blockchain KYC – The Bridge Between Identity and Decentralized Finance

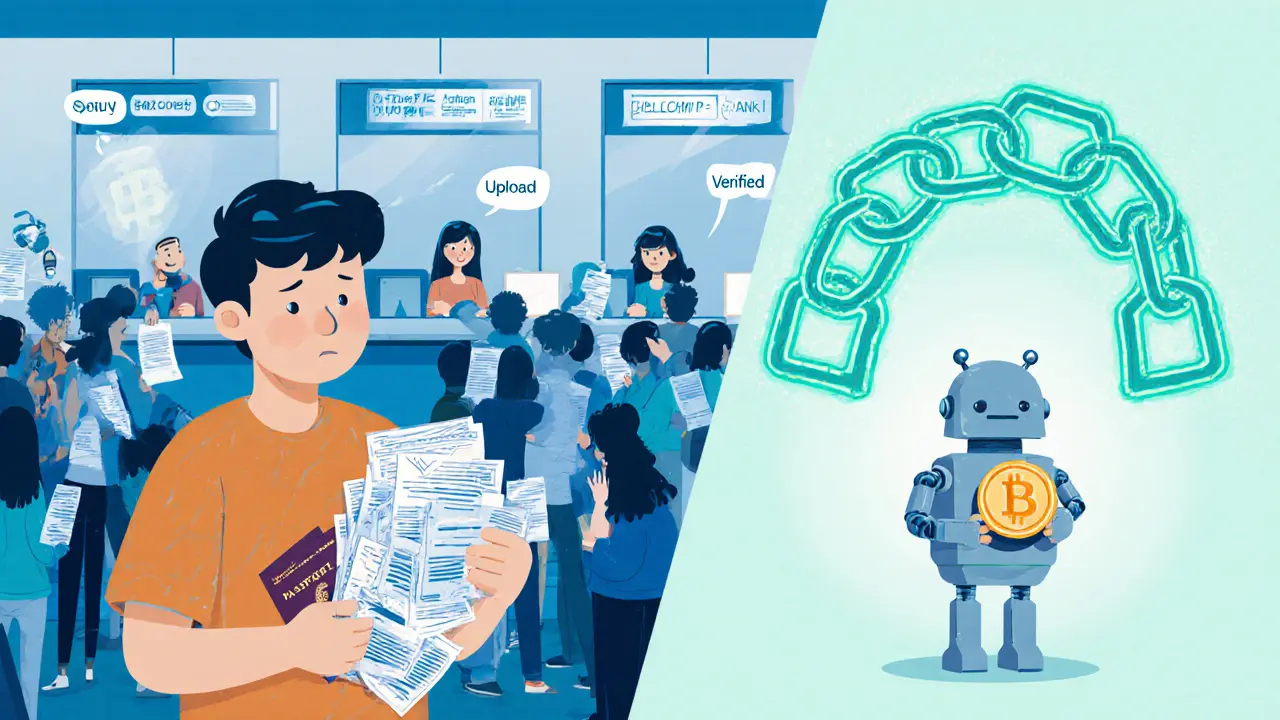

When working with blockchain KYC, the process of confirming a user’s real‑world identity on a blockchain platform. Also known as crypto KYC, it helps projects meet AML and regulatory standards while preserving as much decentralization as possible.

Decentralized exchanges (decentralized exchanges, or DEXs) were built to let anyone trade without a middleman, but regulators are catching up fast. In practice, a DEX that wants to stay on the right side of the law must embed KYC checkpoints—often at the point of fiat on‑ramp, large‑volume swaps, or token listings. These checkpoints use on‑chain identity layers, like soul‑bound tokens or attestations, to tie a wallet address to a verified person without exposing every transaction. The result is a hybrid model: users keep control of their assets, yet the platform can answer a regulator’s request for a client’s name, address, or source of funds.

Smart contracts (smart contracts) are the automation engine behind blockchain KYC. A well‑written contract can lock a user’s funds until an off‑chain verifier confirms their identity, then automatically lift the restriction. This eliminates manual paperwork and reduces the chance of human error. Some projects even deploy “KYC as a service” contracts that other DApps can call, turning compliance into a reusable building block. The beauty is that the same contract logic can be upgraded to meet new AML rules, making compliance future‑proof without rebuilding the entire platform.

For users, the shift means a few extra steps but also clearer protection. When you pass a KYC check, the platform can enforce limits that stop stolen funds from moving freely, and you gain access to higher‑volume markets, staking programs, and institutional liquidity pools that would otherwise stay closed. From a business angle, having a robust blockchain KYC framework opens doors to banking partnerships, insurance products, and even tokenized securities, because traditional financial institutions feel more comfortable dealing with a verified on‑chain identity.

What to Expect from the Articles Below

In the collection that follows, you’ll find detailed looks at real‑world KYC implementations, from airdrop eligibility rules that hinge on verified identities to full‑stack compliance guides for crypto exchanges operating in regulated jurisdictions. Each piece breaks down the technical steps, legal considerations, and practical tips you need to navigate the evolving landscape of blockchain KYC. Dive in to see how projects balance privacy with transparency, how regulators shape the rules of the game, and which tools are making automated compliance a reality.

Ready to explore the specifics? The articles below will walk you through everything from token‑based identity solutions to step‑by‑step compliance checklists, giving you the actionable knowledge to stay ahead in the world of decentralized finance.

Discover how blockchain reshapes KYC verification, cutting onboarding time, boosting security, and giving users control. Learn benefits, technical steps, real‑world examples, challenges, and FAQs.

Explore how blockchain transforms KYC verification into a fast, secure, and reusable digital identity system, covering mechanics, benefits, challenges, and future trends.