Crypto Trading Volume Decline: Why It Happens and What It Means for Your Portfolio

When crypto trading volume decline, a measurable drop in the total value of cryptocurrency bought and sold over a set period. Also known as market liquidity contraction, it’s not just a blip—it’s often a warning sign that traders are pulling back, projects are losing steam, or exchanges are losing trust. This isn’t about price going down. It’s about fewer people actually trading. And that’s more dangerous than a 20% price drop.

Look at tokens like Archer Swap (BOW), a low-liquidity DeFi token with almost no trading volume and zero presence on major exchanges like Coinbase. Its price collapsed not because of a hack or scam—but because nobody was buying or selling it. That’s the quiet death of a crypto asset. Same with Donkey King (DOKY), a Solana-based meme coin that saw spikes in hype but zero real trading activity. When volume dries up, even the loudest tokens go silent. This isn’t random. It’s tied to DeFi trading, the ecosystem where tokens rely on liquidity pools and user participation to survive. If users leave, the pool dries up, and the token becomes a ghost.

Why does this happen? Sometimes it’s regulatory. When Vietnam introduced its $379M capital requirement for exchanges, volume dropped across local platforms. Sometimes it’s trust. After the Bitbaby Exchange scandal, traders fled—not just from that site, but from similar platforms. And sometimes it’s just fatigue. After a year of airdrop chasing, traders stopped engaging with tokens that offered no real utility, like Pax.World (PAXW), an NFT airdrop that vanished after initial hype. The common thread? No real users, no real demand, no real volume.

What you’ll find in the posts below aren’t just reports on falling numbers. They’re investigations into why those numbers fell. You’ll see how crypto market trends, patterns in how traders behave during downturns or regulatory shifts connect to real token failures. You’ll get breakdowns of exchanges that lost volume—and why. You’ll learn how to spot a token that’s already dead before you even buy it. This isn’t theory. It’s what’s happening right now, on-chain, in real time. And if you’re holding crypto, you need to know the difference between a dip and a death spiral.

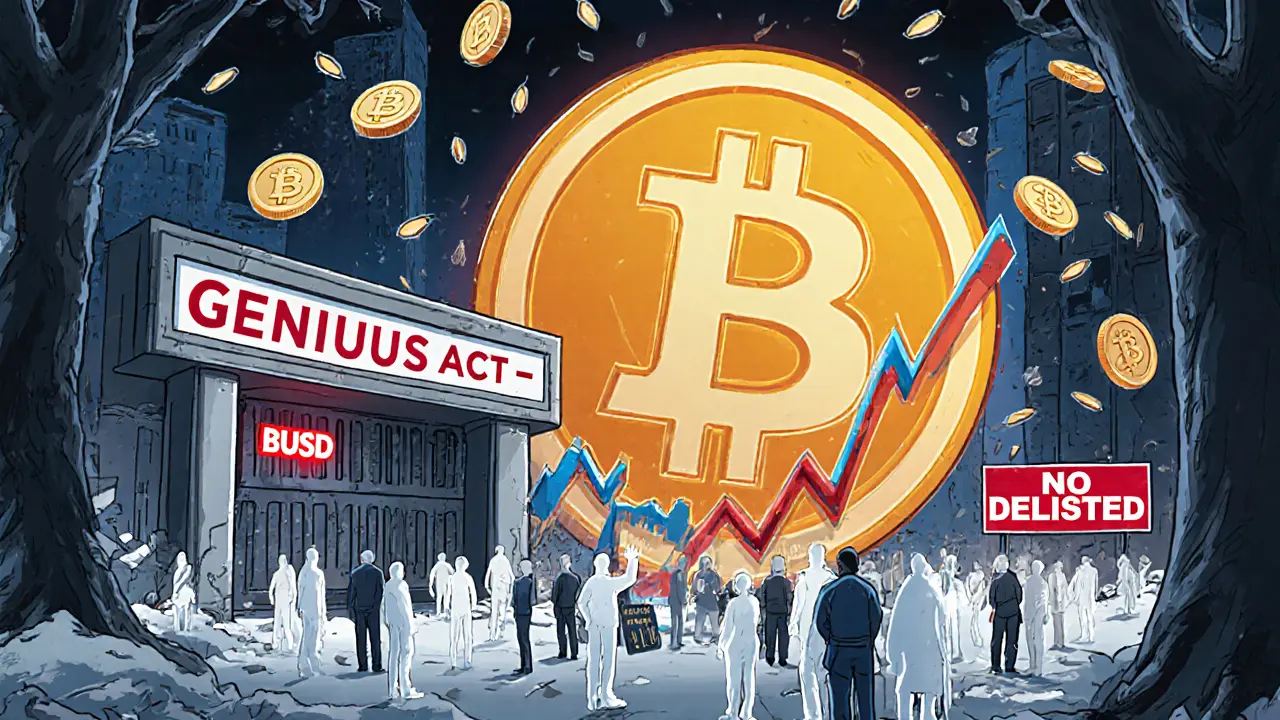

Crypto trading volume dropped nearly 28% in Q2 2025 despite Bitcoin hitting new highs. Why? New regulations forced exchanges to delist tokens and restrict users. This isn't a market crash-it's a painful but necessary shift toward compliance.