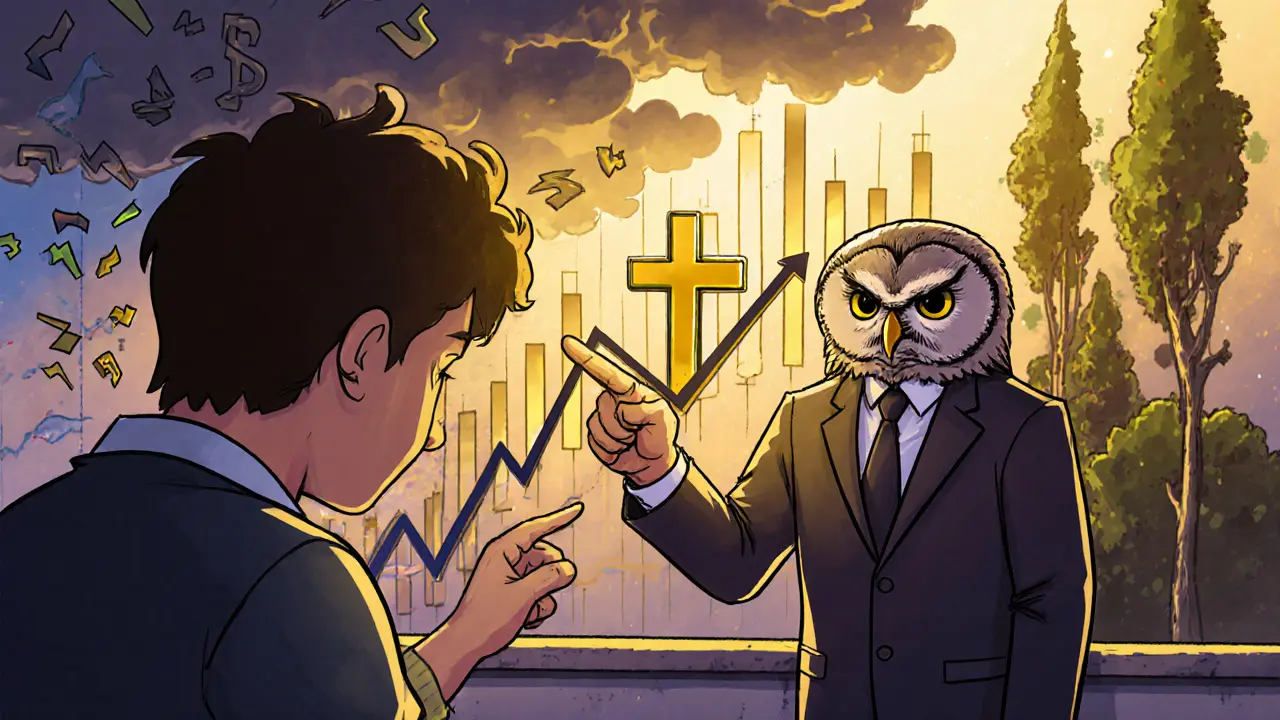

Golden Cross: What It Really Means for Crypto Traders

When you hear golden cross, a technical indicator that forms when a short-term moving average crosses above a long-term moving average, signaling potential bullish momentum. Also known as bullish crossover, it’s one of the most talked-about patterns in crypto trading—but not always for the right reasons. Many traders treat it like a magic button: buy when it appears, sell when it disappears. But the truth? It’s just one piece of a much bigger puzzle. In crypto, where prices swing 20% in a day, a golden cross can show up after a huge rally—and still lead to a crash. It doesn’t predict the future. It reacts to what already happened.

That’s why looking at moving averages, the smoothed lines on price charts that filter out noise and show trend direction alone is risky. The 50-day and 200-day moving averages are the usual suspects in a golden cross setup, but their effectiveness changes depending on the asset. Bitcoin might respect these levels more than a low-cap memecoin. And in crypto, where liquidity dries up fast, even a clean golden cross can turn into a trap if no one’s buying. You need context: volume, market sentiment, and whether the broader trend is up or down. A golden cross on a token with zero trading volume? That’s not a signal—it’s noise.

Then there’s technical analysis, the practice of using historical price and volume data to forecast future price movements. It’s not magic, but it’s not useless either. Traders who ignore it completely often get blindsided. Those who rely on it alone? They get burned. The posts below show real examples: a token that formed a golden cross but never gained traction, another that crashed right after the signal appeared, and one that used the pattern as part of a larger strategy—and survived. This isn’t about chasing patterns. It’s about understanding when they matter, and when they’re just background static.

You’ll find posts here about dead tokens with fake signals, exchanges that misrepresent data, and traders who lost money because they trusted a chart without checking the fundamentals. The golden cross doesn’t cause gains. It doesn’t prevent losses. But if you know how to read it—and when to ignore it—it can help you avoid the traps others walk into. These aren’t theory pieces. They’re after-the-fact breakdowns of what actually happened. No fluff. No hype. Just what the data says.

Learn how to spot real bull markets in crypto by confirming signals like the golden cross, 18-day rule, and volume surges-avoiding fake rallies and bull traps with proven strategies.