bolívars or Petro | Up to 20% | SENIAT |

| ISLR (Income Tax) | Net profit from mining or crypto sales | 15-30% (progressive) | SENIAT |

| VAT | Exchange service fees | 16% | SENIAT |

Because there is no specific crypto‑tax law, the general Income Tax Law treats crypto as an asset. This means you must calculate cost basis in bolívars, convert any sales to the local currency, and report the gain on your annual tax return.

Equipment Imports & Manufacturer Licensing

If you plan to import ASICs or GPUs, you need a separate license from SUNACRIP for hardware importation. The process mirrors the mining license but adds:

- Customs clearance paperwork approved by the Servicio Nacional Integrado de Administración Aduanera y Tributaria (SENIAT).

- Proof that the equipment will be used exclusively within the National Digital Mining Pool.

- An import duty waiver that is only granted after the mining license is active.

Manufacturers that want to sell locally must also obtain a “Special Equipment License” and register with CAVEMCRIP, the private‑sector body created during the 2024 SUNACRIP re‑organization.

Record‑Keeping, Reporting & Audits

Compliance is data‑heavy. You must:

- Log every hash submitted to the pool, along with timestamps.

- Track electricity consumption per rig (meter readings are mandatory).

- Maintain financial ledgers for all crypto inflows/outflows, kept for a minimum of ten years.

- Submit monthly PDFs to SUNACRIP via the secure portal; the files must be signed with a qualified digital certificate.

Random audits are announced via the SUNACRIP website. If selected, you’ll be required to present original hardware invoices, power bills, and the full ten‑year log on site.

Penalties for Non‑Compliance

- Equipment seizure. Unlicensed rigs are confiscated and may be auctioned by the state.

- Payment freeze or revocation. The National Digital Mining Pool can withhold payouts indefinitely.

- Fines. Up to 200% of the unpaid tax plus a fixed penalty of 10,000bolívars.

- Criminal charges. Repeated violations can trigger charges of “economic sabotage,” which carry prison terms.

Because enforcement has been inconsistent-some miners report months‑long freezes while others face immediate closure-risk management is essential.

Regulatory Timeline & Volatility

Understanding the recent history helps you gauge future risk:

- Sept2020 - Venezuela legalizes Bitcoin mining; SUNACRIP issues the first licensing guidelines.

- Mar2023 - SUNACRIP operations suspended amid a $3million corruption probe.

- 2024 - Complete mining ban announced, then lifted in March when SUNACRIP re‑organized.

- 2025 - SENIAT ramps up tax enforcement using KYC data from exchanges.

The pattern shows abrupt policy shifts. If you’re planning a long‑term project, budget for legal counsel and be ready to pause operations if a new decree arrives.

Practical Compliance Checklist

- ✅ Register a Venezuelan legal entity with RIF.

- ✅ Compile technical specs, power contracts, and AML/KYC policies.

- ✅ Submit the SUNACRIP license application (3‑6months).

- ✅ Enroll in the RIM and integrate with the National Digital Mining Pool.

- ✅ Set up a 10‑year digital archive (cloud + local backups).

- ✅ Register for IGTF and ISLR with SENIAT; keep exchange fee invoices for VAT.

- ✅ If importing hardware, obtain the import license and SENIAT clearance.

- ✅ Schedule quarterly internal audits to match SUNACRIP reporting cadence.

- ✅ Retain a local crypto‑law attorney for policy updates.

Future Outlook

Two forces will shape what happens next:

- Political stability. Any shift away from Maduro’s administration could either relax the regime or replace it with an even tighter control model.

- Economic pressure. Hyperinflation has forced many citizens onto crypto; the government may loosen rules to keep tax revenue flowing, or tighten them to protect the Petro.

For now, the safest bet is to treat the Venezuelan mining license as a high‑risk, high‑reward opportunity. Keep costs low, stay transparent, and have an exit strategy ready.

Frequently Asked Questions

Do I need a license if I only run a few GPUs?

Yes. The law does not differentiate by scale. Even a single GPU must be registered with SUNACRIP, listed in the RIM, and attached to the National Digital Mining Pool.

Can I mine a cryptocurrency other than Bitcoin?

The pool accepts any proof‑of‑work coin, but earnings are converted to the state‑approved token before distribution. Expect an extra conversion fee and IGTF on the transaction.

What happens if my payout is frozen?

The pool can freeze payouts indefinitely until you provide additional documentation or settle any outstanding tax liabilities. Many miners report weeks‑long delays, so keep cash reserves to cover operating costs.

Are there any tax deductions available?

You can deduct electricity costs, hardware depreciation (5‑year straight‑line), and any fees paid to SUNACRIP. These are reported on the ISLR return.

How can I stay updated on regulatory changes?

Subscribe to the official SUNACRIP bulletin, follow the Venezuelan Ministry of Digital Economy on Twitter, and retain a local legal advisor who monitors the Official Gazette for new decrees.

Thsi SUNACRIP tax nonsense is just a govt ploy to bleed miners dry.

When I tried to register my rig in Caracas, the lines were longer than a Netflix binge 🍿📜, and the officials kept asking for extra paperwork that never existed. It felt like a maze designed to keep us guessing.

Understanding Venezuela's state‑licensed crypto mining regime begins with acknowledging the SUNACRIP registration process, which can take anywhere from three to six months. First, prospective miners must submit a detailed application outlining hardware specifications, projected hash power, and anticipated electricity consumption. Upon acceptance, the Integral Miners Registry (RIM) issues a unique license number that must be displayed on all mining equipment.

Second, the tax structure comprises three primary components: IGTF, ISLR, and VAT, each calculated on different bases and with distinct filing deadlines.

Third, license and compliance fees are levied annually and must be paid before the fiscal year ends to avoid penalties.

Moreover, maintaining a ten‑year audit trail of all transactions, electricity invoices, and revenue statements is mandatory; failure to do so can trigger equipment confiscation.

Practically, miners should engage a local crypto‑law attorney to navigate bureaucratic nuances and to ensure that all documentation conforms to evolving regulations.

From a financial perspective, the IGTF (large financial transactions tax) applies at a rate of 3 % on all crypto‑related payouts, while ISLR is a progressive income tax that can reach up to 34 % based on net profit.

VAT, at 16 %, is imposed on the sale of electricity to the grid, which some miners offset by feeding excess power back to utility companies.

It is crucial to differentiate between gross revenue and net taxable income; operational costs such as electricity, cooling, and equipment depreciation are deductible under ISLR.

For electricity, miners should negotiate with local distributors to secure a preferential rate, as standard residential tariffs can render mining unprofitable.

Additionally, the government may offer tax incentives for renewable‑energy‑powered farms, which can lower the effective tax burden dramatically.

Compliance costs also include periodic on‑site inspections by SUNACRIP officials, who verify that miners adhere to power usage caps and anti‑money‑laundering protocols.

If any irregularities are detected, fines can soar up to 200 % of the unpaid taxes, and payouts may be frozen indefinitely.

Therefore, a robust risk‑management strategy, including insurance against equipment seizure, is advisable.

Finally, continuous monitoring of regulatory updates via official bulletins will keep miners ahead of sudden policy shifts.

In summary, while the Venezuelan mining landscape offers low electricity rates, the intricate licensing and tax regime demands meticulous planning, legal counsel, and disciplined record‑keeping to achieve sustainable profitability.

It's fascinating how Venezuela blends its rich cultural heritage with cutting‑edge crypto policy – the blend feels like a digital carnival where every step must be carefully choreographed.

Stay positive! Even with the paperwork, the low electricity costs can still make a modest rig profitable if you keep the books clean.

Great breakdown, Daron. Just add that keeping digital backups of all receipts can save you a lot of headaches later.

Don't be fooled, the whole SUNACRIP thing is a front for the regime to funnel crypto profits into secret state wallets. They'll track every hash you produce.

Honestly, the entire compliance maze sounds like a bureaucratic horror story – endless forms, vague deadlines, and the ever‑looming threat of confiscation.

Look, if you don't want to drown in red tape, just skip Venezuela. There are cleaner jurisdictions that actually reward miners.

While Leo’s frustration is understandable, it’s worth noting that many miners have successfully navigated SUNACRIP with the right legal partner. The key is patience and meticulous documentation.

From a cultural standpoint, embracing the local compliance spirit can open doors to community support and potential subsidies for renewable‑energy mining setups.

Hey folks, remember that the best way to stay afloat is to share knowledge – keep your compliance calendars updated and help each other avoid those nasty fines.

Seriously, the tax calculator is a lifesaver; it lets you see the real impact before you commit your hardware.

Brandon nailed it – use the tool, do the math, then decide.

The compliance steps are more straightforward than they appear once you break them down into weekly tasks.

i think its pretty simple, just follow the steps and dont miss any deadline.

💥 The real drama begins when the tax office shows up unannounced! Keep those records tight, or you’ll feel the sting. 😎

Think of the whole process as a meditation – each form is a breath, each deadline a heartbeat. When you align with the rhythm, the system feels less like a punishment.

Philosophically, the Venezuelan mining framework raises the question of sovereignty over digital assets. On one hand, the state asserts control to protect its economy; on the other, miners seek autonomy to innovate.

Balancing these forces requires a dialogue where both parties recognize mutual benefit: the state gains tax revenue, while miners gain access to cheap power.

Thus, compliance should not be viewed solely as a burden but as a partnership contract.

Orlando’s idealistic take is nice, but let’s be real – governments love to co‑opt tech for their own agenda. The more you trust them, the more you lose.

Look, the whole jargon‑filled compliance spiel is just a smoke screen. If you want real profit, you need to go underground, figuratively speaking.

Alright, buckle up because here's the deep dive 🧠. First, the tax algorithm isn’t just a static percentage; it dynamically adjusts based on reported revenue brackets, which the government updates quarterly without notice – a moving target that keeps accountants on their toes. Second, the licensing fee is tiered by hash power, meaning a 10 TH/s operation pays significantly more than a hobbyist, yet both are subject to the same base IGTF rate, creating a hidden tax disparity. Third, the compliance audit isn’t a one‑off event; you’ll face random field inspections where officials verify that your power meters align with declared consumption, and any discrepancy can trigger a retroactive audit spanning the past five years. Fourth, on the legal front, there’s a growing body of case law where miners successfully challenged confiscation orders by proving they had maintained proper records, but those rulings are obscure and require a specialized lawyer to navigate. Fifth, you should factor in the opportunity cost of capital tied up in hardware during the registration lag – many miners lose up to six months of potential profit, which, at current hash rates, can be a substantial sum. Sixth, the currency volatility adds another layer: the tax is calculated in Bolívares, which can swing wildly against the US dollar, meaning you might owe more than anticipated if the exchange rate spikes. Seventh, consider the strategic advantage of joining a mining cooperative; pooled resources can lower per‑unit licensing fees and provide collective bargaining power with electricity providers. Eighth, remember that the government occasionally offers tax holidays for renewable‑energy‑powered farms, so aligning your power source with solar or wind can grant you a temporary exemption from VAT. Ninth, the digital filing portal has been known to suffer downtimes during peak filing periods; always have a backup PDF of your submissions. Tenth, keep an eye on the “integral miners registry” updates – they periodically release new compliance checklists that add minor but billable items, like mandatory fire‑safety certifications. Eleventh, the penalty structure is punitive: fines can reach 200 % of the unpaid tax, plus interest, effectively doubling the cost of non‑compliance. Twelfth, you’ll need to allocate a compliance budget – roughly 5‑10 % of gross revenue – to cover legal counsel, accounting software, and occasional bribes (just kidding, but honest facilitation fees are common). Thirteenth, ensure your mining software logs are timestamped and immutable; this can serve as evidence if you’re accused of under‑reporting. Fourteenth, the overarching theme is uncertainty; proactive risk management, continuous monitoring of policy changes, and a solid legal partnership are your best defenses against the labyrinthine Venezuelan mining regime. Finally, stay adaptable – the crypto landscape evolves fast, and so does state policy. If you can pivot quickly, you’ll survive and maybe even thrive.

Mark, your endless lecture is overkill. The real issue is that Venezuelan officials skim off any profit you make, and you end up paying double taxes. Get a local lawyer, pay them off, and move on.