Decentralized Identity Verification: What It Is and Why It Matters

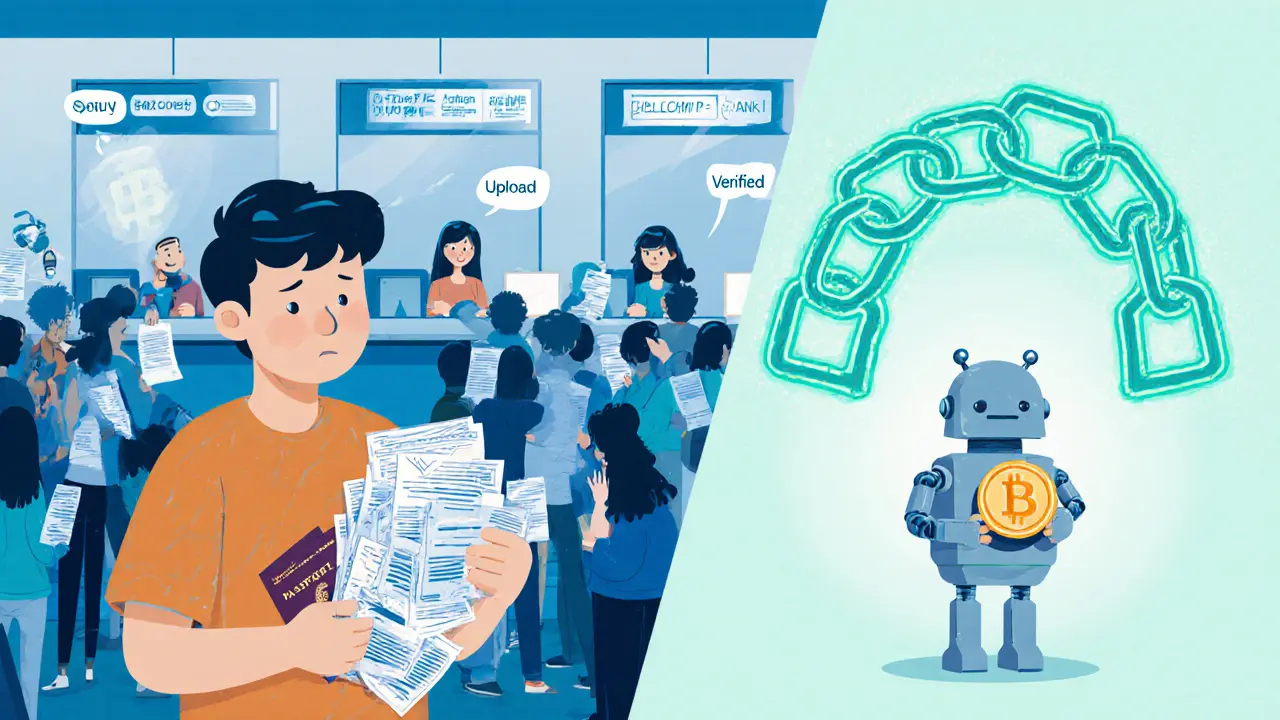

When working with decentralized identity verification, a method that lets users prove who they are without handing over a central authority’s data. Also known as self‑sovereign ID, it shifts control of personal credentials to the individual using blockchain and cryptography, you instantly avoid the single‑point‑of‑failure that traditional KYC systems create. The first real‑world example you’ll meet is self‑sovereign identity, a digital identity model where the user stores proofs on a personal wallet rather than a corporate server. To make that work, projects lean on zero‑knowledge proofs, cryptographic techniques that let you confirm a fact without revealing the underlying data. Think of it like proving you’re over 18 without showing your exact birthdate. And while it sounds high‑tech, the goal is simple: let people interact with DeFi, NFTs, or any online service without handing over a passport scan that can be stolen or misused. This shift also nudges traditional KYC compliance, the “Know Your Customer” checks regulators require from banks and exchanges toward a privacy‑first approach without breaking the law.

How It Works, What It Needs, and Why It’s Growing Fast

Decentralized identity verification enables users to own and control their data, and that empowerment drives three core attributes. First, it requires blockchain or distributed ledger technology to store immutable credential hashes – the ledger guarantees the proof can’t be altered. Second, it needs cryptographic primitives like zero‑knowledge proofs or decentralized identifiers (DIDs) to let the holder answer verification challenges without exposing raw data. Third, it benefits from open standards such as W3C’s Verifiable Credentials, which let any app read a proof the same way it reads a passport’s MRZ barcode. Those standards create a semantic triple: Decentralized identity verification encompasses self‑sovereign identity. Another triple links the tech: Zero‑knowledge proof enables privacy‑preserving verification. Finally, regulatory pressure forms a third: KYC compliance influences the design of decentralized identity solutions. In practice, a DeFi platform might ask for “prove you’re a resident of the EU” and receive a zero‑knowledge attestation that satisfies both the user’s privacy and the regulator’s residency check. The result is faster onboarding, lower fraud rates, and a better user experience that keeps the crypto ecosystem fluid.

Below you’ll find a mix of articles that show how these ideas play out across the market. From airdrop eligibility that hinges on verified on‑chain identities, to token projects that embed self‑sovereign credentials directly into their smart contracts, the collection gives you concrete examples of the theory in action. Whether you’re a developer looking to add verifiable credentials to a DApp, an investor scouting projects that prioritize privacy, or just a crypto enthusiast curious about the next wave of identity tech, the posts ahead break down the mechanics, risks, and real‑world use cases. Dive in to see how decentralized identity verification is reshaping everything from gaming airdrops to global compliance, and pick up practical tips you can apply right now.

Discover how blockchain reshapes KYC verification, cutting onboarding time, boosting security, and giving users control. Learn benefits, technical steps, real‑world examples, challenges, and FAQs.

Explore how blockchain transforms KYC verification into a fast, secure, and reusable digital identity system, covering mechanics, benefits, challenges, and future trends.