Crypto Bull Market: What It Really Means and Why Most Tokens Fail

When people talk about a crypto bull market, a sustained period of rising cryptocurrency prices driven by investor confidence and increased adoption. Also known as a bull run, it’s when traders expect prices to keep going up and new money flows into the ecosystem. But here’s the truth: not every coin rises in a bull market—most don’t even move. In fact, over 80% of tokens listed in the last three years have zero trading volume today. A bull market doesn’t save bad projects. It just gives them more time to fade away quietly.

The real drivers of a healthy bull market are trading volume, the total amount of a cryptocurrency bought and sold over a set period and DeFi, a system of financial applications built on blockchain that operate without banks or middlemen. Look at the posts below—CherrySwap, Isabelle (BELLE), Airbloc (ABL), and Archer Swap (BOW) all had flashy promises but no real users. No volume. No liquidity. Even in a bull market, these tokens stayed dead. Meanwhile, projects that survived—like those tied to clear regulations in the UAE or Switzerland—gained trust because they followed real rules, not hype.

What separates winners from ghosts in a bull market? Transparency. Audits. Exchange listings. Community. If a project can’t show you where its tokens are traded, who’s behind it, or why anyone would use it, it’s not a coin—it’s a gamble. And in 2025, regulators are cracking down hard. The UAE’s removal from the FATF grey list, Vietnam’s new $379M licensing rules, and India’s list of risky exchanges all show one thing: the era of anonymous, zero-volume tokens is over. The bull market rewards projects that build, not just market. The posts here aren’t just reviews—they’re survival guides. You’ll see how fake airdrops, unregulated exchanges, and dead tokens get exposed. You’ll learn what to look for before you buy. And you’ll understand why the next big move isn’t about guessing price targets—it’s about spotting the few projects that actually work.

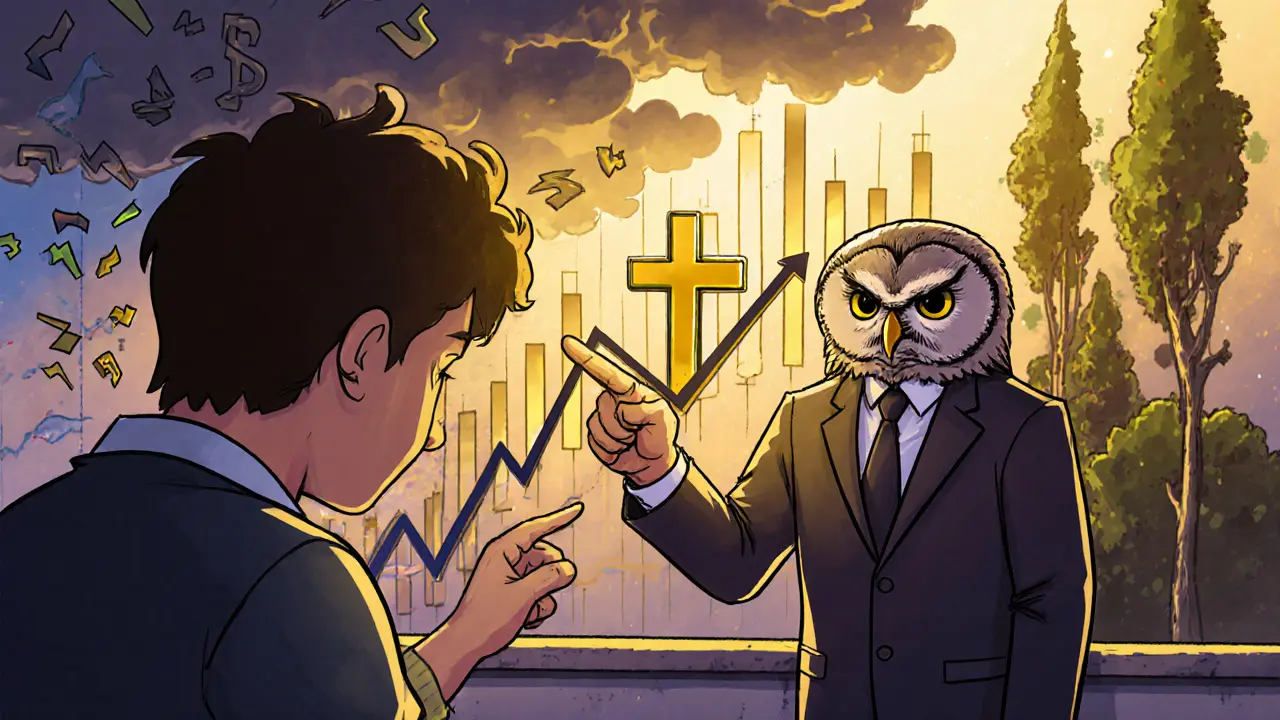

Learn how to spot real bull markets in crypto by confirming signals like the golden cross, 18-day rule, and volume surges-avoiding fake rallies and bull traps with proven strategies.