Cryptocurrency Energy Use: Why It Matters and What’s Really Happening

When you hear cryptocurrency energy use, the total electricity consumed by blockchain networks, especially through mining and transaction validation. Also known as crypto power consumption, it’s not just a tech issue—it’s a resource battle playing out across continents. Bitcoin alone uses more electricity than entire countries like Argentina or the Netherlands. That’s not a guess. It’s tracked by the Cambridge Centre for Alternative Finance. And it’s not just Bitcoin. Every time a new memecoin launches on Solana or Ethereum, it adds load to networks that rely on real-world power plants, often burning coal or gas to keep the lights on.

But here’s the twist: most of that energy isn’t going to traders or investors. It’s going to unlicensed crypto mining, illegal operations that steal electricity to mine crypto without paying for it. In Iran, the IRGC runs massive mining farms that suck power from the national grid, leaving millions without heat in winter. In China, after the 2021 crackdown, miners didn’t vanish—they moved to places like Kazakhstan and Russia, where regulations are weak and electricity is cheap. This isn’t innovation. It’s resource theft disguised as decentralization. And while some claim crypto is going green with renewables, the truth is messier. Solar panels don’t run 24/7. Wind doesn’t blow when miners need power. Most mining still depends on fossil fuels, especially during peak demand. The idea that crypto is "carbon neutral"? That’s marketing. The data shows otherwise.

Then there’s the human cost. In Bolivia, people risk jail for trading crypto because their government can’t control inflation. In Egypt, citizens use Bitcoin to send money abroad, even though it’s illegal—and they’re fined up to $213,000 if caught. Meanwhile, in the U.S., the IRS is tracking every transaction. The crypto electricity costs, the financial and environmental price tag of running blockchain networks aren’t just on utility bills—they’re on court dockets, in prison cells, and in blacked-out neighborhoods.

What you’ll find below isn’t a list of opinions. It’s a collection of real cases: mining rigs running on stolen power, exchanges with zero volume but high energy demands, scams built on fake sustainability claims. Some posts show how crypto mining is used to evade sanctions. Others reveal how a single memecoin can drain more energy than a small town uses in a week. You’ll see who’s paying the real price—and who’s just pretending to care.

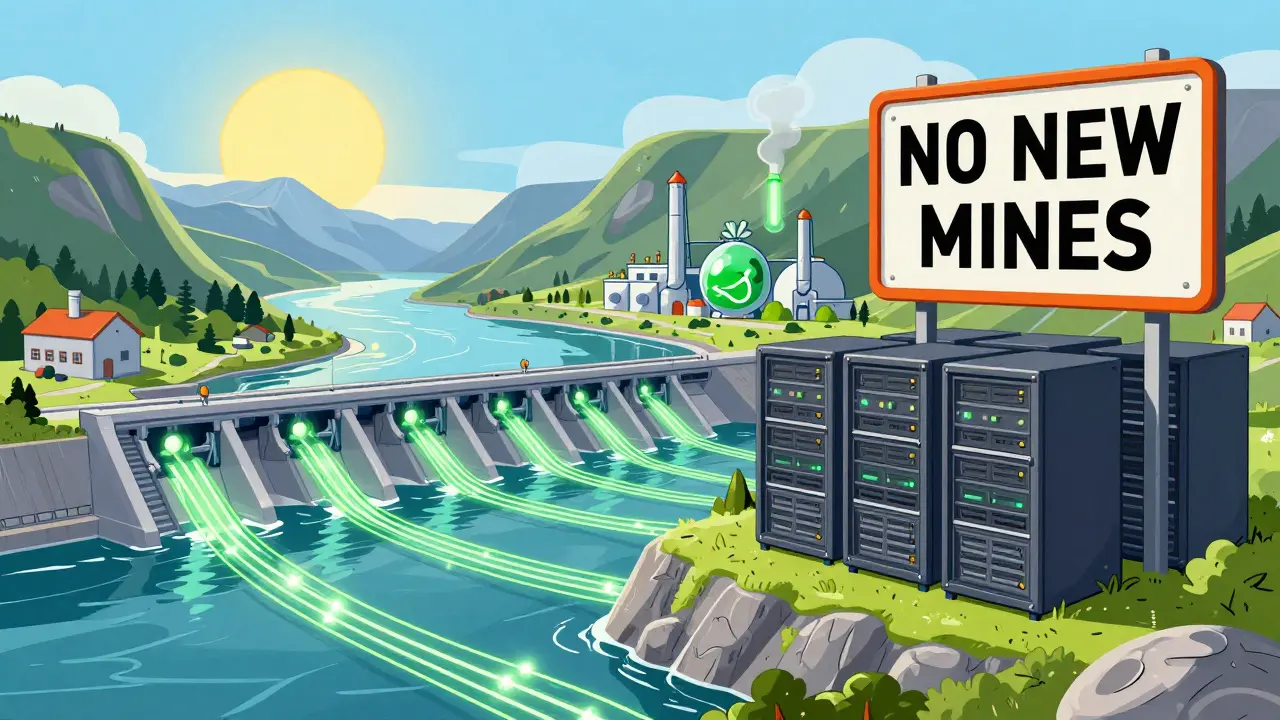

Norway is blocking new crypto mining data centers to protect its renewable energy for industries that create local jobs and economic value, not just global digital assets.