Exchange Reviews – In‑Depth Crypto Exchange Analysis

When diving into Exchange Reviews, a curated look at how crypto platforms work, covering everything from fee structures to security measures. Also known as crypto exchange reviews, they help traders decide which market fits their style. Crypto exchange is any platform that lets you buy, sell, or swap digital assets, either centrally or on a decentralized network becomes the core subject, and every review breaks down its unique strengths and weak spots.

Understanding fees the cost you pay per trade, withdrawal, or liquidity provision is crucial because high fees can erode profits, especially for frequent traders. At the same time, security covers everything from encryption to insurance and audit frequency determines whether your assets stay safe during hacks or bugs. Tokenomics refers to the economic design of a platform’s native token, influencing rewards, governance and price dynamics often sways user incentives and long‑term value. DEX a decentralized exchange that runs on smart contracts without a central intermediary adds another layer, offering permissionless trading but sometimes higher slippage. Together, these entities create a web of decisions: Exchange Reviews encompass fee analysis, require security assessment, and are shaped by tokenomics and DEX architecture.

What you’ll discover in our collection

The reviews below span a wide range of platforms – from big CEXs like Binance‑type services to niche DEXs operating on zkSync, Solana, or Polygon. Each article points out who the exchange suits best – whether you’re a beginner in Iran, a liquidity provider on Velas, or a high‑frequency trader chasing low‑fee arbitrage. We also compare user experience, cross‑chain capabilities, and regulatory posture, so you can match a platform to your risk appetite and geographic needs. Expect clear tables, quick FAQs, and side‑by‑side fee charts that let you spot differences without wading through endless data.

By the time you finish reading, you’ll have a practical framework to evaluate any new market: check the fee model, verify the security track record, understand the tokenomics, and decide if a DEX or CEX aligns with your strategy. The lineup that follows puts these steps into action, giving you ready‑to‑use insights for every exchange on our radar.

DefySwap claims to be a multi-exchange crypto platform, but it lacks transparency, liquidity, and community support. Unlike real DEXs like Uniswap or PancakeSwap, it offers no verifiable data, smart contracts, or token utility - making it a risky and unreliable option.

CoinRui crypto exchange is defunct and inaccessible as of 2026. Users lost funds with no recovery options. Learn why this unregulated platform failed and what safer alternatives exist today.

IndoEx is a decentralized crypto exchange with low fees and no KYC, but serious security concerns, withdrawal issues, and zero regulation. Learn why experts warn against using it in 2026.

Fcex Exchange shows all signs of a crypto scam: zero trading volume, a worthless token, no regulatory licenses, and a low trust score. Avoid this platform - your funds are at serious risk.

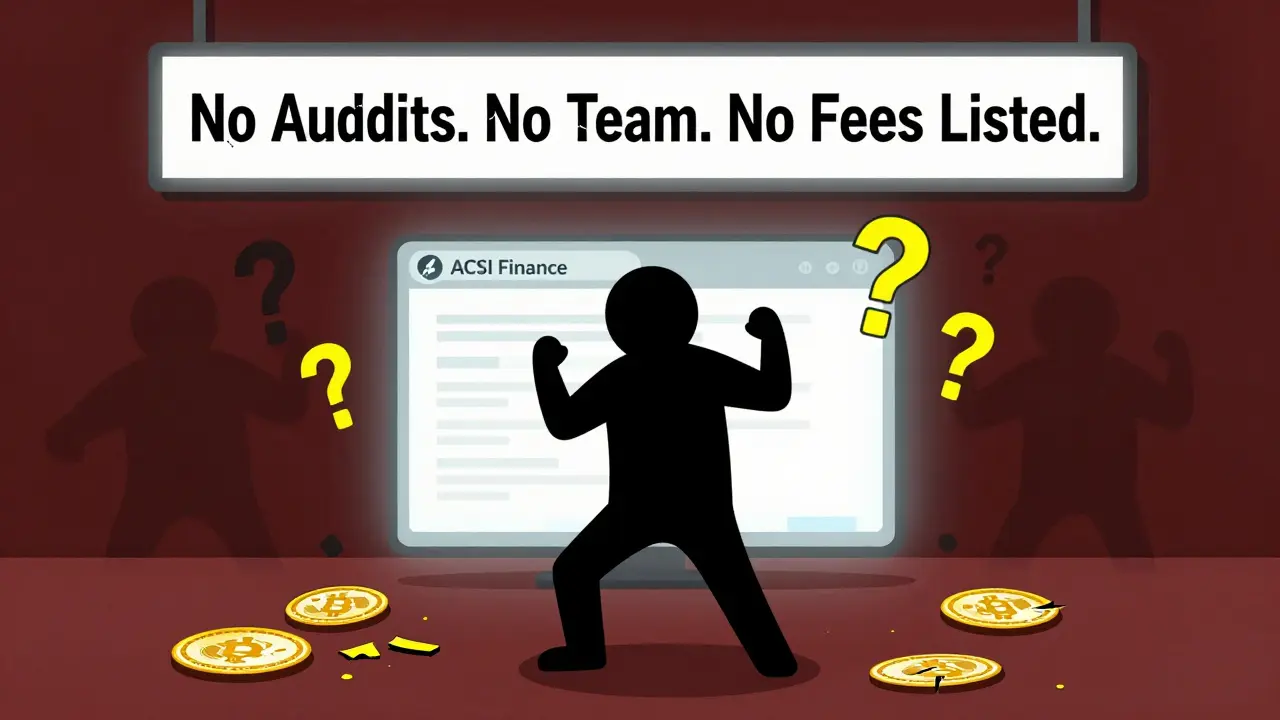

ACSI Finance (powered by ACryptoS) lacks audits, fee transparency, and team info-major red flags in crypto. Avoid this high-risk DeFi platform and stick with regulated, transparent exchanges like Coinbase or Kraken.

YOOBTC doesn't exist as a verified exchange in 2026. This review covers YoBit - the no-KYC platform people often confuse it with. Learn about its 3,900+ trading pairs, gamified features, lack of mobile app, and why it's only for experienced traders.

UEEx crypto exchange offers strong security, 125x leverage, and copy trading with a $100M risk fund. Ideal for U.S. and Canadian traders who prioritize safety over advanced tools. Customer support remains slow.

ZigZag is a ZK-Rollup DEX with fast trades and fee-sharing $ZZ tokens - but it's not on Arbitrum. Learn how it stacks up against Arbitrum-based exchanges like MM Finance and why ecosystem matters more than speed.

mimo.exchange is a niche DeFi exchange focused on Euro-pegged stablecoins, but it suffers from low liquidity, frequent downtime, zero user reviews, and no regulatory compliance. Avoid unless you're a DeFi expert with specific needs.

Bitladon was a user-friendly crypto exchange for Europeans that shut down in 2023 and was replaced by BCM Exchange. Learn what changed, why it rebranded, and if BCM is still a good option for buying crypto without the complexity.

BitClover, formerly Hotbit Korea, is an unregulated crypto exchange with unverified trading volume and multiple user reports of withdrawal failures. Avoid it if you want to protect your funds.

QuickSwap v2 on Base offers near-zero gas fees, 2-second trade confirmations, and 100x leverage on perpetuals. A top DEX for active traders who want speed and decentralization without centralized custody.