Vietnam Crypto Market Value Estimator

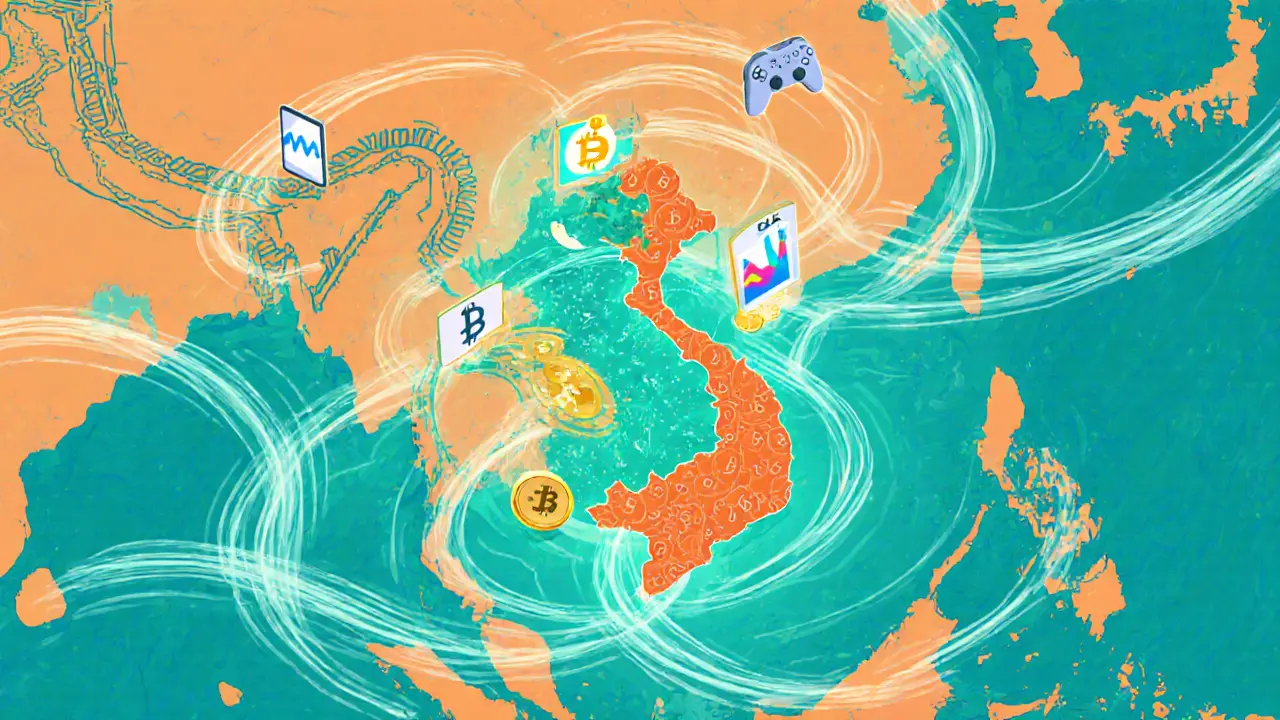

Market Overview

Based on recent data, Vietnam's crypto market is valued at $220 billion with an annual transaction volume exceeding $100 billion. With over 21.2 million adult users, the country ranks third in the APAC region by market value.

Estimated Market Value

Based on your inputs, the estimated market value of Vietnam's crypto sector in 2033 is $0 billion.

This projection assumes steady growth from current levels and reflects the impact of user adoption and transaction volume.

Vietnam's cryptocurrency market is now pulling in roughly $91billion in crypto value each year, according to the latest Chainalysis figures for 2025. That number alone raises a lot of questions: How did we get here? Who’s driving the surge? And what does the future look like for a market that’s already ranking among the world’s top adopters?

Key Takeaways

- The market is valued at $220billion and moves over $100billion in crypto transactions annually.

- 21.2million Vietnamese adults (about 22% of the population) own or use crypto assets.

- From July2024 to June2025, the market grew 55%, shifting from speculation to a more mature ecosystem.

- Regulatory pilots and a booming tech talent pool are anchoring sustainable growth.

- Vietnam sits third in APAC by market value, behind India and Pakistan, but leads in per‑capita transaction depth.

Why $91Billion Matters

When you hear that Vietnam receives $91billion in crypto value each year, the figure isn’t just a headline-it’s a signal that the country’s digital finance infrastructure can handle massive on‑chain activity. Compare this to the United States, where annual crypto transaction volume hovers around $150billion, but spread over a much larger population and more mature markets. Vietnam’s per‑capita involvement is therefore strikingly high.

That $91billion flows through a mix of centralized exchanges, decentralized protocols, and gaming platforms. The diversity means the market isn’t dependent on a single revenue stream. It also hints at a resilient ecosystem that can withstand regulatory headwinds because participants are spread across multiple use cases.

Market Size and Growth Trajectory

According to the 2025 Chainalysis Global Adoption Index, Vietnam’s crypto market value sits at $220billion, making it the third‑largest in the Asia‑Pacific region. IMARC Group projects the market to reach $22.38billion by 2033, reflecting a 9.4% compound annual growth rate (CAGR) from 2025 onward.

Transaction volume has stayed above $100billion annually since 2022, with daily peaks topping $600million. Monthly volumes steadied above $185billion through mid‑2025, even after a brief dip following the December2024 peak.

Who’s Using Crypto in Vietnam?

There are roughly 21.2million adult crypto users in a country of 97million people. That translates to about one in five adults holding digital assets. The user base is remarkably broad: urban professionals, rural entrepreneurs, gamers, and even retirees are on‑boarding.

Gaming - especially play‑to‑earn titles like Axie Infinity - sparked the first mass adoption wave in 2021. Since then, DeFi platforms, NFT marketplaces, and local wallet apps have expanded the use cases. The tech talent pipeline is also robust, with over 560,000 IT professionals and 50,000‑60,000 new graduates each year, most under 35.

Regulatory Landscape: From Caution to Pilot Programs

Vietnam’s government issued a resolution on 9September2024 establishing a five‑year pilot program for crypto‑asset trading. The pilot aims to protect participants while allowing the market to experiment with licensing, KYC/AML standards, and tax reporting.

Regulators are taking a “controlled openness” stance: they forbid crypto as legal tender but permit trading and investment under the pilot’s umbrella. This balance encourages institutional participation without stifling the grassroots enthusiasm that fuels the $91billion flow.

Vietnam in the APAC Crypto Ecosystem

The Asia‑Pacific region saw crypto transaction value jump from $1.4trillion to $2.36trillion in 2024, a 69% YoY increase. Within this boom, Vietnam ranks third by market value, following India and Pakistan. The table below puts Vietnam side‑by‑side with its regional peers.

| Country | Market Value (USDbn) | Annual Transaction Volume (USDbn) | Adult Users (millions) | Key Drivers |

|---|---|---|---|---|

| India | 340 | 210 | 38 | Large retail base, crypto‑friendly startups |

| Pakistan | 180 | 115 | 22 | Remittance demand, Mobile money |

| Vietnam | 220 | 100+ | 21.2 | Gaming boom, tech talent, regulatory pilot |

Key Drivers Behind the $91Billion Flow

- Mobile‑first financial services: Over 80% of Vietnamese internet users access crypto via smartphones, making on‑the‑go trading seamless.

- Gaming and NFTs: Axie Infinity and local GameFi projects keep millions transacting weekly.

- DeFi adoption: Protocols like PancakeSwap and local DEXes capture a growing share of lending and yield‑farming activity.

- Talent pool: With more than half a million IT professionals, home‑grown blockchain startups can build infrastructure in‑country.

- Regulatory clarity: The 2024 pilot program reduces legal uncertainty, encouraging both retail and institutional investors.

Potential Risks and How They’re Managed

While the numbers look impressive, a few risks linger:

- Regulatory tightening: If the pilot ends with stricter bans, capital could shift offshore.

- Price volatility: A sharp market correction could curb retail enthusiasm.

- Cybersecurity: High on‑chain activity attracts hackers; robust wallet security education is essential.

Industry groups such as Tiger Research stress that continuous education, multi‑factor authentication, and a transparent regulatory roadmap are the best mitigants.

What’s Next for Vietnam’s Crypto Landscape?

Looking ahead to 2026‑2030, several trends are likely to shape the market:

- Institutional entry: Banks may launch custodial services under the pilot’s umbrella.

- Cross‑border payments: Vietnam could become a regional hub for crypto‑based remittances, leveraging its diaspora.

- Decentralized finance scaling: Layer‑2 solutions and sidechains (like Ronin) will lower transaction costs and improve speed.

- Policy evolution: Expect a phased expansion of the pilot, possibly moving toward a licensing regime for exchanges.

All these factors suggest the $91billion annual flow isn’t a one‑off spike but part of a longer growth curve.

How to Tap Into Vietnam’s Crypto Boom

If you’re an investor, developer, or business looking to get involved, here’s a quick checklist:

- Identify a local partner - many Vietnamese startups prefer joint‑ventures.

- Choose a regulated exchange operating under the pilot (e.g., Binance VN).

- Implement KYC/AML compliance from day one to avoid future penalties.

- Leverage the talent pool - consider hiring developers from Hanoi or HoChiMinh City.

- Stay updated on regulatory announcements - the pilot’s rules evolve quarterly.

Following these steps can help you capture a slice of the $91billion pie while staying on the right side of the law.

Frequently Asked Questions

Why is Vietnam’s crypto transaction volume so high compared to its GDP?

Vietnam’s GDP is about $410billion, but its digital‑savvy population uses crypto for gaming, remittances, and DeFi. The low cost of mobile data and a tech‑focused youth keep transaction volume disproportionally high.

Is crypto legal in Vietnam?

Crypto is not recognized as legal tender, but trading and investment are allowed under a government‑approved pilot program that started in September2024.

Which Vietnamese blockchain projects are worth watching?

Projects like TomoChain, Kyber Network, and the ongoing development of the Ronin sidechain are leading the home‑grown innovation wave.

How does the regulatory pilot affect foreign investors?

Foreign investors can participate via licensed exchanges that comply with KYC/AML rules. The pilot aims to protect both local and foreign participants, offering a clearer legal pathway than before.

What’s the outlook for the $91billion annual inflow?

Analysts from Chainalysis expect the inflow to stay above $90billion through 2028, driven by continued DeFi growth, gaming, and expanding cross‑border payment use cases.

In short, the $91billion figure isn’t just a headline-it’s a testament to Vietnam’s rapid digital‑finance evolution. Whether you’re an investor, developer, or curious observer, the market offers a blend of high‑volume activity, youthful talent, and a regulatory environment that’s starting to give clear signals. Keep an eye on the pilot’s next milestones, and you’ll likely see Vietnam’s crypto story keep getting bigger.

Interesting data, indeed, the numbers are staggering, and the growth rate is impressive, but we must stay cautious, especially regarding regulatory shifts, which could alter the landscape dramatically, don’t you think?

The sheer scale of Vietnam's crypto activity invites reflection on how digital economies reshape societal priorities. One can see a quiet transformation, not just in finance, but in cultural attitudes toward risk. Yet the data also whispers of uneven access, where urban youth are the primary beneficiaries. It is worth pondering whether this momentum will translate into broader financial inclusion. In any case, the trajectory suggests a deeper integration of blockchain into everyday life.

Wow, $91 billion a year? That sounds like a fantasy novel plot, but the numbers are there, so let\'s break it down. First, the article says Vietnam has over 21 million adult crypto users – that\'s roughly one in five, which is massive for a developing economy. Second, the transaction volume staying above $100 billion annually implies a deep‑rooted habit, not a fleeting hype. Third, the gaming sector, especially play‑to‑earn, has acted as a catalyst, pulling in users who might otherwise stay offline. Fourth, the regulatory pilot launched in September 2024 adds a veneer of legitimacy, but it also introduces uncertainty about future restrictions. Fifth, the talent pool – half a million IT professionals – means local solutions can be built, reducing reliance on foreign platforms. Sixth, cross‑border remittances could become a major use case, leveraging Vietnam\'s large diaspora. Seventh, the per‑capita transaction depth surpasses many larger economies, hinting at a cultural affinity for digital assets. Eighth, the diversification across centralized exchanges, DEXes, and gaming platforms creates resilience against single‑point failures. Ninth, the volatility risk remains high; a market crash could wipe out enthusiasm overnight. Tenth, cybersecurity is a genuine threat – high on‑chain activity attracts hackers, and many users still lack robust security practices. Eleventh, institutional entry is hinted at, but banks are still cautious, waiting for clearer regulation. Twelfth, the projected CAGR of 9.4% to 2033 looks optimistic, especially if global crypto sentiment sours. Thirteenth, the data from Chainalysis is reliable, yet it may not capture informal peer‑to‑peer transfers that happen off‑chain. Fourteenth, the article glosses over the fact that crypto tax compliance is still evolving, which could deter some participants. Fifteenth, overall, the picture is impressive, but it rests on a fragile balance of regulation, technology, and consumer sentiment.

When one surveys the Vietnamese crypto tableau, one cannot help but admire the confluence of avant‑garde technocracy and grassroots enthusiasm. The metrics presented are not merely numeric; they are emblematic of a nascent digital renaissance. Yet, one must remain wary of the seductive allure of raw figures, for they often obscure underlying structural fragilities. The regulatory pilot, while commendable, may conceal a labyrinth of compliance pitfalls. Moreover, the reliance on gaming as a primary adoption vector could tether growth to the whims of entertainment cycles. In sum, the narrative is compelling, yet demands a discerning, critical eye.

The numbers definitely show that Vietnam is doing something right with crypto. It\'s great to see the government giving some space for innovation while still protecting users. The talent pool you mentioned is a big plus – fresh ideas can keep the ecosystem healthy. I think the mix of gaming, DeFi, and cross‑border payments makes it resilient. Let\'s keep an eye on how the pilot evolves; it could become a model for other countries.

Indeed, the balance between innovation and regulation is delicate. Your observation about the talent pipeline aligns with global trends where skilled developers accelerate ecosystem maturity. Maintaining clear KYC/AML guidelines within the pilot will likely enhance investor confidence. It is essential, however, to ensure that compliance measures do not stifle the very creativity that fuels growth. I appreciate your measured perspective on the topic.

Look, the hype train is overblown – $91 billion sounds huge, but it’s just a fraction of the global market. Those gaming numbers are inflated, and the DeFi space is riddled with rug pulls. Plus, the so‑called ‘regulatory pilot’ is a half‑hearted attempt to control a wild west that’s already too entrenched. Investors should stay skeptical and not chase every headline.

There’s definitely excitement around the numbers, but it’s also important to stay grounded. Even if some projects stumble, the overall ecosystem still has room to grow, especially with the talent Vietnam is nurturing. Keeping an eye on real‑world use cases can help separate the noise from genuine progress.

From an analytical standpoint, the article glosses over several critical risk vectors. The volatility intrinsic to crypto assets, combined with an evolving regulatory framework, creates a volatile investment climate. Moreover, the concentration of activity within gaming platforms may lead to systemic vulnerability should that sector contract. It is imperative for stakeholders to conduct rigorous due‑diligence and not be swayed solely by headline figures.

Oh, absolutely – because we all know regulators will instantly perfect a half‑baked pilot once they realize the money is flowing. Meanwhile, the rest of the world watches skeptically as Vietnam rides a wave powered by speculative gaming hype. If you think this is the future, you’re probably drinking the same kool‑aid as everyone else.

It’s encouraging to see such momentum – keep the optimism alive!

Numbers look solid, but the underlying infrastructure still needs work.

Interesting stats.

The sheer scale of the annual inflow suggests that shadow networks could be leveraging the same pipelines for undisclosed purposes. One has to wonder whether the regulatory pilot is merely a façade, allowing covert data aggregation by intelligence agencies. The concentration of activity on a few exchanges also creates chokepoints that could be exploited for surveillance. In that sense, the $91 billion might be a double‑edged sword – boosting the economy while feeding into a hidden monitoring apparatus.

While it’s tempting to jump to conspiratorial conclusions, we must also recognize the genuine efforts by Vietnamese authorities to modernize finance responsibly. Accusations of hidden surveillance should be backed by concrete evidence, not speculation.

Another over‑hyped industry with no real value.

I respectfully disagree; the data highlights a burgeoning sector that, if guided wisely, can contribute significantly to economic development. Continued monitoring and transparent policy will be essential.