Smart Contract KYC

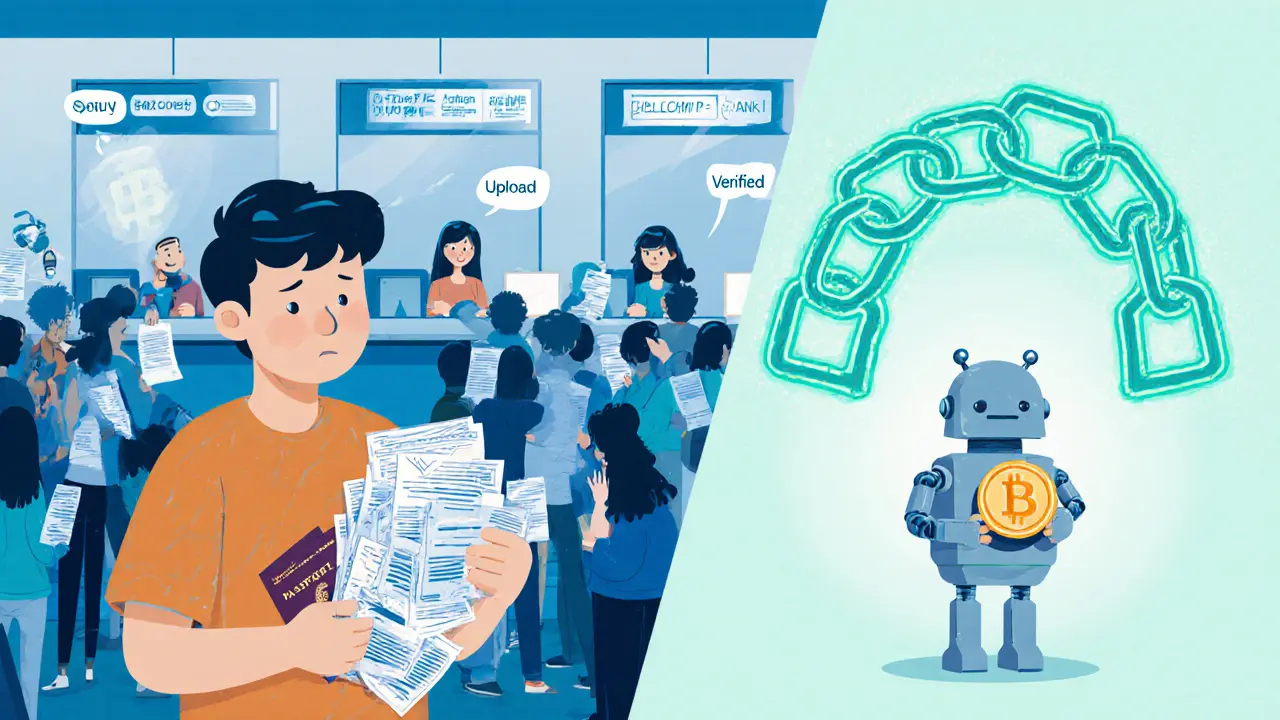

When working with Smart Contract KYC, the process of embedding Know‑Your‑Customer checks directly into blockchain code so transactions can be screened automatically. Also known as on‑chain KYC, it lets regulators verify user identities without exposing private data, businesses can meet KYC compliance, the legal requirement to verify the identity of customers before allowing financial activity while staying within the decentralized ethos of crypto.

Why smart contract KYC matters for DeFi

DeFi platforms are built on trust‑less protocols, but trust‑less doesn’t mean regulator‑free. DeFi regulation, rules that aim to align decentralized finance with existing financial laws pushes projects to prove who participates in their ecosystems. Embedding KYC logic directly into smart contracts creates a clear, auditable trail that satisfies both users and authorities. In effect, smart contract KYC bridges the gap between permissionless access and compliance obligations.

Another key piece is blockchain identity verification, methods that use cryptographic proofs to confirm a person’s identity on a public ledger. These solutions let users retain control of personal data while still proving they’re real people. The combination of on‑chain verification and privacy‑preserving zero‑knowledge proofs makes it possible to run KYC checks without a central data hoarder.

Smart contract KYC also demands rigorous security. A flawed KYC module can let bad actors slip through or accidentally lock legitimate users out. Regular smart contract audit, an independent review of code to find bugs, logic errors, and security gaps becomes essential. Auditors assess whether the KYC flow respects privacy, correctly flags prohibited addresses, and can be upgraded without compromising existing data.

For developers, the implementation path looks like this: first, define the identity attributes you need (e.g., government‑issued ID hash, AML check result). Next, choose a verification provider that supplies a verifiable credential on‑chain. Then, write the contract logic to read that credential and enforce access rules. Finally, submit the code to a reputable audit firm and plan for future upgrades via proxy patterns.

Projects that get this right gain several advantages. They can list on regulated exchanges, attract institutional investors, and reduce the risk of sanctions. Users benefit from faster onboarding and the confidence that their data isn’t stored in a vulnerable off‑chain database. In short, smart contract KYC turns compliance from a blocker into a feature.

Below you’ll find a curated set of articles that dive deeper into each aspect—whether you’re looking for technical guides, regulatory overviews, or real‑world case studies. Explore the collection to see how smart contract KYC is shaping the future of decentralized finance.

Discover how blockchain reshapes KYC verification, cutting onboarding time, boosting security, and giving users control. Learn benefits, technical steps, real‑world examples, challenges, and FAQs.

Explore how blockchain transforms KYC verification into a fast, secure, and reusable digital identity system, covering mechanics, benefits, challenges, and future trends.