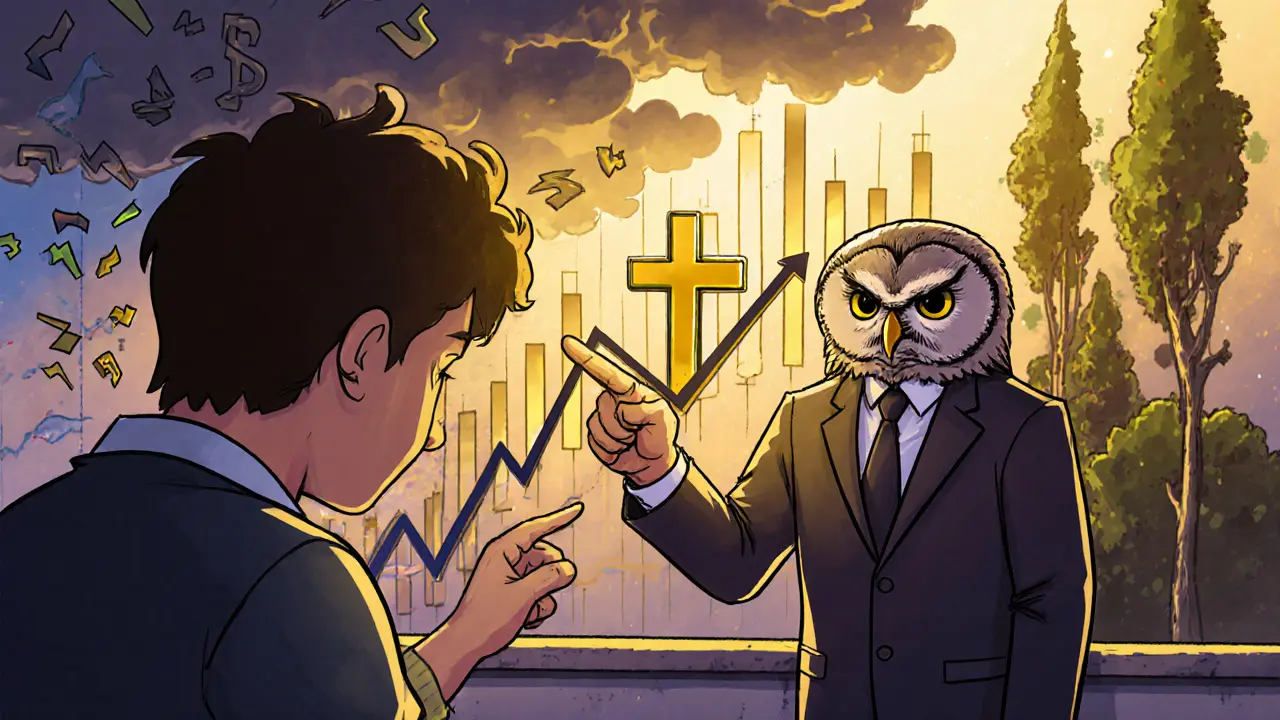

Bull Market Signals: How to Spot Real Crypto Trends Before Everyone Else

When people talk about a bull market, a sustained period of rising asset prices driven by investor confidence and real adoption, they often mean Bitcoin hitting a new all-time high. But that’s not enough. True bull market signals aren’t just about price—they’re about what’s happening beneath the surface. Look at trading volume. If it’s climbing while prices rise, that’s real demand. If exchanges are adding new listings, institutions are entering, and regulatory clarity is improving, those aren’t noise—they’re foundations. A bull market built on hype collapses fast. One built on usage, infrastructure, and trust lasts.

One key related concept is trading volume, the total amount of a cryptocurrency bought and sold over a set period. In Q2 2025, crypto trading volume dropped nearly 28% after new regulations forced exchanges to delist risky tokens. That wasn’t a bear market signal—it was a purge. The volume that remained? That was real. Look at the UAE: after being removed from the FATF greylist, its crypto volume surged because exchanges could operate openly. That’s a bull market signal rooted in policy, not speculation. Another is crypto adoption, the real-world use of cryptocurrencies for payments, savings, or DeFi services. When Vietnam introduced a $379 million capital requirement for exchanges, it didn’t kill the market—it filtered out fly-by-night operators. The ones left? They’re building for the long term. When projects like Golden Pact (GOT) or Paladin (PAL) get real traction because people use them—not just trade them—that’s adoption. And adoption fuels lasting price growth.

You’ll see this in the posts below. We don’t chase pump-and-dump coins with zero volume like Isabelle (BELLE) or CherrySwap. We track what moves markets: regulatory shifts, exchange security, vesting schedules that protect investors, and real user activity. You’ll find deep dives on why some tokens die quietly, while others gain traction because their teams deliver. We show you how to spot the difference between a fake rally and a real bull run. No fluff. No guessing. Just the signals that matter—and what to do when you see them.

Learn how to spot real bull markets in crypto by confirming signals like the golden cross, 18-day rule, and volume surges-avoiding fake rallies and bull traps with proven strategies.