Permissioned Blockchain KYC: Real‑World Use Cases & Benefits

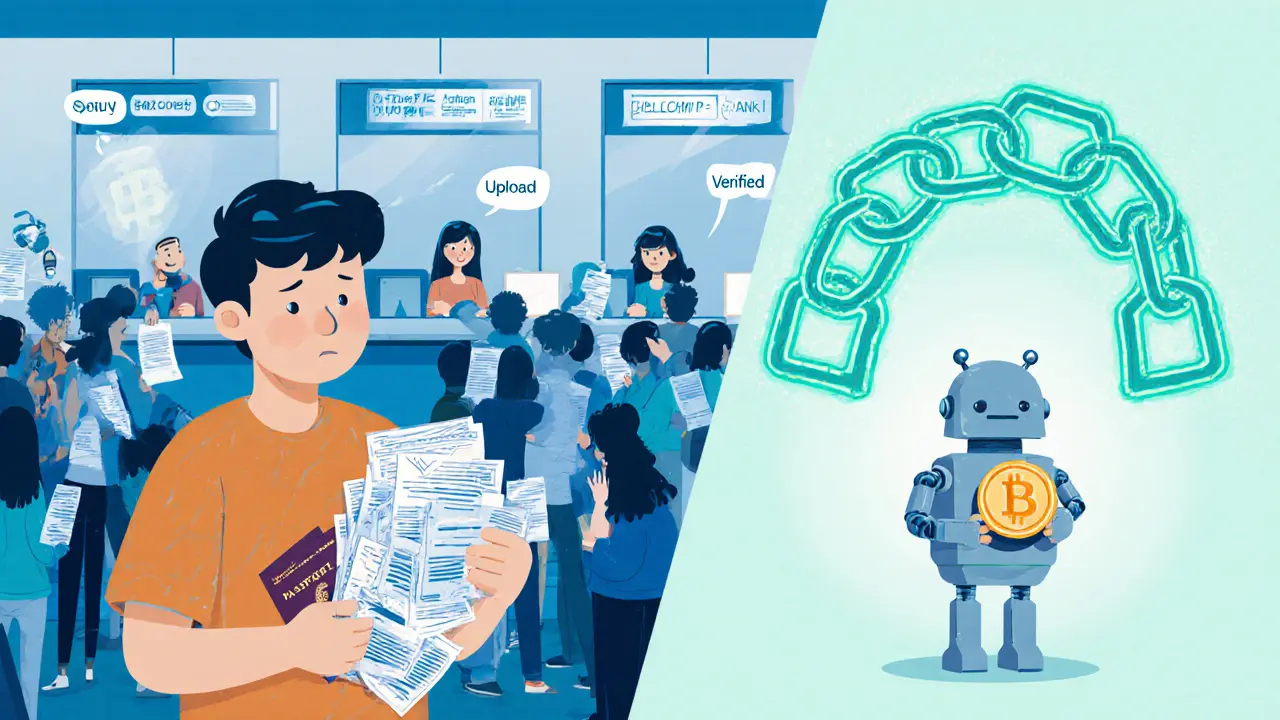

When working with Permissioned Blockchain KYC, a regulated, private‑ledger approach to Know‑Your‑Customer verification that lets institutions share identity data securely while staying compliant. Also known as restricted‑ledger KYC, it bridges traditional compliance requirements with blockchain’s immutability and auditability.

This model encompasses a set of permissioned ledgers—like Hyperledger Fabric, an open‑source framework designed for private consortium networks—that restrict who can read or write data. It requires a robust digital identity, a verifiable credential that links a real‑world person to a blockchain address to satisfy anti‑money‑laundering (AML) rules. Smart contracts then automate compliance checks, triggering alerts when data changes or when a user’s risk profile shifts. In short, permissioned blockchain KYC enables secure, reusable identity verification across banks, crypto exchanges, and fintech platforms.

Key Components of Permissioned Blockchain KYC

The stack breaks down into three core pieces. First, the ledger itself—Hyperledger Fabric, Corda, or Quorum—offers channel‑based privacy, meaning only authorized participants see a given transaction. Second, the identity layer leverages standards like W3C Verifiable Credentials and Decentralized Identifiers (DIDs) to create tamper‑proof profiles that can be audited without exposing raw personal data. Third, business‑logic smart contracts encode KYC rules: age checks, source‑of‑funds verification, and sanction list screening. When a user completes onboarding on one platform, the same verifiable credential can be presented to another, cutting down on duplicate paperwork and reducing onboarding time from weeks to minutes.

Real‑world examples illustrate the payoff. A European bank piloted a permissioned network with Hyperledger Fabric, allowing it to share screened customer data with three partner fintechs. The shared ledger cut duplicate KYC checks by 70% and lowered compliance costs. In the crypto space, a major exchange integrated a blockchain‑enabled KYC module that writes a hashed credential to a consortium ledger; regulators can query the hash to confirm audit trails without seeing the user's full identity. These cases show how the technology satisfies both privacy‑by‑design principles and regulator‑driven transparency.

Challenges remain, though. Governance models must define who can add or revoke participants, and consensus mechanisms need to balance speed with security. Data residency rules can restrict where ledger nodes reside, especially for cross‑border collaborations. Interoperability between different permissioned platforms is still evolving, so many projects adopt a hybrid approach—public blockchain for token issuance, private ledger for KYC data.

Despite the hurdles, the trend is clear: firms are swapping siloed spreadsheets for tamper‑proof, permissioned ledgers that make KYC a shared service rather than a bottleneck. Whether you’re a compliance officer, a blockchain developer, or a fintech founder, understanding how permissioned blockchain KYC ties together private ledgers, digital identity standards, and smart‑contract automation is essential for building the next generation of compliant financial products.

Below you’ll find a curated set of articles that dive deeper into each of these pieces—from technical guides on building Hyperledger Fabric networks to breakdowns of digital‑identity standards and real‑world case studies of blockchain‑enabled KYC implementations. Explore the collection to see how you can start applying permissioned blockchain KYC in your own projects.

Discover how blockchain reshapes KYC verification, cutting onboarding time, boosting security, and giving users control. Learn benefits, technical steps, real‑world examples, challenges, and FAQs.