200-Day Moving Average: What It Tells You About Crypto Trends

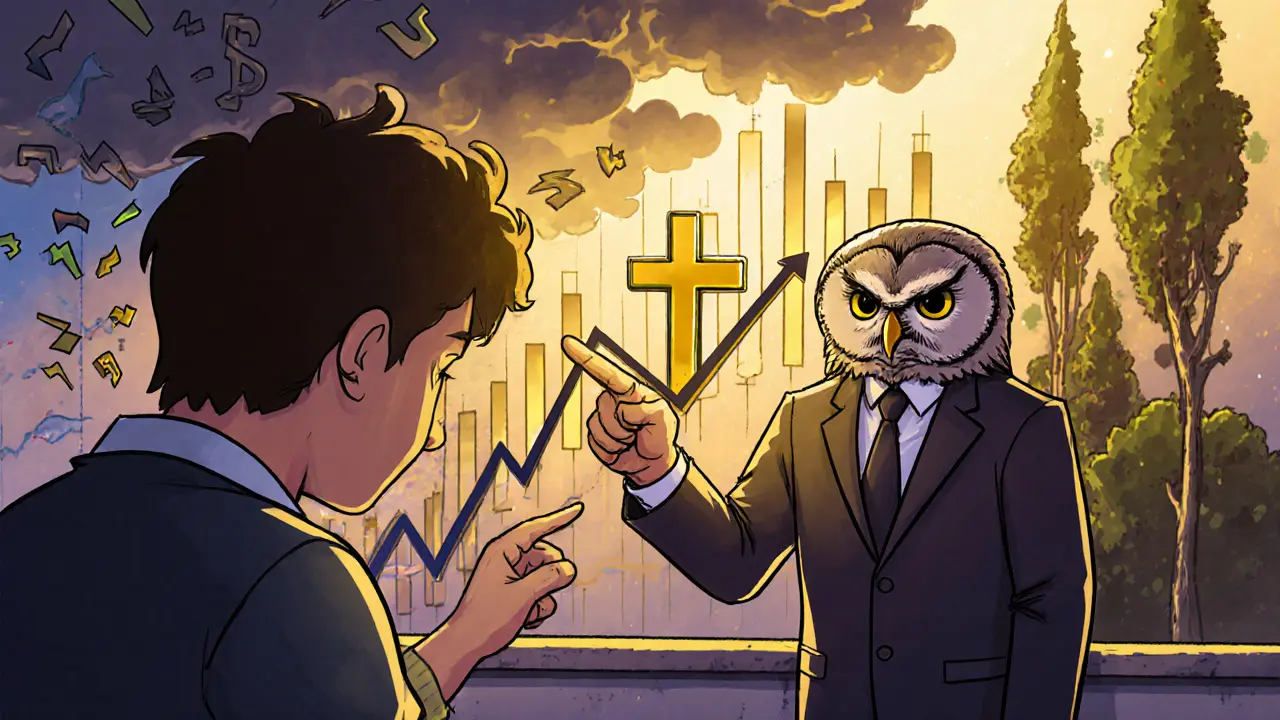

When you look at a crypto price chart, the 200-day moving average, a smoothed line that shows the average price of an asset over the last 200 days. It's not magic, but it's one of the most watched lines in trading. If a coin’s price stays above it, traders see strength. If it drops below, panic often follows. This isn’t just theory—it’s what real traders watch when deciding whether to hold, buy, or get out. And in crypto, where prices swing wildly, the 200-day line acts like a heartbeat monitor for market health.

It’s not just about price. The 200-day moving average, a smoothed line that shows the average price of an asset over the last 200 days tells you if a project has staying power. Look at tokens like Airbloc (ABL), a nearly dead crypto token that promised a data marketplace but delivered nothing, or Isabelle (BELLE), a memecoin with no trading volume and a $0 price. Their prices didn’t just dip—they collapsed below the 200-day line and never came back. Meanwhile, coins that survive long-term often hug that line during pullbacks, showing real demand. It’s not about hype. It’s about whether the market keeps showing up.

Traders use this line to spot reversals, filter out noise, and avoid chasing dead projects. You’ll see it in action when a coin like Archer Swap (BOW), a low-liquidity DeFi token with almost no trading volume breaks below it—suddenly, everyone stops talking about its "clean audits" and starts asking who’s still holding. The same thing happens with CherrySwap, a DEX with zero trading activity and a dead website. Even if the team claims it’s "coming back," the chart doesn’t lie. The 200-day moving average doesn’t care about promises. It only cares about what’s actually happening in the market.

That’s why the posts here focus on tokens that failed to hold this line. They’re not just bad projects—they’re signals. When a coin’s price stays below the 200-day moving average for months, it’s not a correction. It’s a funeral. And if you’re trying to avoid losing money, you need to know what that looks like before you click "buy." Below, you’ll find real examples of what happens when crypto projects lose this key support. No fluff. Just facts from the charts.

Learn how to spot real bull markets in crypto by confirming signals like the golden cross, 18-day rule, and volume surges-avoiding fake rallies and bull traps with proven strategies.